Euronext reports 8.3% Y/Y drop in FX trading revenue in Q3 2025

European capital market infrastructure Euronext today published its results for the third quarter of 2025.

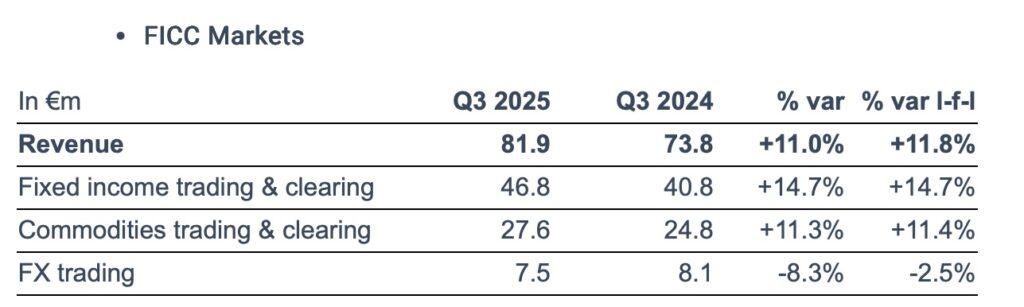

FX trading revenue was €7.5 million in Q3 2025 down 8.3% from the year-ago quarter, reflecting lower volatility and the negative currency impact of the USD.

Financial derivatives trading and clearing revenue was €11.2 million in Q3 2025, down 19.4% compared to Q3 2024. This mostly reflects lower volatility.

Across all segments, Q3 2025 revenue and income was up 10.6% to €438.1 million.

Depreciation and amortisation accounted for €49.3 million in Q3 2025, 4.4% more than Q3 2024. PPA related to acquired businesses accounted for €19.7 million. Adjusted operating profit was €253.5 million, up 12.8% compared to Q3 2024.

Income tax for Q3 2025 was €58.5 million. This translated into an effective tax rate of 26.7% for the quarter, compared to 23.8% in Q3 2024. In Q3 2024, the tax rate was positively impacted by the tax-exempt €23.4 million dividend received. Due to a different dividend payment schedule, Euronext received dividends in Q2 2025 and expects to receive a second dividend in Q4 2025, and none in Q3 2025.

Share of non-controlling interests amounted to €11.0 million, correlated with the resilient performance of MTS and Nord Pool.

As a result, the reported net income (share of the parent company shareholders) decreased by 6.1%for Q3 2025 compared to Q3 2024, to €149.7 million.

This represents a reported EPS of €1.49 basic and €1.46 diluted. Adjusted net income, share of the parent company shareholders, was down 6.5% to €169.0 million. Adjusted EPS (basic) was €1.68 and adjusted EPS (diluted) was €1.64.

In Q3 2025, Euronext reported a net cash flow from operating activities of €401.0 million, compared to €237.4 million in Q3 2024, mainly reflecting higher working capital from Euronext Clearing and Nord Pool CCP activities in Q3 2025. Excluding the impact of working capital from Euronext Clearing and Nord Pool CCP activities, net cash flow from operating activities accounted for 99.9% of EBITDA in Q3 2025.

Euronext will launch a share repurchase program of a maximum of €250 million (around 2% of Euronext’s outstanding share capital). The program will commence on 18 November 2025 and will conclude no later than 31 March 2026. This share repurchase program is enabled by Euronext’s swift deleveraging path.