Nasdaq reports slight increase in revenues in Q4 2022

Nasdaq, Inc. (NASDAQ:NDAQ) today reported financial results for the fourth quarter and year 2022.

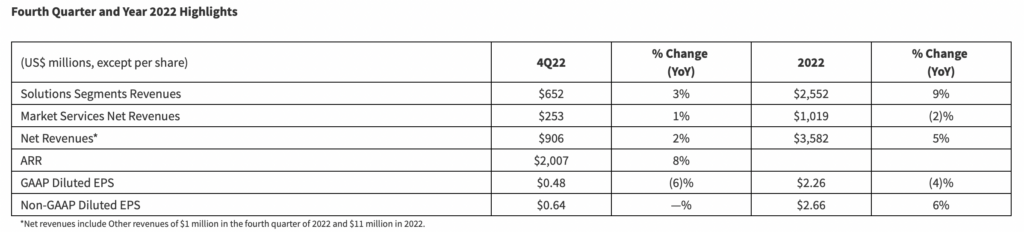

Fourth quarter 2022 net revenues were $906 million, an increase of $21 million, or 2%, from $885 million in the prior year period. Net revenues reflected a $41 million, or 5%, positive impact from organic growth, including positive contributions from all segments, partially offset by an $18 million decrease from the impact of changes in FX rates and a $2 million decrease from the net impact of an acquisition and divestiture.

Solutions businesses revenues were $652 million in the fourth quarter of 2022, an increase of $21 million, or 3%. The increase reflects a $30 million, or 5%, positive impact from organic growth, and a $1 million increase from an acquisition, partially offset by a $10 million decrease from the impact of changes in FX rates.

2022 net revenues were $3,582 million, an increase of $162 million, or 5% over 2021. Net revenues reflected a $239 million, or 7%, positive impact from organic growth, a $70 million decrease from the impact of changes in FX rates and a $7 million decrease from the net impact of acquisitions and divestitures.

Adena Friedman, Chair and CEO, said:

“We delivered another year of strong growth against an uncertain macroeconomic backdrop, illustrating the strength of our diversified business and our ability to deliver on our longer-term objectives. As we look to 2023, our new corporate structure positions us to deliver greater liquidity, transparency, and integrity solutions to our clients throughout the financial system.”

Ann Dennison, Executive Vice President and CFO, added:

“In 2022 we successfully executed our capital plan to minimize the impact of rising rates, reduce net leverage and support our long-term growth strategy. We enter 2023 with a strong capital position and the flexibility to adapt to varying operating environments. Additionally, we raised our dividend growth potential with an expectation for a rising payout ratio over the next five years, amplifying our ability to continue delivering a compelling dividend growth story.”