BGC Partners registers 9% drop in Forex revenues in Q4 2020

Global brokerage and financial technology company BGC Partners, Inc. (NASDAQ:BGCP) today reported its financial results for the quarter and year ended December 31, 2020.

BGC continued its optimization of front office headcount across less profitable businesses, which lowered revenues in the short-term, but increased profitability during the quarter. This led to an 8.4% increase in average productivity of financial brokers and salespeople compared to the fourth quarter a year ago. Additionally, pandemic-related lockdowns and continued dislocations across the globe weighed on overall revenue.

During the fourth quarter, BGC’s financial brokerage businesses had strong growth across European government and credit bonds, Asian bonds, U.S. and European inflation products, and U.S. and European equities. The Group’s fixed income agency brokerage business, which serves a broader client set, also outperformed during the period. This growth was offset by lower revenue across European listed rates and emerging market credit and FX products.

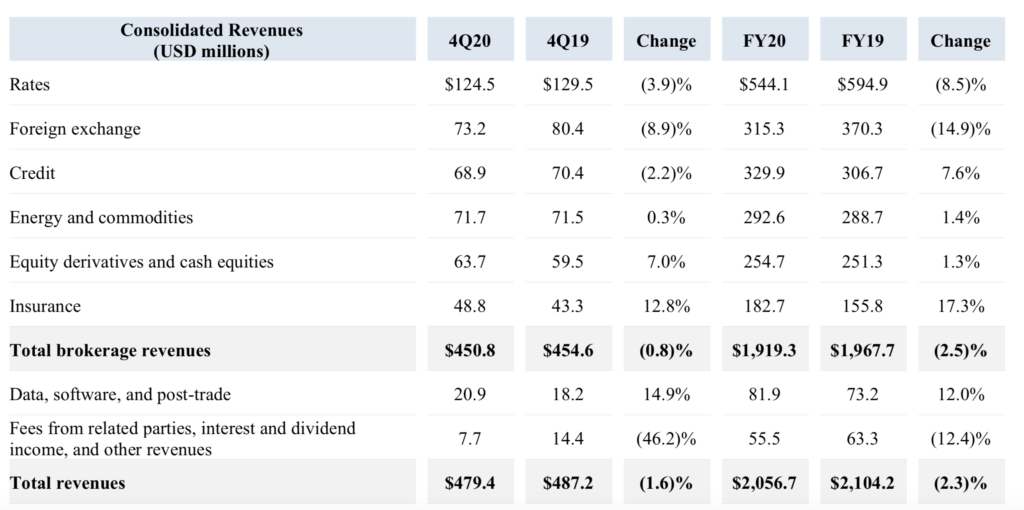

In the final quarter of 2020, BGC Partners registered Forex revenues of $73.2 million, down 8.9% from the year-ago period. For the whole of 2020, Forex revenues amounted to $315.3 million, down 14.9% from 2019 levels.

Corant posted record revenue for both the fourth quarter and full year 2020 as it continued to benefit from improved productivity from recently hired brokers and hardening pricing trends. Corant’s growth was also driven by new business lines, including its aviation and aerospace business, Piiq, which won key new clients, driving record quarterly revenue.

Fenics net revenue increased by 33.4% in the fourth quarter, driven by 41% growth in brokerage and 14.9% growth in Data, Software, and Post-trade.

The improvement in Fenics brokerage reflects accelerating Rates and FX growth which were up 51.2% and 125.9%, respectively, driven by Fenics Integrated. Fenics Rates growth was driven by Euro and U.S. rates products, including government bonds, interest rate derivatives and inflation products, while FX growth was primarily driven by FX options and spot FX.

Across all segments, revenues totalled $479.4 million in the fourth quarter of 2020, down 1.6% from the year-ago period. The result was in line with forecasts. For 2020, revenues fell 2.3% to $2,056.7 million.

On February 23, 2021, BGC Partners’ Board of Directors declared a quarterly qualified cash dividend of $0.01 per share payable on March 30, 2021 to Class A and Class B common stockholders of record as of March 16, 2021. The ex-dividend date will be March 15, 2021.

BGC’s 2021 capital allocation priorities are to return capital to stockholders and to continue investing in its high growth Fenics businesses. BGC plans to prioritize share and unit repurchases over dividends and distributions. The Company plans to reassess its current dividend and distribution with an aim to nominally increase it toward the end of the year.

The company continues to explore a possible conversion into a simpler corporate structure, weighing any significant change in taxation policy. In particular, BGC Partners is awaiting insight into future U.S. Federal tax policies, which remain uncertain after the results of the U.S. elections.