Aquis Exchange registers 21% Y/Y rise in revenue in H1 2022

Exchange services group Aquis Exchange PLC (LON:AQX) today posted its unaudited results for the six months ended 30 June 2022.

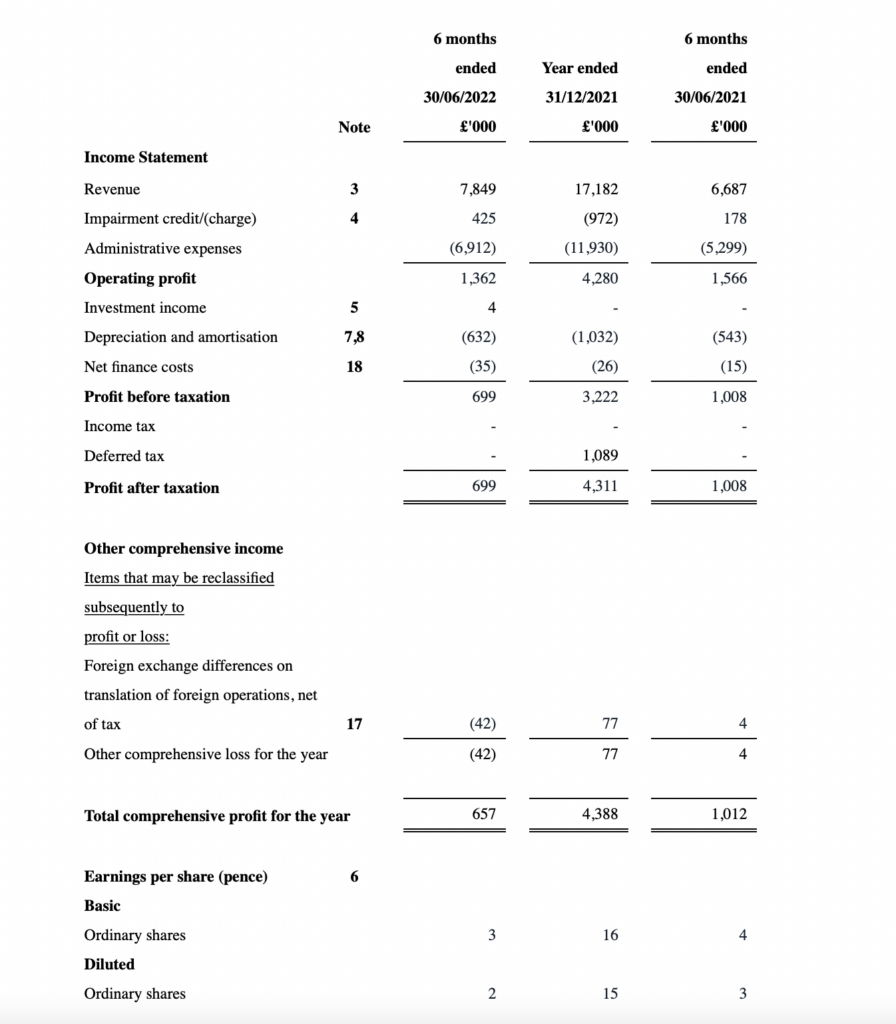

Net revenue increased 21% from the year-ago period to £8.3 million (1H21: £6.9m) and the EBITDA profit for the half year was £1.4 million, broadly in line with the EBITDA profit of £1.6 million generated in 1H21.

This EBITDA profit and the profit before tax of £0.7m includes £0.4m of income recognised from an impairment credit per IFRS 9 consistent with the 1H21 impairment credit. The EBITDA has remained broadly consistent as the Group made some controlled increases in costs during both in 1H 2022 and the back end of last year as it continued to invest in personnel and technological resources.

Revenue from market data vendors increased significantly by £0.3m, 29%, to £1.4m for the six-month period compared to the 2021 equivalent, with continued growth in both terminal use and non-display licences across the period.

The Group’s cash and cash equivalents as at 30 June 2022 were £13.3 million (30 June 2021: £13.9 million).

The successful exchange cloud technology Proof of Concept (PoC) completed in 2021 has resulted in a number of new exchange platform prospects. The investment Aquis has made in the first half of 2022 has allowed it to further develop its innovative technology which is at the core of Aquis Technologies.

The company says it is working to enhance its software licensing activities and build presence internationally. It has made significant progress on a number of material technology contracts post-period end that will support the second half performance and into FY23, as this growing division becomes an increasingly important part of its business.

Notwithstanding the macroeconomic uncertainty, the company says its current trading is tracking in line with market expectations for the full year.