Citi registers 16% Y/Y increase in Markets revenues in Q2 2025

Citigroup Inc. today posted its financial results for the second quarter of 2025.

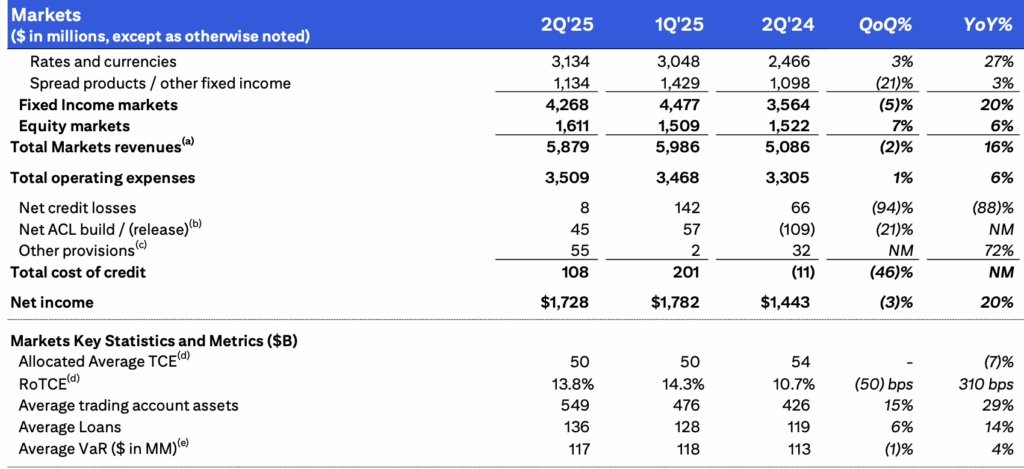

Markets revenues of $5.9 billion increased 16%, driven by growth in both Fixed Income and Equity markets revenues.

Fixed Income markets revenues of $4.3 billion increased 20%, driven by growth across rates and currencies as well as spread products and other fixed income. Rates and currencies revenues increased 27%, thanks to increased client activity and monetization with both corporate and financial institution clients. Spread products and other fixed income revenues increased 3%, on the back of higher financing activity and loan growth, partially offset by lower credit trading.

Equity markets revenues of $1.6 billion increased 6%, driven by momentum in prime services, with record prime balances up approximately 27%, as well as higher client activity and volumes in cash equities and monetization of market activity in derivatives, partially offset by the absence of gains related to the Visa B share exchange in the prior-year period.

Markets net income was $1.7 billion, compared to a net income of $1.4 billion in the prior-year period, supported by the higher revenues, partially offset by the higher expenses and the higher cost of credit.

Across all segments, Citigroup revenues of $21.7 billion in the second quarter 2025 increased 8%, on a reported basis, driven by growth in each of Citi’s five interconnected businesses, partially offset by a decline in All Other. Excluding the divestiture- related impacts in both periods, revenues were up 9%.

Net interest income increased 12%, driven by Markets, Services, U.S. Personal Banking (USPB), Wealth and Banking, partially offset by a decline in All Other. Non-interest revenue decreased 1%, due to All Other, USPB, Markets and Services, offset by increases in Banking and Wealth.

Citigroup net income was $4.0 billion in the second quarter 2025, compared to net income of $3.2 billion in the prior-year period, with the increase driven by the higher revenues, partially offset by the higher expenses and the higher cost of credit.