Bank of America registers 25% Y/Y drop in Global Markets income in Q4 2022

Bank of America Corp (NYSE:BAC) today posted its financial report for the three-month period to end-December 2022.

The Global Markets segment generated net income of $504 million, down $165 million, or 25% from the year-ago quarter. The result compares with a net income of $1.1 billion seen in the preceding quarter.

The segment generated revenue of $3.9 billion, up 1% from a year earlier, primarily driven by higher sales and trading revenue, partially offset by lower investment banking fees.

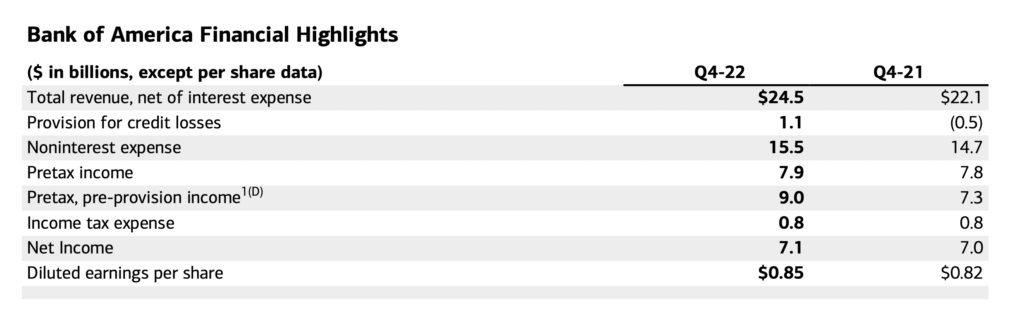

Across all segments, Bank of America posted net income of $7.1 billion, or $0.85 per diluted share, compared to $7.0 billion, or $0.82 per diluted share for the fourth quarter of 2021.

Revenue, net of interest expense, increased 11% to $24.5 billion.

Net interest income (NII) was up $3.3 billion, or 29%, to $14.7 billion, driven by benefits from higher interest rates, including lower premium amortization expense, and solid loan growth.

Chair and CEO Brian Moynihan commented:

“We ended the year on a strong note growing earnings year over year in the 4th quarter in an increasingly slowing economic environment. The themes in the quarter have been consistent all year as organic growth and rates helped deliver the value of our deposit franchise. That coupled with expense management helped drive operating leverage for the sixth consecutive quarter. Our earnings of $27.5 billion for the year represent one of the best years ever for the bank, reflecting our long-term focus on client relationships and our responsible growth strategy.

We believe we are well positioned as we begin 2023 to deliver for our clients, shareholders and the communities we serve.”