Exclusive: Equiti Capital UK Revenues top $24 million in 2019

FNG Exclusive… FNG has learned that Equiti Capital UK Limited, the FCA regulated arm of UAE based global FX and CFDs brokerage Equiti Group, has continued on its growth path, performing quite well in 2019 (and into early 2020) despite what were fairly difficult conditions for much of the FX trading sector.

Equiti Capital is the B2B arm of Equiti Group, which includes affiliated entities in the UAE, Jordan, Kenya, Armenia, United States, Cyprus and New Zealand. (We also recently reported that Equiti Group received a license for a new subsidiary in Seychelles). Equiti Capital began trading operations in 2008 as Divisa Capital (changing its name to Equiti in 2018), to offer accessible Prime Brokerage and White Label services with real liquidity from top tier banks and ECN venues, across FX and other traded instrument classes.

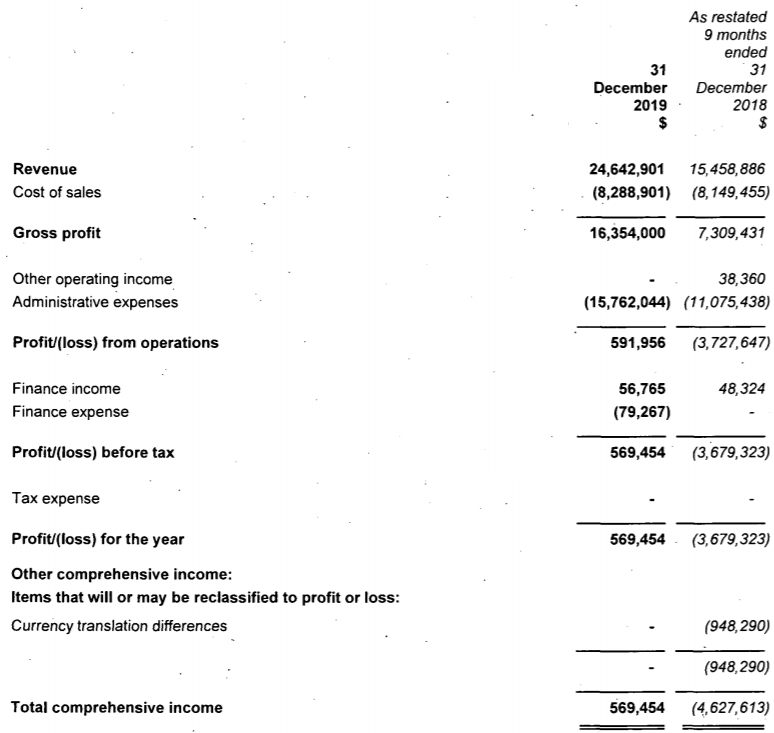

Equiti Capital, headed by CEO Brian Myers, reported revenue for 2019 of $24.6 million, up 19% from $20.6 million in 2018. (2018 is an annualized figure, from $15.5 million achieved in the nine months ended 31/12/2018). A 2018 loss of $4.6 million turned into a small profit of $569,000 for the company in 2019. That was achieved, as noted, in an environment where FX trading volumes in the UK and Europe were down significantly, following the FCA and ESMA’s implementation of CFD leverage caps (of 30x and below) for retail traders, which coincided with fairly low volatility in currency, commodity, and equity markets.

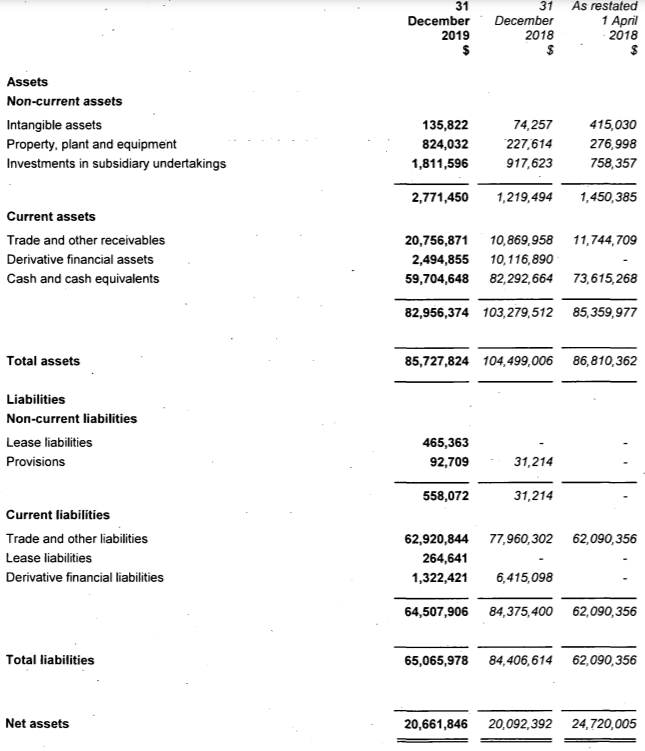

Equiti Capital held $40.2 million of client funds as at end -of-year 2019. To remain compliant with FCA requirements, Equiti Capital client funds are immediately placed into segregated accounts held in Trust with Barclays Bank PLC, RBS PLC and Wells Fargo Bank N.A. London. These are created, maintained, and reconciled daily in accordance with FCA Client Money rules (CASS).

FNG spoke with London based Equiti Capital CEO Brian Myers about the results:

“Our 2019 financial results were built on top of substantial investment into key staff and best-in-class technology. These foundations have contributed heavily to the performance we continue to see through 2020.

We have continued to invest in growing the business by adding a wide range of new financial instruments, new technology partnerships including FXCubic, Gold-i, Your Bourse, revamping and investing in our FX Agency Desk with new technology and growing the team as well as adding new offerings.

We still have many new initiatives to launch by year-end 2020, and anticipate another hugely successful year. We are so proud of our team and what we are achieving together.”

The company also noted that it continued to perform well into the beginning of 2020, achieving record revenue for Q1 2020.

Equiti Capital stated that it added a further 49% staff increase to its London office through 2019.

The increase in activity occurred despite the fact that Equiti Capital ceased to onboard retail clients, to focus instead on Institutional and Brokerage business. The group still services a growing number of retail clients through other entities in the group and this positioning will continue into the foreseeable future.

Key growth plans for Equiti Capital include launching new retail brands across the group targeting diverse market segments, expanding its its vendor network, and building scalable customised solutions for its clients to support their business needs.

The company said it will be investing into its Trading Infrastructure both in terms of expanding its 3rd party vendor network, and also further development of Equiti’s proprietary risk management software. The focus on technology will be supported with a growth in markets offered, with these being added within its customised liquidity streams with which it services clients.

Equiti Capital is controlled by Saudi businessman Abdulraouf Al Bitar, who led a group of MENA investors who invested $100 million in Equiti (then Divisa Capital) in 2017. Mr. Al Bitar is the Executive Director of Al Manhal & Nestlé Waters Group of Factories in Saudi Arabia, and sits on the board of a number of companies throughout the Middle East including Saudi Tabreed District Cooling Company, Middle East Specialized Cables Factory (MESC), Springs Beverage Factory, Middle East Mold and Plastic Factory, Gulf Insulation Group, Shaker Group and LG – Shaker Company. Mr. Al Bitar holds a Bachelor of Science degree in Civil Engineering from Syracuse University, USA.

Equiti Capital’s 2019 income statement and balance sheet follow:

Anonymous

July 13, 2021 @ 1:59 am

4.5