Another major stock exchange down – this time Australia ASX

This certainly feels like more than just a “glitch” or a coincidence.

After what were most certainly hacker attacks brought down the New Zealand NZX for four days in a row back in August, and the Tokyo Stock Exchange for one day in October, now Australia’s leading stock exchange, the ASX, has been brought to its knees. At least temporarily.

After trading opened in Sydney on Monday morning, a number of problems were quickly experienced in the provision of market data, quotes, and then execution of orders. At 10:24am the ASX issued a “Critical Operation Impact” status notice indicating a halt in all trading on the ASX.

After trading opened in Sydney on Monday morning, a number of problems were quickly experienced in the provision of market data, quotes, and then execution of orders. At 10:24am the ASX issued a “Critical Operation Impact” status notice indicating a halt in all trading on the ASX.

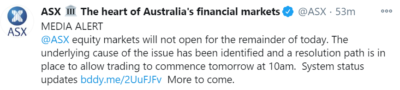

After a number of additional market-remains-halted notices, at 14:58 the ASX posted that the markets would remained closed for the remainder of the day. It said that the underlying cause of the issue was identified, and that a resolution path is in place to allow trading to resume at 10am Tuesday as usual.

The ASX later gave some more specifics, saying that a software issue limited to the trading of multiple securities in a single order (known as combination trading) created inaccurate market data.

The country’s main alternative stock exchange Chi-X Market Australia noted that it has been operating as usual.

The ASX later issued a more complete statement, which reads as follows:

ASX statement on the equity market outage

ASX sincerely apologises and deeply regrets the disruption to the market caused by the outage of the ASX Trade system today.

The market will remain closed today, Monday 16 November. It will reopen at the normal time (10am) tomorrow, Tuesday 17 November.

ASX and its technology provider Nasdaq have identified the root cause and a resolution path to fix it. A software issue limited to the trading of multiple securities in a single order (combination trading) created inaccurate market data.

The issue will be resolved overnight with the market re-opening at 10am tomorrow.

Today was the go-live for the refreshed ASX Trade system, which is the trading platform for ASX’s equity market.

ASX, our technology provider Nasdaq, customers and independent specialist third parties conducted extensive testing for over a year, including four dress rehearsals, in preparation for today’s go-live.

The refresh is the latest generation of a Nasdaq-developed trading system used around the world.

Dominic Stevens, ASX Managing Director and CEO, said:

“ASX is very disappointed with today’s outage and sorry for the disruption caused to investors, customers and other market users.

“The outage falls short of the high standards we set ourselves and the standards others expect of us.

“Notwithstanding the extensive testing and rehearsals, and the involvement of our technology provider, ASX accepts responsibility. The obligation to get this right and provide a reliable and resilient trading system for the market rests with us.

“While I am disappointed with today’s outage, we are determined to continue our program of contemporising ASX’s technology stack from top to bottom. This initiative is critical to ASX building an exchange for the future and ensuring we best serve the needs of our customers and the Australian market”, Mr Stevens said.

Australia’s financial regulator ASIC issued its own statement with regards to the ASX being down, saying:

Monday 16 November 2020

ASIC statement on ASX equity market outage

The ASX cash equity market trading platform did not reopen for trading today Monday, 16 November 2020, after an outage occurred during the opening auction. ASIC remains in regular communication with ASX, market participants, and members of the Australian Council of Financial Regulators. We are focussed on ensuring that ASX reopens in an orderly manner on Tuesday 17 November, and that market integrity is not compromised. ASIC will also monitor for any impacts resulting from the failure of ASX Trade to open for most of the day.

ASIC views outages of this nature with significant concern. It has had a significant impact on the market, including market participants and investors. The ASX is one of the world’s most active and visible public markets and forms a critical part of Australia’s national economic infrastructure. Well-functioning financial market infrastructure is critical to the integrity and reputation of the Australian equity market and the trust and confidence investors have in it. As the primary equities market in Australia, ASX performs a vital role.

Market licensees are required to operate a market that, to the extent reasonably practicable, is fair, orderly and transparent, and to have sufficient resources (financial, technological and human) to operate the market, including for any outsourced services. Following the reopening of the market, ASIC will determine whether ASX followed the relevant regulatory requirements under the Corporations Act and met its obligations under its Australian Market Licence.

In addition to ASIC’s expectations that this outage will be resolved as soon as is possible in a safe manner, ASX will be required to provide a full incident report to ASIC.

We note that the Chi-X market remained open for participants to trade ASX listed equities, as well as Chi-X quoted ETFs and TraCRs.