BGC Group registers 21.9% Y/Y increase in FX revenues in Q2 2025

BGC Group, Inc. (NASDAQ:BGC) today reported its financial results for the quarter ended June 30, 2025.

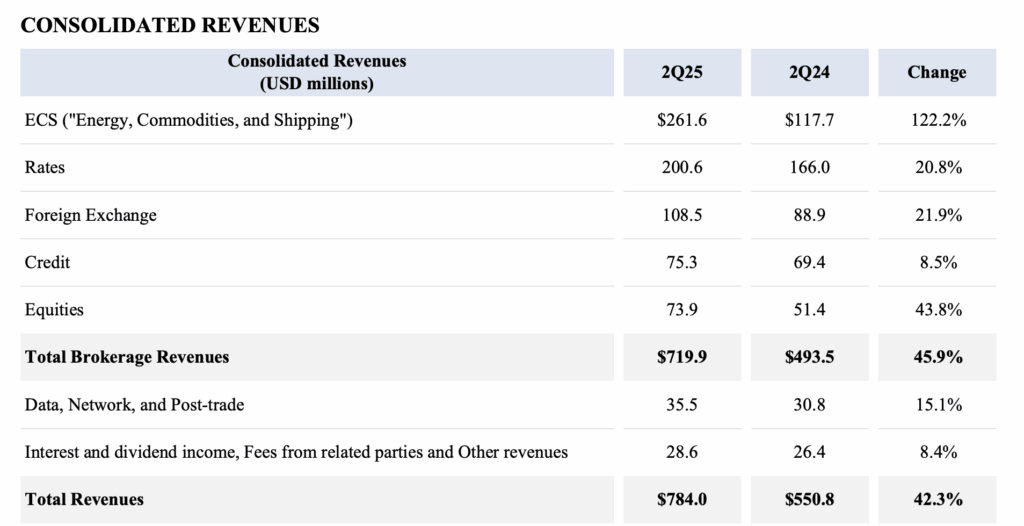

Foreign Exchange revenues were up 21.9% to $108.5 million, due to strong growth in FX options and emerging market currencies.

Across all segments, BGC Group reported record quarterly revenues of $784.0 million, a 42.3% increase versus last year. Excluding OTC, revenues were $665.7 million, up 20.9% – also a quarterly record.

Revenues across EMEA, Americas, and APAC grew by 50.3%, 40.3%, and 17.4%, respectively.

BGC Group posted record Pre-tax Adjusted Earnings of $173.6 million, up 38% from the year-ago period.

Post-tax Adjusted Earnings amounted to $153.7 million, a 34% increase, resulting in post-tax Adjusted Earnings per share of $0.31, a 34.8% improvement.

Adjusted EBITDA totalled $213.3 million, 31.4% higher compared to last year.

On July 30, 2025, BGC’s Board of Directors declared a quarterly qualified cash dividend of $0.02 per share payable on September 3, 2025 to Class A and Class B common stockholders of record as of August 20, 2025, which is the same date as the ex-dividend date.

Sean Windeatt, Co-Chief Executive Officer, commented:

“We delivered historic results, generating record revenues of $784 million, a 42 percent increase versus last year. Excluding OTC, revenues grew by 21 percent, surpassing last quarter’s record revenues. We continue to gain market share in the ECS and financial markets with strong growth across all asset classes and geographies. BGC is now the world’s largest ECS broker.

FMX had its best ever quarter, with record volumes and market share across both our FMX UST and FX platforms. Total Fenics revenues grew by 19 percent, with Fenics Growth Platforms increasing by 30 percent, driven by strong double-digit growth from FMX, PortfolioMatch, and Lucera.

Following our most recent acquisition, we launched a cost reduction program, which we expect will be completed by year-end and deliver at least $25 million in annualized savings through expense synergies. These savings will enhance our profitability, drive margins higher, and we expect them to deliver long-term shareholder value.”