Yen Dipped to New Record Low Against the Euro

The following is a guest editorial courtesy of Carolane de Palmas, Markets Analyst at Retail FX and CFDs broker ActivTrades.

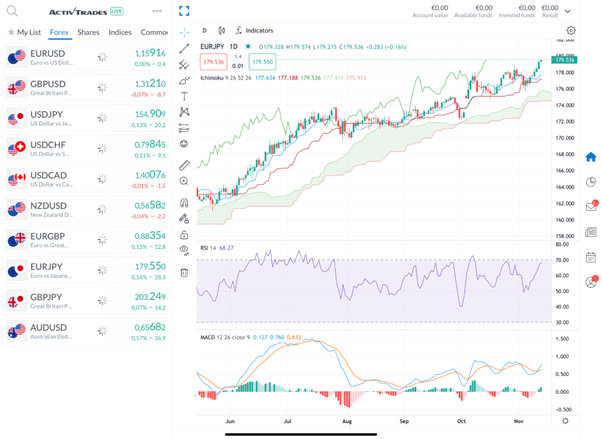

Investor sentiment turned against the Yen today following statements from Japan’s new Prime Minister advocating for a cautious approach to raising interest rates. This policy guidance immediately pushed the JPY to ¥179.574 against the Euro according to ActivTrades’ trading data—an all-time low—and to a nine-month trough versus the US Dollar. Let’s take a closer look at the policy statements and market reaction.

Daily EUR/JPY Chart – Source: ActivTrader

Prime Minister Advocates for Maintaining Low Interest Rates Amid Inflation Concerns

Japanese Prime Minister Sanae Takaichi has made clear her administration’s strong preference for keeping interest rates low and avoiding a return to deflation. Speaking in parliament on Wednesday, Takaichi called for close coordination with the Bank of Japan (BOJ) while expressing her vision for the country’s monetary policy direction.

The Wrong Kind of Inflation

At the heart of Takaichi’s concerns is the nature of Japan’s current inflation. While core consumer inflation reached 2.9% in September—exceeding the Bank of Japan’s 2% target—the Prime Minister emphasized that this is not the healthy inflation Japan needs.

The current price increases have been driven predominantly by rising food costs rather than wage growth, creating what economists call “cost-push inflation” that erodes purchasing power without improving household incomes.

Inflation driven by wages reflects a growing economy where companies can afford to pay workers more, who in turn spend more, creating a virtuous cycle. In contrast, inflation driven primarily by import costs and food prices simply makes people poorer without corresponding income gains. Japanese households find themselves paying more for groceries and gasoline while their salaries remain relatively stagnant.

There are some positive signs on the cost front. Japan’s wholesale prices rose just 2.7% in October compared to the previous year—a slowdown from the 2.8% of September—partly due to falling import costs. The yen-based import price index actually fell 1.5% in October year-over-year, offering some relief from external price pressures.

The Deflation Danger

Takaichi’s advocacy for low interest rates stems from her assessment that Japan still faces the risk of sliding back into deflation—the prolonged decline in prices that plagued the country for decades.

This deflationary mindset, deeply ingrained in Japanese consumers and businesses after years of stagnant prices, makes the country’s economic situation particularly fragile. If interest rates rise too quickly and choke off the nascent recovery, Japan could return to the deflationary spiral where consumers delay purchases expecting lower prices, businesses cut costs and wages, and the economy stagnates.

Government Stimulus Plans

To address these challenges, Takaichi’s administration is preparing a comprehensive economic package aimed at cushioning households from rising living costs while simultaneously investing in growth sectors. The government’s plan is to develop its package of measures by the end of the month, and then secure the necessary financing through a supplementary budget for this fiscal year.

“We will create a strong economy. This is a matter that affects monetary policy in a big way, so we hope to coordinate closely with the Bank of Japan,” Takaichi said, emphasizing the interconnection between fiscal and monetary policy.

According to a draft obtained by Reuters, the government describes Japan’s economy as being “in a transition period from one prone to deflation and cost cuts,” and pledges to spend “boldly without hesitation on necessary policies.” The package aims to boost corporate profits and brighten consumer sentiment through strategic investments in growth areas, such as artificial intelligence and semiconductors among others, which the administration hopes will create the conditions for sustainable wage increases.

Labor’s Push for Higher Wages

Despite external economic headwinds, there are encouraging signs that Japan’s wage dynamics may be shifting. The nation’s largest labor union has declared its intent to push for wage increases of 5% or higher in 2026, marking the fourth straight year it will seek substantial pay hikes. If achieved, this would represent a significant departure from Japan’s decades-long wage stagnation and could help create the wage-driven inflation Takaichi envisions.

The challenge for policymakers is threading the needle: keeping interest rates low enough to support economic growth and wage increases, while preventing the kind of runaway food-price inflation that hurts consumers. Bank of Japan Governor Kazuo Ueda has reiterated this cautious stance, emphasizing that rate increases must be undertaken carefully. He wants to ensure that sustained inflation is due to robust domestic demand rather than external cost factors, even though inflation has already exceeded 2% for over three years.

The Yen’s Critical Role in BOJ Decision-Making

While domestic wage growth and inflation dynamics are at the forefront of the Bank of Japan’s policy considerations, currency movements play an increasingly influential role in the central bank’s decision-making process. The yen’s value against major currencies has become a critical factor that could accelerate or delay the BOJ’s next interest rate move, creating a complex feedback loop between monetary policy, exchange rates, and inflation.

How Currency Weakness Imports Inflation

Japan’s heavy reliance on imported energy, raw materials, and food makes the country particularly vulnerable to yen depreciation. When the yen weakens, the cost of imports rises in yen terms, directly feeding into consumer prices—especially for essentials like food and fuel. This is precisely the type of “cost-push” inflation that both Prime Minister Takaichi and Governor Ueda have criticized as harmful to the economy. This currency-driven inflation is particularly problematic because it doesn’t reflect genuine economic strength.

Currency Movements as a Policy Trigger

In practice, sharp or sustained yen depreciation could serve as a trigger that forces the BOJ to act sooner rather than later. If the yen were to weaken dramatically—even though it is already at its record low against the Euro and a nine month low against the U.S. Dollar—the resulting spike in import costs could generate public and political pressure for the central bank to raise rates, even if domestic wage conditions haven’t fully materialized.

Japanese policymakers have vivid memories of past currency crises. In 2022, when the yen plunged to 32-year lows against the dollar, authorities intervened 3 times directly in currency markets to stem the decline. While direct intervention remains an option, raising interest rates represents a more sustainable approach to supporting the currency.

The BOJ is therefore watching currency markets closely as it deliberates on timing. If the next rate hike is delayed, the yen could decline again, leading to higher import costs and accelerating broader inflation. If currency weakness accelerates, it could override other considerations and prompt the central bank to act in December rather than waiting for more complete wage data in January.

Sources: Reuters

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Rates may change. Political risk is unpredictable. Central bank actions may vary. Platforms’ tools do not guarantee success.