OANDA publishes “The State of Crypto” report

OANDA, a provider of online multi-asset trading, currency data and analytics to retail and corporate clients, today published “The State of Crypto” report.

In November 2022 OANDA surveyed 2,018 non-professional traders across various demographics to discover how attitudes towards trading cryptocurrency have changed and what the outlook is for 2023.

Of traders surveyed for The State of Crypto report, 56% had traded cryptocurrency in the past week. Male traders were the most likely to be active – with 63% having traded in the past 7 days compared to just 47% of women.

When looking at specific crypto currencies, the top three most traded included Bitcoin – which 70% of respondents who were existing cryptocurrency traders had traded; followed by Ethereum at 45% and Bitcoin Cash at 41%.

In fact crypto appears to be becoming a common diversification in a trader’s portfolio, a tradable asset in its own right, with two thirds (64%) reporting that previous experience in trading other assets helped when trading crypto. When asked about trading these other assets, 37% had previously traded Forex and 42% later disclosed that they used traditional trading methods including in-app or trading platform charts and technical analysis to help them navigate the crypto market. Leading the way for incorporating these methods were 35-44 year olds when it comes to their crypto trades (45%), closely followed by the younger 16-24 year old demographic (42%).

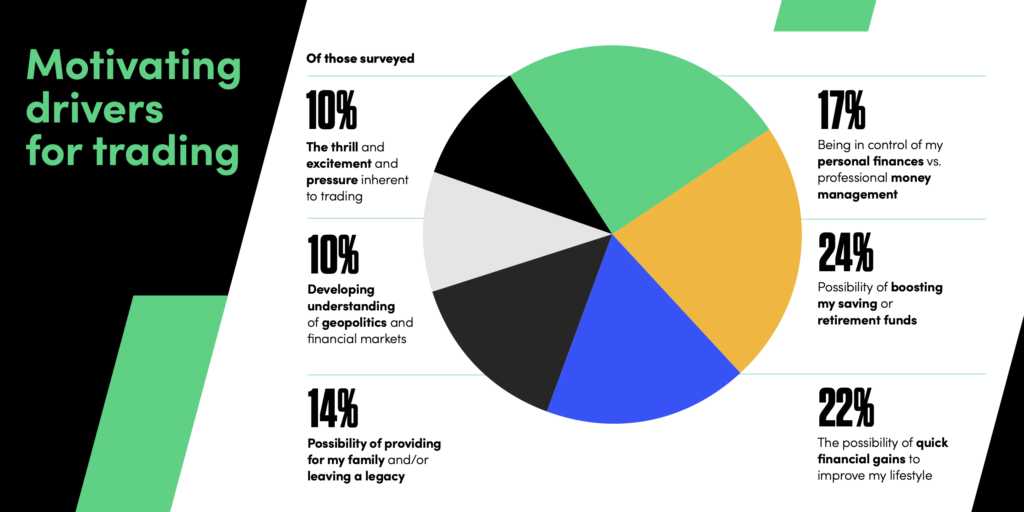

Of those surveyed, about a quarter (24%) of existing traders said that ‘the possibility of boosting savings and retirement funds’ was a primary motivation to trade. This motivation to boost savings was most popular amongst divorced traders (37%) and already retired traders (44%).

Although not a top answer, ‘leaving a legacy and providing for family’ was a motivation for 14% of traders surveyed–mainly amongst traders over 55 years of age (16%) and 16-24 year olds (15%).

A similar proportion of traders (22%) are motivated by ‘the possibility of quick financial gains to improve their lifestyle’ – with those in the 35–44-year-old age bracket the most motivated by the possibility of quick wins at 27%.

However, when asked more generally about why they trade crypto, 51% of traders stated that they ‘view it as a long-term investment’ and 49% as ‘an important way to diversify my investments’.

Nearly all traders surveyed had traded crypto at some point (87%), but for those traders who had not put finances into cryptocurrency, 57% said a ‘lack of knowledge of crypto markets’ was a barrier.

When crypto traders were asked what they use to gather information and plan their trades, OANDA saw that a wide variety of sources are used. Over half (53%) said they use a crypto exchange or forum and 47% use social media to inform their decisions – although this falls to just 28% of those aged over 55.

Financial and investment sites are still key with 42% citing these and the same proportion using charts and technical analysis (41%). While a similar number (40%) said they rely on tips from experts or friends, however, over one in three (37%) still do use traditional media to help guide trading decisions.

Social media has become a key source of crypto-trading insights for retail traders – with 47% of those surveyed revealing they now use platforms like Twitter, Facebook and Instagram to inform their trading decisions

When asked to describe their investment plans for 2023, nearly half of traders surveyed (48%) said they plan to invest more in crypto, perhaps portraying a confidence that the current ‘Crypto Winter’ will thaw.

Traders aged 35-44 years old were deemed the most optimistic about the industry, with 54% planning to increase crypto trading in 2023. Similarly, traders’ overall outlook for 2023 in terms of personal trading gains was positive, with more than three-quarters (76%) of all respondents optimistic about returns and only 22% pessimistic.

Ed Moya, Senior Market Analyst at OANDA, comments:

“2023 should be a better year for the cryptoverse as much of the contagion risks from the FTX fallout have been priced in and the space appears to have avoided crippling legislation. Crypto volatility most likely will remain elevated given global recession risks, but it could start to get some underlying support if the major central banks quickly approach the end of their tightening cycles.”