SIX registers rise in operating income and improved margin in H1 2025

SIX today posted its financial report for the first half (H1) of 2025.

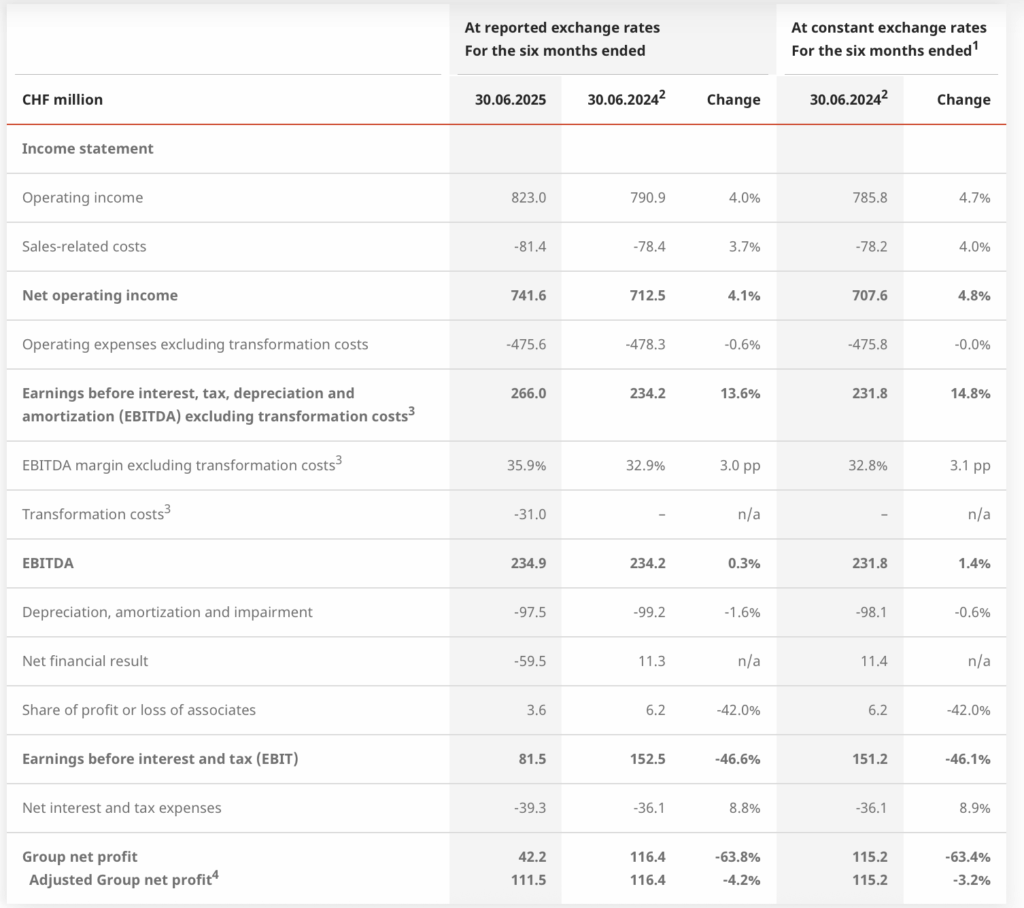

The Group increased its operating income by 4.7% year-on-year to CHF 823.0 million (at constant exchange rates). At reported exchange rates, this increase was 4.0%.

Less sales-related costs, net operating income was CHF 741.6 million, up 4.8% at constant exchange rates and up 4.1% at reported exchange rates. The transformation program Scale Up 2027 has begun to contribute both to income growth and to cost savings. Associated transformation costs (TC) in the first half of 2025 were CHF 31.0 million.

Excluding TC, operating expenses were CHF 475.6 million, in line with the first half of 2024. Earnings before interest, tax, depreciation, and amortization (EBITDA) excluding TC increased by 14.8% to CHF 266.0 million at constant exchange rates, with a margin of 35.9% based on net operating income.

Due to the share price decline at Worldline, SIX adjusted the value of its 10.5% stake in the European payments provider by CHF 69.3 million.

Earnings before interest and tax (EBIT) were CHF 81.5 million. Adjusted Group net profit was CHF 111.5 million, compared to CHF 116.4 million in the first half of 2024. Group net profit was CHF 42.2 million.

In the Exchanges business unit, the trend of rising trading turnovers that started in the second half of 2024 was strongly supported by elevated levels of volatility during the first half of 2025. Combined equity trading turnover in CHF for the first half of 2025 rose by 13.2%, year-on-year. At SIX Swiss Exchange, ETF trading turnover for the reporting period grew by more than 100% compared to the first half of 2024. Market data and connectivity solutions also showed strong results, driving further growth.

The Securities Services business unit again was able to achieve robust growth in its core business areas against a strong comparative period, thus partially compensating for declining net interest income. Main drivers of organic growth were domestic and international custody business, followed by securities finance. SDX business has been integrated into the Securities Services business unit to capitalize on synergies as part of the broader SIX ecosystem.

The Financial Information business unit also continued its growth trajectory. Driven by organic growth and the acquisitions of FactEntry in March 2024 and Swiss Fund Data at the beginning of 2025, the business unit was able to offset negative exchange rate impacts. Main drivers of organic growth were market data and display products and services, particularly real-time data, followed by tax and regulatory services and indices.

Banking Services demonstrated strong growth in debit processing and services as well as in billing and payments. Important drivers were higher transaction volumes as well as debit operations and related digital services.