ATFX UK sees growth in 2022 revenues and profit as Connect business takes off

Leading Retail FX and CFDs broker ATFX has released 2022 financial results for its FCA regulated UK entity, AT Global Markets (UK) Limited, indicating a strong year of growth for the company on both the top and bottom line. ATFX UK operates the ATFX Connect brand targeting mainly HNW and institutional clients.

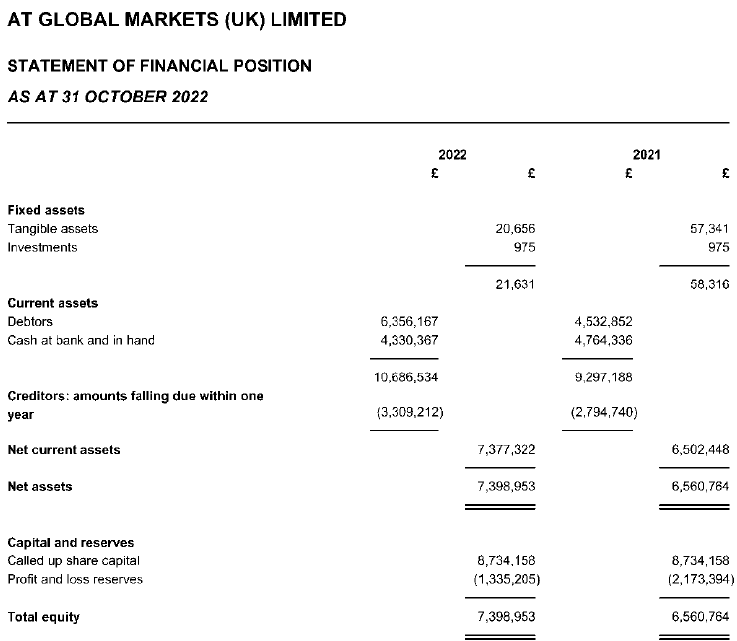

Revenues at ATFX UK rose by 8% in 2022 (fiscal year end October 31) to £3.2 million, versus £2.9 million in 2021. The company saw a 13% rise in net assets to £7.4 million (2021: £6.56 million), which included £4.3 million of cash balances. Accordingly the company said it has a strong balance sheet and is well placed to achieve its long term strategy. ATFX UK made a profit of £838,189 in 2022, up from £224,558 the previous year.

Following the end of the year ATFX UK continued to grow the brand making a number of key hires, including former Swissquote executive Gonzalo Canete who joined as Chief Market Strategist, and Chris James who joined ATFX UK from State Street / Currenex as Head of Liquidity Management.

ATFX UK noted that the firm will continue to market itself directly to EEA and other international territories, where permitted. The key targets will be the existing high net worth clients , fund managers, brokers and banks who are looking to diversify their portfolio and are comfortable with the risk profile and volatility that investing and trading in derivatives can offer.

ATFX is controlled by Hong Kong based entrepreneur Joe Li. The group has licensed subsidiaries in the UK (FCA), Cyprus (CySEC), Mauritius, the UAE, and recently acquired the ASIC licensed CFDs business of Rakuten Australia.

ATFX UK’s 2022 income statement and balance sheet follow below.