Euronext registers 30.4% Y/Y increase in FX trading revenue in Q1 2025

European capital market infrastructure Euronext today posted its results for the first quarter of 2025.

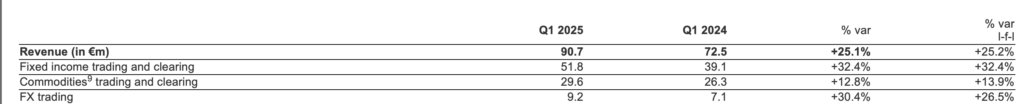

FX trading revenue was up 30.4%, at €9.2 million in the first quarter of 2025, reflecting record trading volumes, and a positively geared volume mix.

Fixed income trading and clearing revenue reached €51.8 million in Q1 2025, up 32.4% compared to Q1 2024, driven by record fixed income trading activity supported by favourable market conditions.

Commodities trading and clearing revenue reached €29.6 million in Q1 2025, up 12.8% compared to Q1 2024, reflecting record intraday power trading volumes and dynamic agricultural commodity trading and clearing.

Financial derivatives trading and clearing revenue was €14.4 million in Q1 2025, down 4.8% compared to Q1 2024. This decrease is mostly linked to the decrease of the average clearing fees, as following the clearing migration certain clearing fees are now reported in the line Other Post Trade revenues, and as such not fully comparable with Q1 2024.

Adjusted EBITDA was €294.1 million (+17.0%) and adjusted EBITDA margin was 64.1% (+1.6pts).

Adjusted net income was €183.5 million (+11.8%) and adjusted EPS was €1.80 (+13.9%).

Reported net income was €164.8 million (+17.9%) and reported EPS was €1.62 (+20.0%).

Net debt to EBITDA4 was at 1.4x at the end of March 2025, within Euronext’s target range of the “Innovate for Growth 2027” strategic plan. On 22 April 2025, Euronext had successfully redeemed the €500 million bond issued in connection with the acquisition of Euronext Dublin in April 2018.

The Managing Board, upon the approval of the Supervisory Board, has decided to propose for approval at the Annual General Meeting the payment of a dividend of €2.90 per ordinary share (based on the total number of eligible shares). The dividend would be distributed evenly (pro rata the number of shares held) to holders of ordinary shares on the dividend record date set on 27 May 2025 (ex-dividend date is set on 26 May 2025 and payment date is set on 28 May 2025).

This dividend represents a pay-out ratio of 50% of the reported net income, in line with Euronext’s current dividend policy.