DOJ seeks prison sentence for ex-Deutsche Bank traders

About two months after the Court dashed the hopes of acquittal of former Deutsche Bank traders James Vorley and Cedric Chanu, the US authorities have made it clear what sentence it seeks for the traders, convicted of spoofing.

On May 21, 2021, the Department of Justice (DOJ) filed a sentencing memorandum with the Illinois Northern District Court. The document, seen by FX News Group, states that the DOJ is seeking a significant prison sentence for each of the traders.

In particular, the government seeks a sentence of imprisonment at the lower end of the applicable Guidelines range (57 to 71 months) for each defendant.

The defendants, James Vorley and Cedric Chanu, manipulated one of the world’s most important financial markets and defrauded other market participants for years. To boost their own trading profits and minimize their losses, they flooded the gold and silver futures exchange with billions of dollars of false orders. Their intent was to deceive other traders about the existence of genuine supply and demand, and push market prices in whatever direction benefited the defendants and their employer, Deutsche Bank. Their conduct was both deliberate and persistent, repeated thousands of times over five years, the DOJ notes.

On September 25, 2020, after a two-week trial, a jury convicted the defendants of several counts each of wire fraud affecting a financial institution. The jury also acquitted the defendants on several counts, including a conspiracy charge. The evidence at trial revealed the brazenness of the defendants’ criminal scheme in the way they discussed manipulating the public commodities markets, never believing they would be apprehended and held to account.

The evidence also illustrated the sophistication of their scheme in coordinating illicit trading between conspirators on different continents and exploiting their counterparties’ automated trading systems.

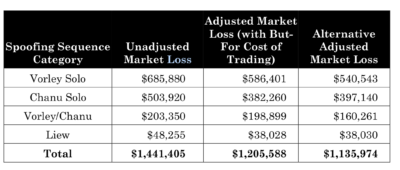

The DOJ stresses that the defendants’ scheme undermined the public’s confidence in the integrity of the financial markets, distorted market participants’ view of supply and demand, and caused over one million dollars of loss to identifiable victims in the gold and silver futures markets.

Considering, in particular, the seriousness of the offense and the need to promote general deterrence, the DOJ argues that a significant term of imprisonment is both appropriate and necessary in this case.

The US Government acknowledges that there is little need to specifically deter these defendants from committing trading crimes in the future. But it is critical that the sentence imposed by the Court serve as a general deterrent to others who may be engaged in, or considering whether to engage in, this type of offense.

“Market manipulation, whether through spoofing or otherwise, is difficult and costly to detect and prosecute. Would-be manipulators know this and likely consider the low prospects of apprehension in deciding whether to engage in abusive trading practices,” the DOJ concludes.

Anonymous

May 23, 2021 @ 4:29 am

5