Bank of America registers rise in Global Markets net income in Q4 2024

Bank of America today posted its financial report for the final quarter of 2024, with Global Markets net income increasing compared to the equivalent period in 2023.

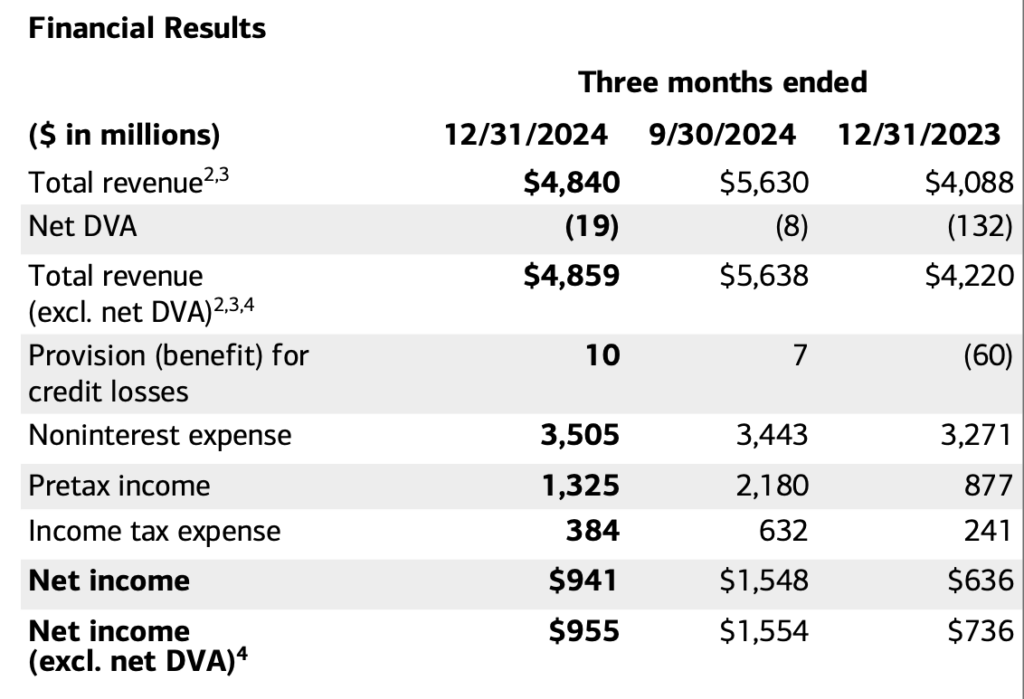

Global Markets reported net income of $941 million, up from $636 million in the fourth quarter of 2023.

The segment reported revenue of $4.8 billion, up 18% year-on-year, driven by higher sales and trading revenue and investment banking fees.

Noninterest expense of $3.5 billion increased 7% due to higher revenue-related expenses and investments in the business, including technology.

Sales and trading revenue of $4.1 billion increased 13% in annual terms. FICC revenue increased 19% to $2.5 billion, driven by improved trading performance in macro products and continued strength in credit products. Equities revenue increased 7% to $1.6 billion, driven by improved trading performance and increased client activity.

Across all segments, net income amounted to $6.7 billion, or $0.82 per diluted share, compared to $3.1 billion, or $0.35 per diluted share, in the final quarter of 2023.

Revenue, net of interest expense, was $25.3 billion, up 15%. This increase was driven primarily by higher asset management and investment banking fees, and sales and trading revenue.

Net interest income (NII) reached $14.4 billion, up 3% from 4Q23 and 3Q24.

The year-over-year increase was driven primarily by Global Markets activity, fixed-rate asset repricing and loan growth, partially offset by the impact of lower interest rates.

Chair and CEO Brian Moynihan commented:

“We finished 2024 with a strong fourth quarter. Every source of revenue increased, and we saw better than industry growth in deposits and loans.

We also ended with strong capital and liquidity, enabling us to return $21 billion of capital to shareholders in 2024.

We believe this broad momentum sets up 2025 very well for Bank of America. I thank all my teammates for another great year, and together we look forward to driving the company forward in 2025 against the backdrop of a solid economic environment.”