Euronext announces tender offer on existing EUR 2026 Bonds

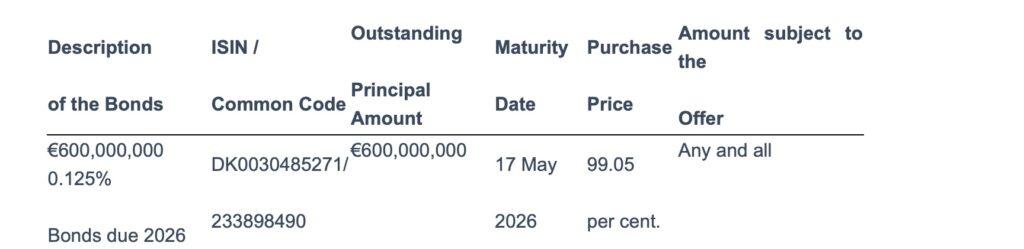

Euronext N.V. announced today an invitation to holders of its outstanding €600,000,000 0.125 per cent. Bonds due 2026 (ISIN: DK0030485271) (of which €600,000,000 in aggregate principal amount currently remains outstanding) to tender any and all such Bonds for purchase by the Offeror for cash.

Summary of the Offer

The purpose of the Offer and planned issuance of the New Bonds is to proactively manage the overall maturity profile of the Offeror’s debt in an efficient manner. The Offer also provides Holders with the opportunity to sell their current holdings in the Bonds and, if they so wish, apply for priority in the allocation of the New Bonds.

It is the current intention of the Offeror to redeem the Bonds that are not purchased by the Offeror pursuant to the Offer on their maturity date.

Bonds purchased by the Offeror pursuant to the Offer will be cancelled and will not be re-issued or re-sold.

Subject to the satisfaction (or waiver) of the New Issue Condition, the Offeror will, on the Settlement Date, pay for any Bonds validly tendered and accepted for purchase by it pursuant to the Offer a fixed cash purchase price for such Bonds (the Purchase Price) equal to 99.05 per cent. of the principal amount of the Bonds.

The Offeror will also, subject to the satisfaction (or waiver) of the New Issue Condition on or prior to the Settlement Date, make an Accrued Interest Payment in respect of any Bonds validly tendered and accepted for purchase pursuant to the Offer.

If the New Issue Condition is satisfied (or waived) and the Offeror decides to accept for purchase any valid tenders of Bonds pursuant to the Offer, the Offeror will accept for purchase all of the Bonds that are validly tendered and there will be no scaling of any tenders of Bonds for purchase (the final aggregate principal amount of Bonds accepted for purchase pursuant to the Offer being the Final Acceptance Amount).

The Offeror also announced today its intention to issue a series of new euro-denominated fixed rate bonds (the New Bonds), subject to market conditions.

Whether the Offeror will purchase any Bonds validly tendered in the Offer is subject, without limitation, to the successful completion (in the sole determination of the Offeror) of the issue of the New Bonds (the New Issue Condition), or the waiver of such condition.

Even if the New Issue Condition is satisfied (or waived), the Offeror is under no obligation to accept for purchase any Bonds tendered pursuant to the Offer. The acceptance for purchase by the Offeror of Bonds validly tendered pursuant to the Offer is at the sole and absolute discretion of the Offeror.