Bank of America marks rise in Global Markets net income in Q4 2020

Bank of America Corp (NYSE:BAC) today posted its financial report for the final quarter of 2020, with Global Markets showing robust results.

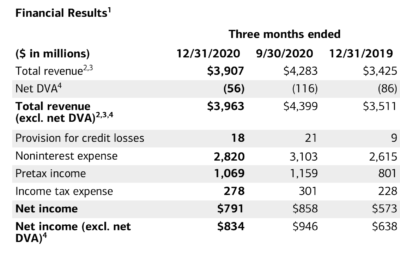

In the final three months of 2020, Global Markets saw net income increase $218 million from a year earlier to $791 million. Excluding net DVA, net income increased 31% to $834 million in the fourth quarter of 2020.

Global Markets’ revenue for the fourth quarter of 2020 amounted to $3.9 billion, up 14% from the equivalent period a year earlier, driven by increases in sales and trading, equity underwriting fees, and card income. Excluding net DVA, revenue increased 13% from the fourth quarter of 2019.

Reported sales and trading revenue in the Global Markets segment amounted to $3.0 billion in the final quarter of 2020. Excluding net DVA, sales and trading revenue increased 7% to $3.1 billion.

FICC revenue, however, decreased 5% to $1.7 billion, as weaker trading performance in macro products and mortgages outweighed gains in credit. Equities revenue increased 30% year-on-year to $1.3 billion thanks to strong trading performance in cash and derivatives and increased client activity.

Across all segments, net income was $5.5 billion, or $0.59 per diluted share, whereas revenue, net of interest expense, decreased 10% to $20.1 billion in the final quarter of 2020.

Provision for credit losses decreased to $53 million, reflecting a reserve release of $828 million.

From Chief Financial Officer Paul Donofrio commented:

“Despite one of the worst economic environments in modern memory, we ended the year stronger than before the health crisis and well positioned to support our clients. We grew deposits by $361 billion, improved our capital ratios and increased liquidity to record levels, exceeding loans. Because of the responsible way we have operated the company over many years, we were able to support the economy by raising $772 billion in capital on behalf of clients, invest in our franchise and still be in a position to return $4.8 billion in capital to our shareholders in the first quarter of 2021 in the form of common stock repurchases and dividends.”