Citi marks slight rise in Markets and Securities Services revenues in Q1 2021

Citigroup Inc (NYSE:C) today posted its financial results for the first quarter of 2021, with Markets and Securities Services delivering solid revenues.

Citi reported net income for the first quarter 2021 of $7.9 billion, or $3.62 per diluted share, on revenues of $19.3 billion. This compared to net income of $2.5 billion, or $1.06 per diluted share, on revenues of $20.7 billion for the first quarter 2020.

Revenues decreased 7% from the prior-year period, as higher revenues in Investment Banking and Equity Markets were more than offset by lower rates, the absence of prior year mark-to-market gains on loan hedges within the Institutional Clients Group (ICG), and lower card volumes in Global Consumer Banking (GCB).

Net income of $7.9 billion increased significantly from the prior-year period driven by the lower cost of credit. Earnings per share of $3.62 increased significantly from the prior-year period, reflecting the increase in net income, as well as a slight decline in shares outstanding.

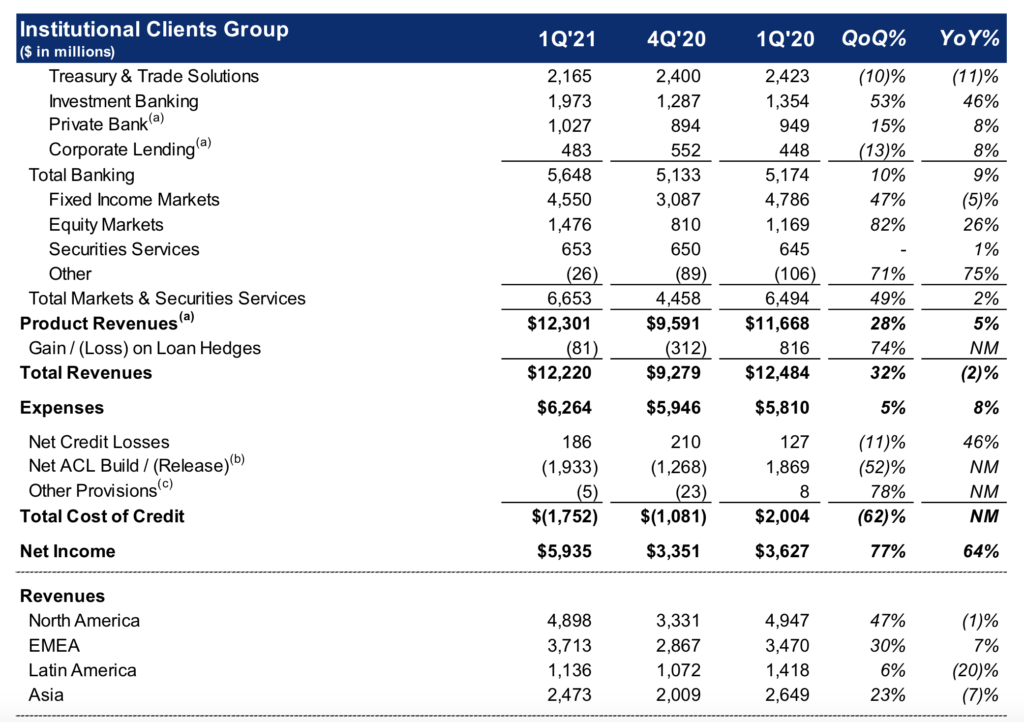

ICG revenues of $12.2 billion decreased 2%, as revenue growth in Banking and Markets and Securities Services, was more than offset by the absence of mark-to-market gains on loan hedges recorded in the prior-year period.

Markets and Securities Services revenues of $6.7 billion increased 2% from the year-ago period. The result was also higher than the one recorded in the final quarter of 2020.

Fixed Income Markets revenues of $4.6 billion decreased 5% versus a strong prior-year period, as higher revenues across spread products partially offset lower revenues in rates and currencies. Equity Markets revenues of $1.5 billion increased 26%, driven by strong performance in cash equities, derivatives and prime finance, reflecting solid client activity and favorable market conditions.

Securities Services revenues of $653 million increased 1% a reported basis, but were unchanged in constant dollars, as growth in deposits, assets under custody and settlement volumes were offset by lower spreads.