Cboe Options Exchange plans to extend Global Trading Hours in Q4 2021

Cboe Options Exchange plans to extend its existing Global Trading Hours (GTH) session and to introduce a 24×5 trading model in its proprietary VIX and SPX options products later this year, subject to regulatory review.

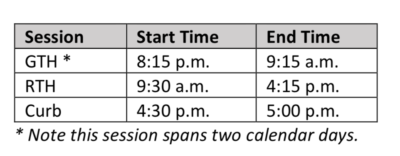

As part of this effort, the Exchange will be introducing a brief Curb session operating from 4:30 p.m. to 5:00 p.m. ET Monday through Friday. There will be no changes to trading floor operations, and the trading floor will remain open only for the Regular Trading Hours (RTH) session.

The 24×5 trading model is expected to launch mid to late Q4 2021 contingent upon completion in July of the OPRA Pillar migration. In preparation for the introduction of a 24×5 trading model, the Curb session will be introduced in Q3 2021.

Upon the effective date, the Exchange standard trading session schedules will be as follows, with the first GTH session starting on Sundays and the last Curb session ending on Friday each week.

Symbols will be in the Queueing state for the 15 minutes immediately preceding GTH, RTH, and Curb sessions each day, with the exception of Sundays prior to the first GTH session of the week as well as holidays with a GTH session in which cases the Pre-Open session will start one hour prior to GTH.

The dissemination of auction messages preceding the opening rotations for GTH and Curb will commence 15 minutes prior to the rotation.

The Multicast PITCH and TOP feeds will continue to disseminate trading status information. If any market data messages or values are changed, those will be communicated in a future Trade Desk notice.

FLEX orders are currently and will continue to be allowed in all non-RTH sessions, with the exceptions of FLEX-% and FLEX-DAC orders which will only be allowed during the RTH session.

No changes will be made to the current clearing edit functionality in coordination with this change. All clearing edits will still be expected to be completed by 5:30 p.m. ET with an optional extension upon request to the Cboe Trade Desk or OSC. The new 24×5 trading model will require a 7:00 p.m. ET hard cutoff deadline for all optional extensions with no ability for Cboe to extend past this time.