ICE registers steep increase in revenues in Q1 2025

Intercontinental Exchange (NYSE:ICE), a leading global provider of technology and data, today reported its financial results for the first quarter of 2025.

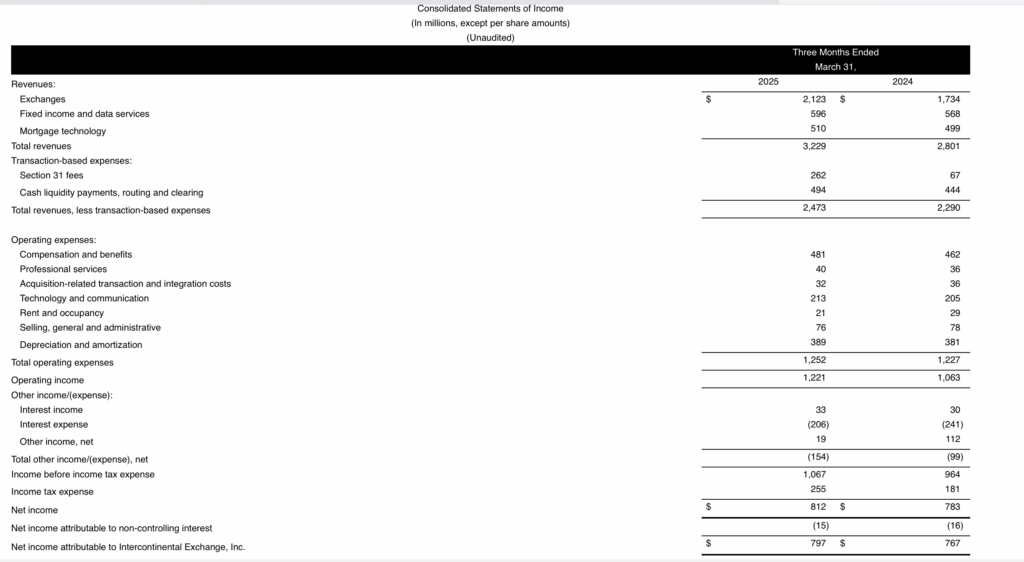

First quarter consolidated net revenues were $2.5 billion including exchange net revenues of $1.4 billion, fixed income and data services revenues of $596 million and mortgage technology revenues of $510 million.

Consolidated operating expenses were $1.3 billion for the first quarter of 2025. On an adjusted basis, consolidated operating expenses were $964 million.

Consolidated operating income for the first quarter was $1.2 billion, and the operating margin was 49%. On an adjusted basis, consolidated operating income for the first quarter was $1.5 billion, and the adjusted operating margin was 61%.

Operating cash flow in the first quarter of 2025 was $966 million and adjusted free cash flow was $833 million.

Unrestricted cash was $783 million and outstanding debt was $20.3 billion as of March 31, 2025.

Through the first quarter of 2025, ICE repurchased $241 million of its common stock and paid $278 million in dividends.

Warren Gardiner, ICE Chief Financial Officer, commented:

“ICE’s first quarter performance underscores the quality and durability of our business model, reporting record revenues and record operating income. This performance enabled us to invest in our business while also returning $519 million to stockholders through dividends and share repurchases, as well as make progress on deleveraging. As we look to the balance of the year, we remain focused on disciplined investment in support of our strategic growth initiatives and on creating value for our stockholders.”