OSE to increase number of single stock options eligible for market making

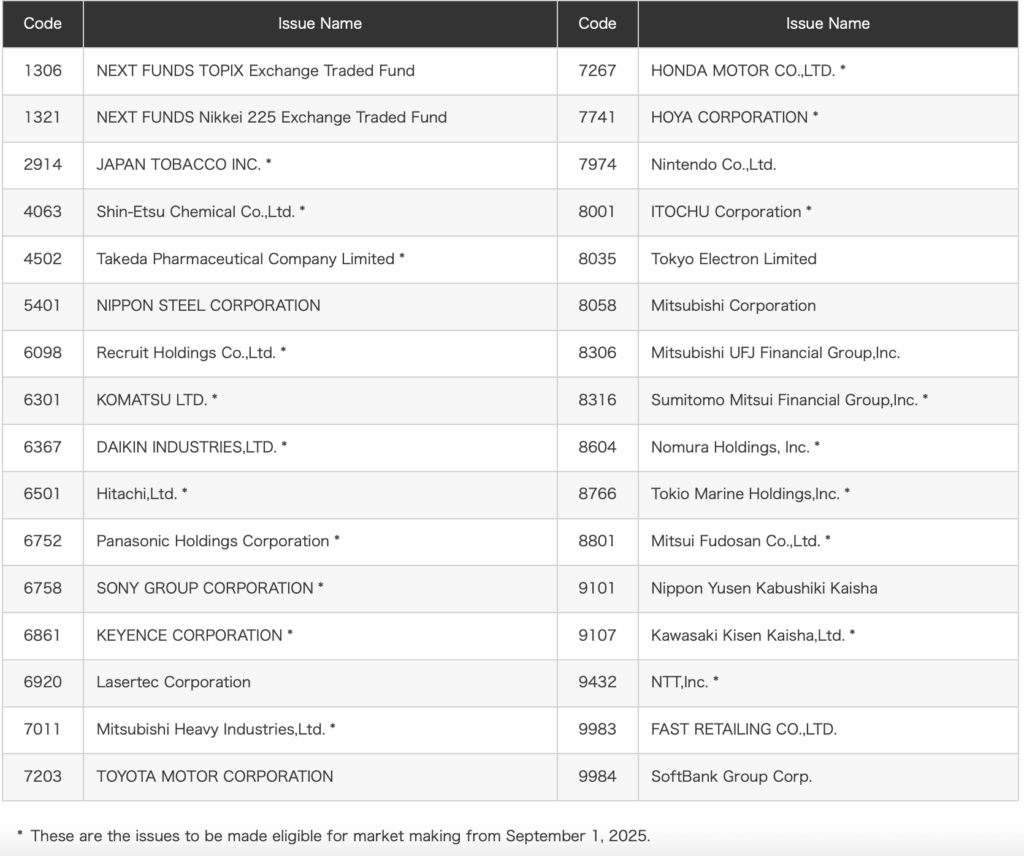

Osaka Exchange, Inc. (OSE) today announced that, effective September 1, 2025, it will expand the number of single stock options (SSOs) eligible for market making to 32 from the current 12 by adding issues on 20 new individual stocks.

Eligible underliers will now comprise 30 individual stocks and 2 ETFs.

To enhance the convenience of the SSO market, since fall 2024, OSE has had market makers continuously quote prices for SSOs on ten new individual stocks in addition to the existing two ETFs, creating a more accessible trading environment for investors for 12 securities in total. As a result, a diverse range of investors have started utilizing the market, and there has been a noticeable increase in transactions, particularly during auction sessions.

The newly added underliers, while centered on the TOPIX Core30, will cover a broader range of industries than before including the TOPIX Large70 and TOPIX Mid400, providing a lineup that meets the wider needs of investors.