Jefferies’ top two execs to get $13M annual bonuses each for 2020

Jefferies Financial Group Inc (NYSE:JEF) has invited its shareholders to participate in its 2021 Annual Meeting of Shareholders on Thursday, March 25, 2021 at 10:00 a.m. New York City time. The agenda will include a vote for the election of directors, an advisory vote to approve 2020 executive compensation, a vote to approve Jefferies Financial Group’s new Equity Compensation Plan, and a vote on the selection of independent auditors.

For 2020, the Compensation Committee decided to pay each of Jefferies’ top two executives $13 million based on strong ROTDE (Return on Tangible Deployable Equity) performance and outstanding results in Jefferies’ financial services business, Jefferies Group, in the face of unprecedented adversity.

Because of the long-term performance nature of the plan, the executives continue to face a situation in which they may not receive the benefit of their long-term incentive RSUs (restricted stock units) for 2020.

Since becoming CEO of Jefferies Group in 2001 and for the eight years he has worked at Jefferies Financial Group, approximately 68% of Rich Handler’s compensation has consisted of non-cash equity related securities vesting over three to five years. Aside from charitable donations and tax-related sales, Mr. Handler has not sold any of his shares.

Likewise, since becoming an executive officer of Jefferies Group in 2005 and as President of Jefferies Financial Group, approximately 73% of Brian Friedman’s compensation from Jefferies and Jefferies Financial Group has consisted of non-cash equity related securities vesting over three to five years. Aside from charitable donations, estate planning and tax-related sales, Mr. Friedman has not sold any of his shares.

Jefferies notes that, although the last year’s advisory say-on-pay vote was approved by its shareholders, that consent was not substantially universal (69.2%). The Group historically engages with shareholders and other stakeholders in an effort to gather input and seek advice with regard to the compensation plans.

In 2020, including during the proxy season, the Chairman of the Compensation Committee and the Executive Vice President and General Counsel had meaningful discussions with more than 70% of Jefferies’ shareholders. Many of those shareholders voted in favor of the 2019 compensation plan; others did not. For those who did not, Jefferies heard disappointment in its metrics pertaining to shareholder returns and its return on tangible deployable equity and questions about why it did not merely adhere to performance metrics in the face of what was perceived to be disappointing performance.

Jefferies says it is in the middle of its most recent round of shareholder engagement, which will continue to and through the Annual Shareholders Meeting on March 25, 2021. During that process, it is engaging with a large majority of its shareholders –again in the 70% or higher range – and soliciting feedback on the actual 2020 compensation and on the planned 2021 framework.

Jefferies states that:

“This year, our shareholders have been extremely pleased with our outstanding performance and seemed to agree with our 2020 compensation decisions. They have also given us great advice regarding how best to disclose our thought processes to explain those decisions”.

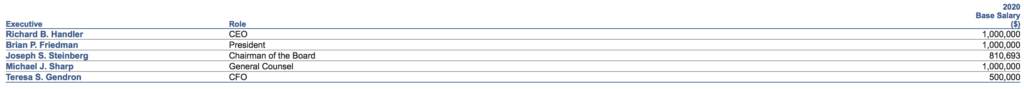

Let’s note that Jefferies pays its named executive officers a market-level base salary to provide them a predictable level of income and to reward current and past short-term performance. The base salaries below are annualized.

Jefferies’ top two executives, Rich Handler (CEO) and Brian Friedman (President), were eligible to receive annual cash bonuses for 2020. Each executive was awarded $13 million.

Jefferies’ General Counsel will get a performance-based bonus of approximately $2.9 million. The Committee approved Mr. Sharp receiving an additional $2.1 million cash bonus that brought his total reward to $5 million.

Jefferies’ CFO will collect a performance-based bonus of approximately $729,000. Ms. Gendron will also receive an additional $571,000 cash bonus that brings her total reward to $1.3 million.

In December 2020 (in Jefferies’ fiscal 2021), Jefferies granted to each of its CEO and President a non-qualified stock option for the purchase of 1,253,133 shares together with separate cash-settled SARs covering 1,253,133 shares. The awards have a term of ten years, become exercisable in equal installments on the first three anniversaries of grant and have an exercise price or strike price of $23.75, the grant-date fair market value of the shares.

The Compensation Committee granted the option under the 2003 Plan and the SARs under the Committee’s general authority to establish cash compensation arrangements.

The Board recommends a vote FOR the 2020 Executive Compensation.