Aquis Exchange registers 17% Y/Y increase in revenues in H1 2023

Aquis Exchange PLC (LON:AQX) today announced its unaudited results for the six months ended 30 June 2023.

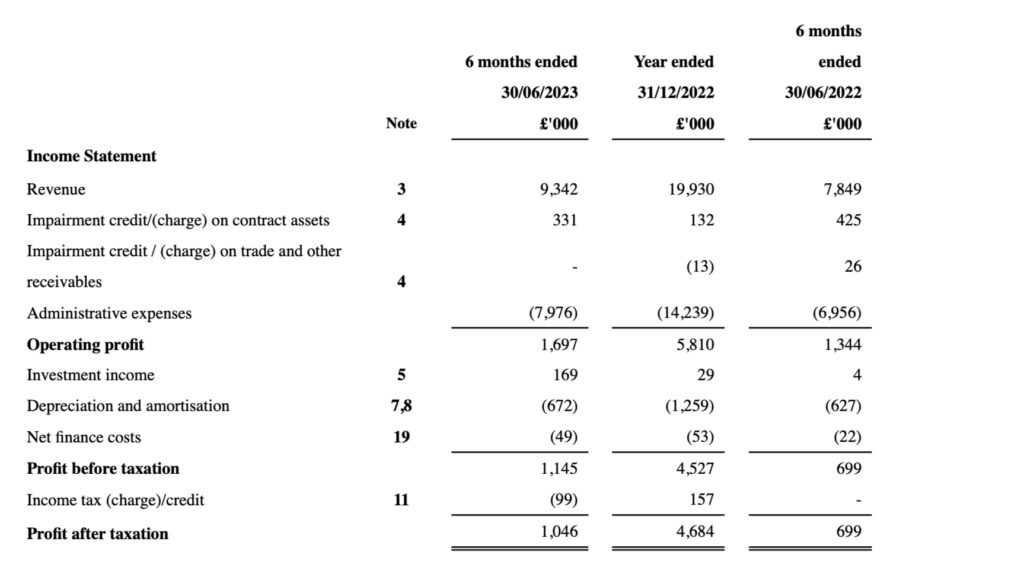

Net revenue increased 17% to £9.7 million (1H22: £8.3m) and the EBITDA profit for the half year was £1.7 million, a 26% increase on the EBITDA profit of £1.4 million generated in the first half of 2022. This EBITDA profit and the profit before tax of £1.1m includes £0.3m of income recognised from an impairment credit per IFRS 9 consistent with the 1H22 impairment credit.

Operating costs have increased by 15% to £8.0m (H1 2022: £6.9m) reflecting primarily increased headcount in the period as well as inflation on both staff cost and data centre costs and increased data costs.

The Group continues to maintain a strong balance sheet and cash equivalents at 30 June 2023 were £13.9m (30 June 2022: £13.3m). The Group continues to generate cash above operational requirement which has allowed the ongoing transfer of funds to the Group Trusts which have purchased shares in support of the Group share schemes.

Aquis says 2023 so far has been a year of continued momentum for the company, with revenues continuing to increase across all divisions.

Following the successful integration of the Aquis Matching Pool in 2022, Aquis Markets has seen increased revenues. The company has also worked to further diversify the products that will be made available to members, adding block trading via OptimX Markets and changing its proprietary trading rule to give members greater execution choice along with best execution outcomes. These changes are laying the foundations for future growth in market share over the medium-term.

Despite challenging market conditions, Aquis remains positive on the long-term potential of the Aquis Stock Exchange, which remains profitable.

In terms of outlook, Aquis says:

“With economic uncertainty continuing to affect all market participants, we are pleased to be delivering continued growth, strategic progress and value for shareholders. We have had a positive start to 2023, with continued revenue growth across all divisions and trading remains in line with Board expectations for the full year”.