Exclusive: BidX Markets triples Revenues in 2023 to £1M

FNG Exclusive… FNG has learned via regulatory filings that London based, FCA regulated multi-asset liquidity solutions provider BidX Markets has continued to grow its business in its second full year of operation in FY2023 (year ended May 31, 2023), with its Revenues more than tripling from 2022.

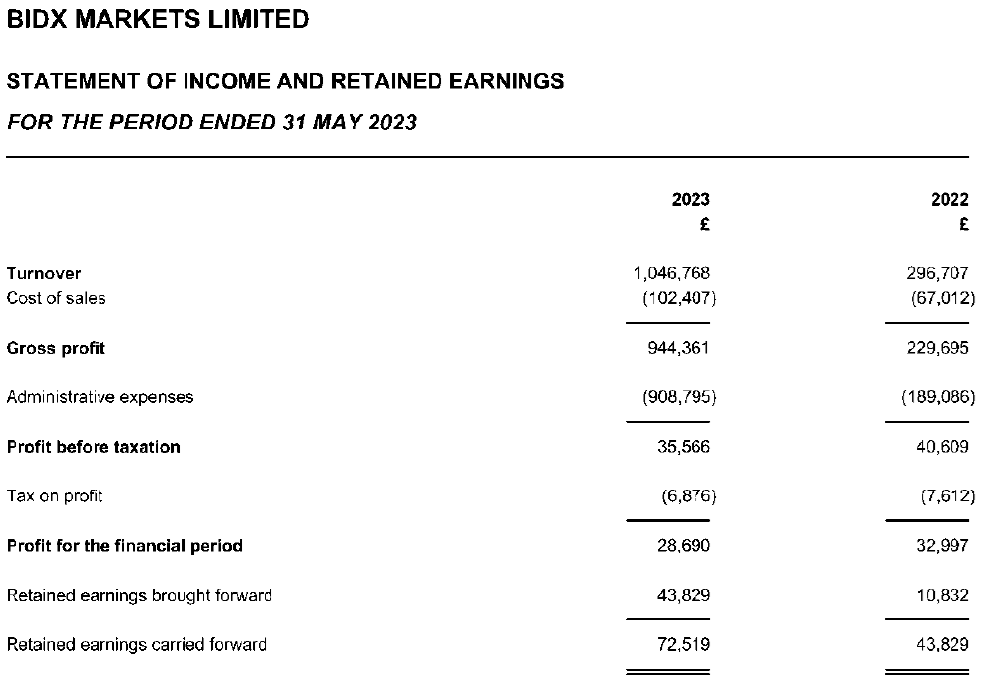

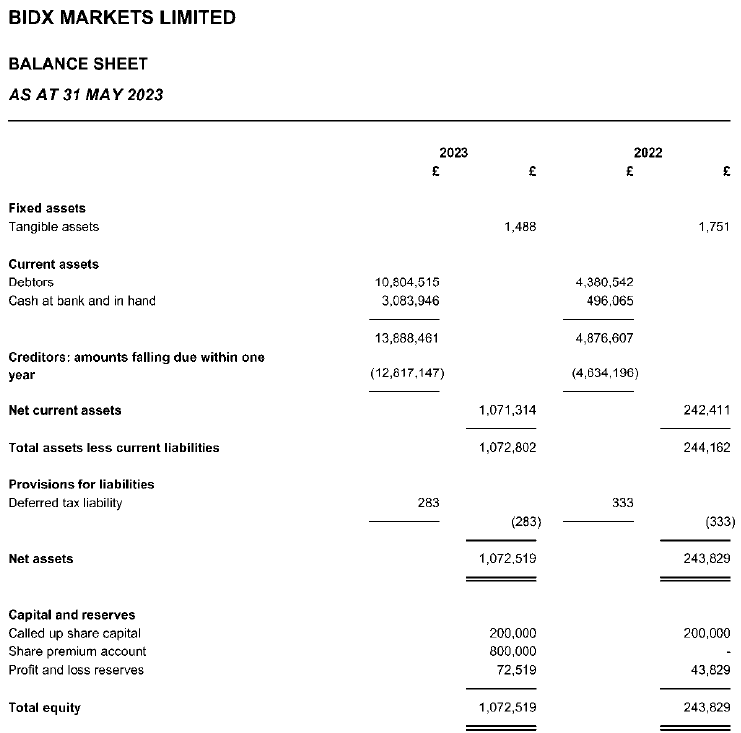

Revenues at BidX Markets came in at £1.05 million in 2023, more than 3x the company’s Revenues of £297K in 2022. BidX managed to grow itself profitably, as Net Profit totaled £73K in 2023, up from £44K the previous year.

The principal activity of the company is that of provision of investment (brokerage) services and acting as principal to its clients in foreign exchange and derivatives including index Contracts For Difference (CFDs).

Management indicated that the company’s business developed in line with the Board’s expectations and early operational stage. The company has continued to gain revenue traction and as such it has achieved significant growth compared to the previous fiscal year.

BidX stated that it continues to look for organic and inorganic opportunities, both in the UK and overseas, for expansion. The directors expect that the company will continue to grow its business both in its core market and new markets, and this will lead to a continued improvement in the company’s financial results. Along these lines BidX recently launched a Spread Betting platform for pro traders.

About BidX Markets

BidX Markets was founded in 2021 by Simon Blackledge, who had previously run MT4/MT5 white label solutions provider itexsys. The London headquartered brokerage provides tailored access for brokers, asset managers and funds to industry leading Tier 1 liquidity, connectivity, and distribution services. BidX received a strategic investment from non-bank market maker Solid in 2022, in return for 9.9% ownership of the company.

BidX Markets’ 2023 income statement and balance sheet follow below.