DNB: The climate impact per bitcoin transaction is rising

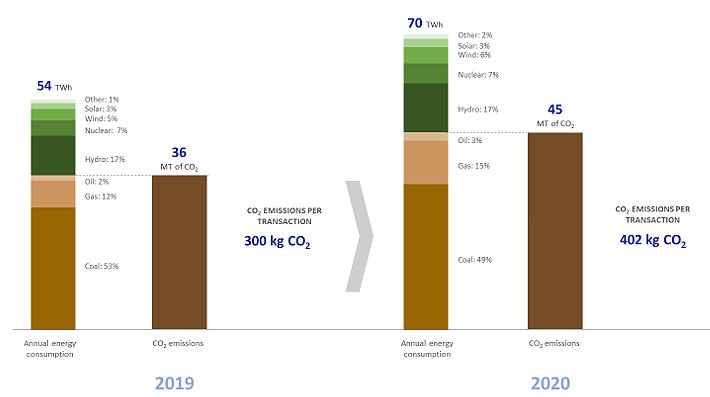

The total carbon footprint of the bitcoin network increased by about 25% in 2020, while the number of transactions fell by 6%. This amounts to a climate impact of about 402 kg of CO2 per bitcoin transaction in 2020, according to the first results of a new method developed by De Nederlandsche Bank (DNB) to measure bitcoin’s carbon footprint.

This study contributes to DNB’s work on making the climate impact of the financial sector more transparent. The first results show that the climate impact of bitcoin in 2020 is estimated at 402 kg of CO2 per transaction. This equates to two thirds of the monthly emissions of an average Dutch household (611 kg of CO2 per month).

The increase in the environmental cost per transaction can be attributed to a sharp increase in the overall energy consumption of the bitcoin network. Total carbon emissions increased by 25%, from 36 to 45 megatonnes in 2020, while the number of transactions fell by 6%, from 119 million to 112 million. Since the energy mix between renewables and fossil fuels remained fairly constant over this period, the increase in carbon emissions can be attributed almost entirely to the growth of computational power required by the bitcoin network.

Further growth in energy consumption is highly dependent on the price of bitcoin. As the value of crypto assets such as bitcoin increases, it attracts more miners, who then consume more electricity to mine cryptos.

Not all cryptos are based on an energy-intensive algorithm, DNB explains. The algorithm of bitcoin and ethereum, among others, has the highest energy consumption per transaction compared to other technologies with similar functionality that are currently available. This is one of the reasons why, for example, the Swedish financial supervisory authority has recently called for an EU-wide ban on cryptos that use this energy-intensive mining method.

It is not yet possible to draw an accurate comparison with the energy consumption of conventional means of payment. Previous DNB analyses offered insight into the climate impact of individual cash and card transactions. However, it is difficult to make comparisons with cryptos due to a mismatch in the methods for calculating the carbon footprint.

Nonetheless, for cryptos as well as for conventional means of payment, it is clear that the large variety of possible design choices can result in large differences in the ultimate carbon footprint per transaction.