CrossTower and Omniex partner to advance institutional adoption of crypto

CrossTower, a Jersey City, NJ based cryptocurrency trading platform startup aimed at institutional traders has announced a new partnership with Omniex, which operates an innovative end-to-end digital asset trading and investment platform. The agreement will see Omniex provide access to the CrossTower exchange for mutual clients, as well as enhance CrossTower’s execution through the use of the Omniex platform.

Omniex provides access to over 30 of the industry’s most trusted exchanges and OTC (over-the-counter) liquidity venues, now including CrossTower. Omniex customers are now able to access deep and liquid order books at CrossTower US and Global exchanges.

Omniex provides sophisticated algorithmic trading and smart order routing tools that give asset managers, active traders, and intermediaries including broker dealers and OTC desks, the highest-caliber consolidated order books across the top venues. Displaying the consolidated pricing from all major digital assets markets, Omniex brings best execution to buyside and sellside market participants.

“The growth rate of the digital asset industry has outpaced the rise of centralized mechanisms to support the transparency and efficiency of crypto spot and derivatives markets around the clock and around the globe,” said CrossTower CEO and Co-Founder Kapil Rathi. “We appreciate Omniex’s recognition of our consistently best-of-book pricing to support these dynamic markets.”

CrossTower said it is proud to be added to the Omniex ecosystem, and recently reported a 200% increase in its month-over-month (MoM) trading volumes, making it one of the fastest growing U.S.-regulated digital asset exchanges. CrossTower credits its rapid growth to its price competitiveness and the breadth of its capabilities, including a recently launched capital markets desk with an expanded offering, such as structured products, lending and trade financing options, now including credit card payments.

“We’re excited to be partnering with CrossTower’s seasoned team to continue the institutional expansion of the crypto market,” said Hu Liang, CEO and Co-Founder, Omniex. “In addition to enabling access to the CrossTower exchange, we’re excited to have CrossTower tap into our world-class liquidity aggregation and execution to support their continued institutional expansion.”

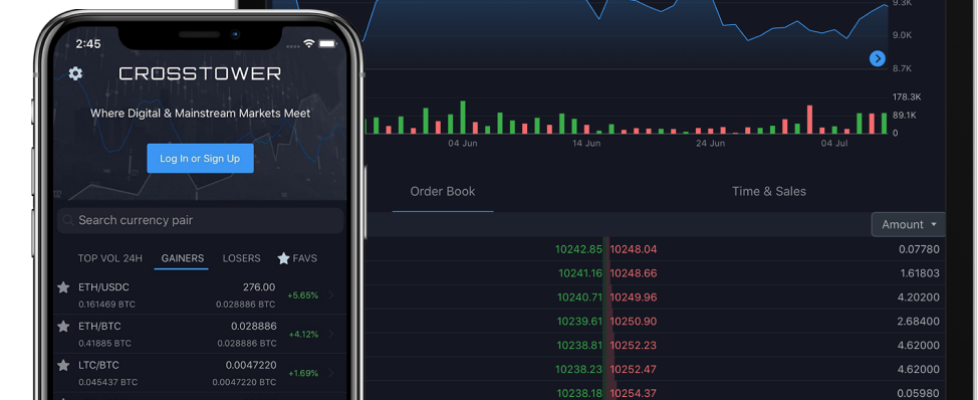

CrossTower supports trading in the most widely traded cryptocurrencies including Bitcoin, Ether, Litecoin, USDC, Bitcoin Cash, Stellar, Chainlink, Basic Attention Token, ZCash, 0x, MakerDAO MKR, MakerDAO DAI and Numeraire. Founded in 2019, CrossTower is a multi-asset investment and trading firm that empowers smart money to push the limits of what is possible with crypto. CrossTower launched its trading platform in 2020, and in 2021 introduced a crypto capital markets desk with best-in-class services and products tailored to the needs of demanding traders and institutions alike, including hedge funds, family offices and other market participants.

Omniex is a front-to-back office investment and trading platform for institutional investors to access the crypto-asset markets. Its purpose-built technology provides portfolio and risk management, trade execution, investment operations, and compliance solutions to buy-side, market-making, and broker-dealer institutions. It was founded in the fall of 2017 by an experienced team of technologists, financial executives, and crypto pioneers, and is backed by leading investors including Wicklow Capital, Jump Capital, Digital Currency Group, Sierra Ventures, Clocktower Technology Ventures, ThirdStream Partners, and Alan Howard of Brevan Howard.