Beyond Geopolitics: How Global Elections Could Reshape Market Volatility in 2026

The following is a guest editorial courtesy of Carolane de Palmas, Markets Analyst at Retail FX and CFDs broker ActivTrades.

After a year in which geopolitics dominated market narratives, political risk is broadening in 2026. Alongside persistent international tensions, a dense global electoral calendar is introducing a different but equally potent source of uncertainty for investors. Elections can alter fiscal priorities, monetary coordination, regulatory frameworks and trade relationships, often with limited warning and uneven market pricing. In highly leveraged economies or countries that play a systemic role in global capital flows, even short electoral cycles can generate volatility.

Japan’s Snap Election: A Mandate for Growth or a Trigger for a Fiscal Crisis?

Japan will head to the polls on February 8 following Prime Minister Sanae Takaichi’s decision to dissolve the lower house and seek a fresh mandate. The move came barely months after she took office. Officially, the objective is to secure political backing for an expansionary fiscal agenda aimed at supporting growth and easing cost-of-living pressures. Unofficially, the vote is a test of whether Takaichi’s personal popularity can overcome structural weaknesses within her own party and a rapidly shifting political landscape.

The election is happening against a sensitive macroeconomic backdrop. Japan remains the most indebted major developed economy, with public debt around 230% of GDP. Markets are therefore highly alert to any signal that fiscal discipline could loosen further. Takaichi’s proposal to temporarily suspend the sales tax on food crystallised these concerns, triggering sharp moves in the bond market and reminding investors how quickly confidence can be tested. By calling a snap election now, she is effectively asking voters—and by extension markets—to endorse a policy mix reminiscent of past stimulus-heavy strategies.

From a political perspective, Takaichi enters the race with clear strengths but also significant vulnerabilities. Her approval ratings as prime minister remain relatively high, especially compared with recent predecessors, and she has managed to build a strong personal profile in a short period of time. However, support for the ruling Liberal Democratic Party trails her own popularity by a wide margin. This gap raises doubts about whether voter approval of the prime minister will translate into sufficient parliamentary seats to deliver stable governance.

Demographics add another layer of uncertainty. Takaichi’s strongest support comes from younger voters, a group that historically turns out in far lower numbers than older generations who have long formed the LDP’s electoral base. At the same time, the party is contesting the election without its long-standing coalition partner, Komeito, for the first time in more than two decades. That break removes a reliable source of vote mobilisation, particularly in urban areas, and makes seat projections far less predictable than usual.

The timing of the election further complicates the outlook. Winter polls are rare in Japan, and adverse weather conditions could depress turnout unevenly across regions, potentially skewing results. For investors, this combination of political fragmentation, unconventional timing and high fiscal sensitivity explains why the election is widely seen as one of the most uncertain in years.

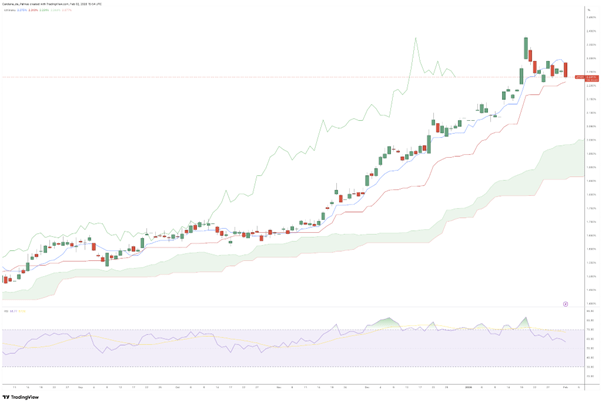

Investors are closely watching government bond auctions and yield movements as real-time indicators of confidence in Japan’s fiscal trajectory. Volatility in long-dated Japanese government bonds has increased, reflecting concern that a strong electoral mandate could accelerate fiscal expansion, while a weak result could produce policy paralysis. Either outcome carries risks: higher yields could pressure domestic financial institutions and the yen, while political instability could limit Japan’s ability to respond to economic shocks.

Japan Government Bonds 10 YR Yield – Source: TradingView.

Columbia’s Market Momentum: Can the Rally Survive Election Uncertainty?

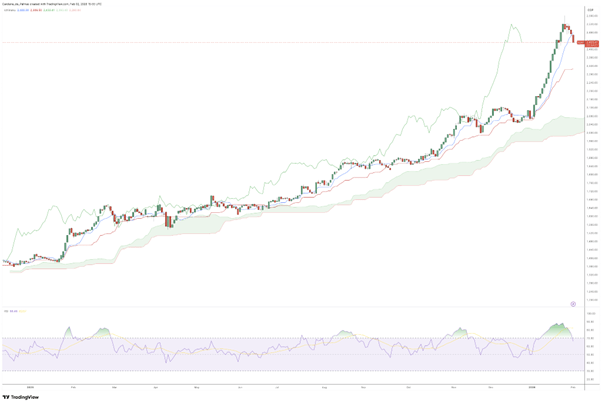

Colombian markets have been one of the standout performers in emerging markets, but their strong momentum is increasingly tied to political expectations rather than hard economic improvements. In 2025, Colombian equities delivered exceptional returns, with the main stock index COLCAP rising more than 70% in dollar terms, far outpacing regional peers such as Brazil (up 45% last year) and Mexico (up 47%). The Colombian Peso also strengthened sharply against the U.S. Dollar (more than 14%), reinforcing the appeal of local assets for international investors at a time when capital was rotating away from dollar-denominated markets.

This rally has been driven by a combination of deeply discounted starting valuations, a weaker U.S. ollar, and growing investor belief that Colombia could be heading toward a more market-friendly political cycle.

High domestic interest rates (10.25% in January 2026 following the first hike in almost 3 years) have supported the currency and made local fixed income attractive, while equity valuations remain low by global standards, with price-to-earnings multiples well below those seen in developed markets (COLCAP P/E of around 10 vs S&P 500 P/E of around 25). Together, these factors have created a compelling risk-reward narrative that has drawn significant inflows into Colombian assets.

That optimism is now being tested by an unusually dense electoral calendar. Beginning in March, Colombians will vote in legislative elections, followed by a presidential contest in May to choose a successor to President Gustavo Petro, who is barred from seeking another term. The race is wide open, with candidates spanning the political spectrum and no clear frontrunner emerging in early polling. This lack of visibility makes the election outcome particularly difficult for markets to price and increases the risk of sharp repricing as new information emerges.

Investor sentiment has so far been supported by the expectation that Colombia could pivot toward a more pragmatic and pro-investment policy framework after years of political friction and policy uncertainty. Markets are effectively betting on greater institutional stability, clearer fiscal direction and a less confrontational stance toward foreign investors. However, these expectations remain speculative, and the absence of a dominant candidate means the probability of disappointment is material.

Underlying the market rally is a fragile fiscal reality that represents the main risk to this optimistic scenario. Public finances have deteriorated significantly following heavy post-pandemic spending, leaving the government with limited fiscal space. The suspension of the fiscal rule and the sharp upward revision of the budget deficit target in 2025 have highlighted the scale of the challenge facing the next administration. Sovereign credit rating downgrades from all major agencies have reinforced concerns about Colombia’s credit profile and raised borrowing costs at a time when fiscal discipline is most needed.

As a result, the election outcome will be critical in determining whether current valuations are justified. A government committed to fiscal consolidation and predictable economic policy could stabilize debt dynamics and support further gains in local assets. By contrast, a continuation of expansionary or populist policies would likely amplify fiscal pressures, undermine investor confidence and expose the vulnerability of what has become a crowded trade.

For investors, low valuations may signal opportunity if political change brings policy normalization, but they also reflect real and persistent risks tied to fiscal sustainability and governance. The legislative elections will offer an early indication of voter preferences, while shifts in presidential polling could quickly alter market expectations. Beyond the vote itself, the credibility of fiscal plans, the direction of interest rates and the new government’s approach to foreign investment and relations with the United States will be decisive in determining whether Colombia’s rally can extend into 2026 or give way to renewed volatility.

MSCI COLCAP Index – Source: TradingView.

Sources: Reuters, Fidelity, Deloitte, Economic Research BNP Paribas.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.