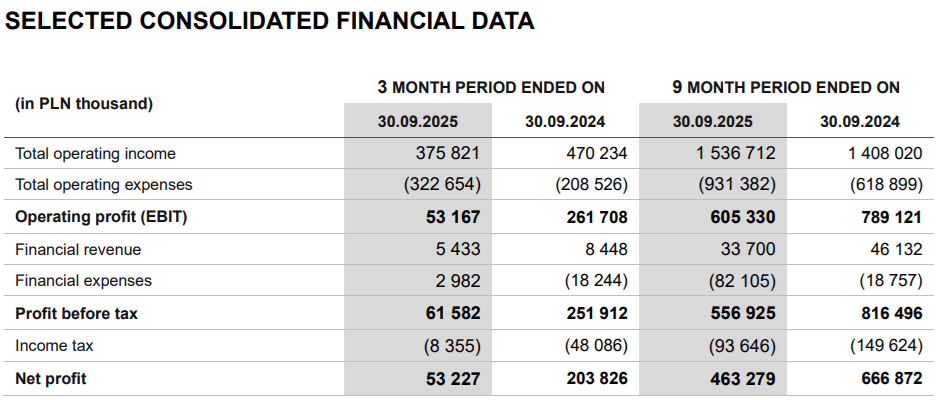

XTB revenues plunge 35% in Q3 2025 to $103 million on low volatility

Following a record start to the year with two strong (and quite similar) quarters in Q1 and Q2, Poland based Retail FX and CFDs broker XTB SA (WSE:XTB) has reported a sharp drop in both Revenues and Profits for Q3 2025.

XTB Revenues and Profits Q3 2025

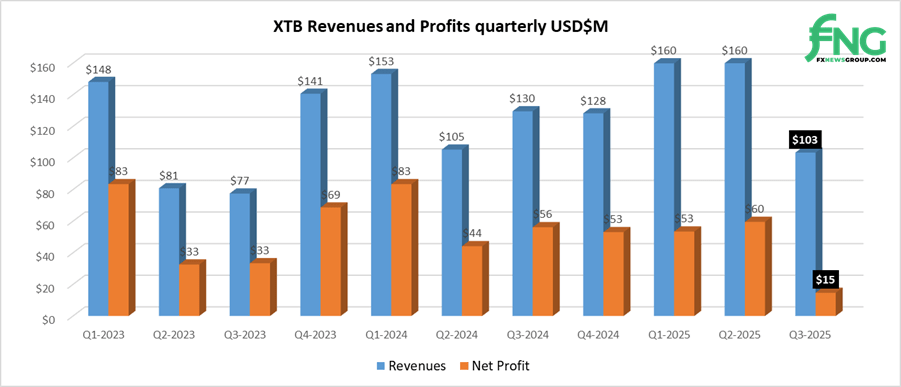

Revenues at XTB for the third quarter of 2025 came in at PLN 375.3 million (USD $103 million), down by more than a third (35%) from $160 million in each of Q1 and Q2. Q3’s top-line result was the lowest at XTB since Q3 of 2023, two years ago.

Net Profit at XTB came in at PLN 53.2 million ($15 million) in Q3 2025, down by 75% from $60 million in Q2 – its lowest quarterly profit result since 2022.

Reasons for Q3 Revenue decline

In Q3 2025, XTB generated revenues of PLN 375.8 million (decrease 20% y/y and 35% q/q). The most significant factor influencing the revenue level was the decline in the profitability of CFD derivative trading. Profitability per lot and profitability per USD 1 million in nominal turnover decreased to PLN 152 (Q3 2024: PLN 272, Q2 2025: PLN 229).

The decline in profitability was a consequence of the low activity observed in the financial and commodity markets in the third quarter of the current year. For most instruments that are most popular among clients, a more predictable trend was observed, with the market moving within a limited price range. This resulted in market tendencies that were more foreseeable than in the case of larger directional market movements, creating favorable conditions for transactions executed within a narrow price range (so-called range trading). In such circumstances, a higher number of client-profitable transactions is typically observed, which in turn leads to a decrease in the market making result or even the occurrence of a loss from market making activities.

The third quarter of 2025 was also very calm in the equity index market. The German index moved within a very narrow sideways trend, despite reaching successive highs. In the case of U.S. indices, the range of movements was broader, though still rather limited. In September, a rally in gold began, driving the metal to successive record-high prices. However, the preceding two months were marked by relative market stagnation.

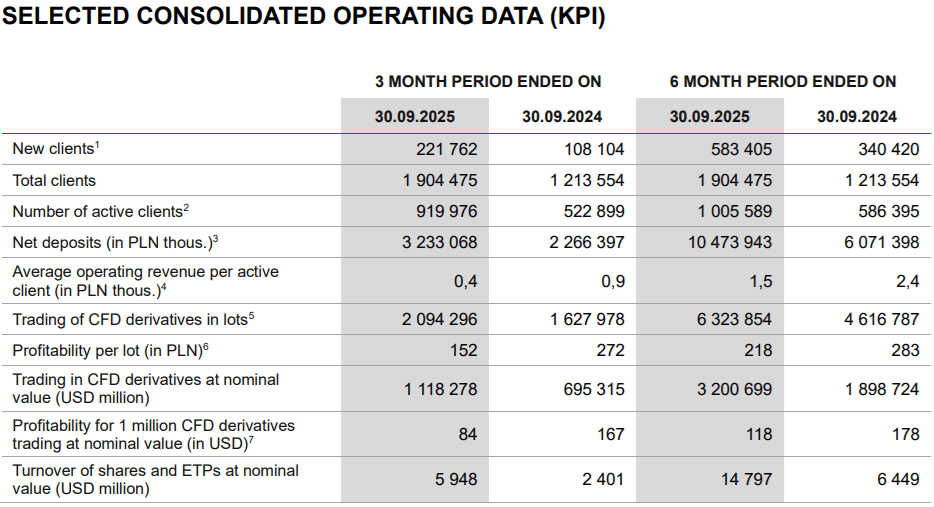

XTB Trading Volumes Q3 2025

Despite the unfavorable market environment during the period, which limited XTB’s ability to fully leverage its client base potential, the number of active clients increased by 71.5% year-on-year. This was accompanied by a high level of trading activity, reflected, among other things, in the number of CFD contracts concluded in lots (an increase of 28.6% y/y) and in the nominal value of CFD derivative trading in USD million (an increase of 60.8% y/y).

As a result, the trading volume in derivative instruments amounted to 2 094.3 thousand lots (Q3 2024: 1 628.0 thousand lots, Q2 2025: 2 321.6 thousand lots) and USD 1 118.3 billion in nominal value (Q3 2024: USD 695.3 million, Q2 2025: USD 1 144.6 billion).

Trading volumes at XTB averaged $373 billion monthly in Q3 2025, down slightly from a record $382 billion monthly in Q2-2025

XTB Client Acquisition Q3 2025

In Q3 2025, XTB has effectively continued the implementation of its adopted strategy, focusing on building its customer base. As a result, the Group acquired a record-high nearly 222 thousand new clients, representing an increase of 105.1% year-on-year (y/y). Consequently, the total number of clients exceeded 1.9 million, marking an increase of 56.9% compared with the corresponding period of the previous year. The number of active clients also reached a record level, rising by 75.9% y/y – from 522.9 thousand to 920.0 thousand.

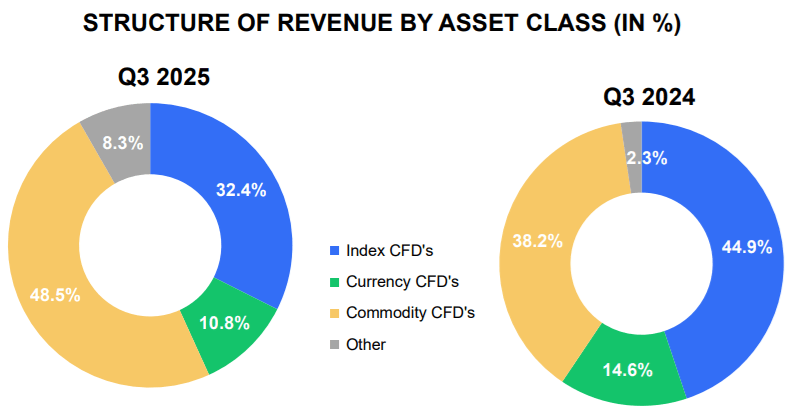

XTB Asset Classes Traded Q3 2025

Looking at the structure of the revenues generated in terms of instrument classes, in Q3 2025 the dominant position was held by CFDs based on commodities. Their share in the overall revenue structure amounted to 48.5% (Q3 2024: 38.2%). This was driven by the high profitability of trading in CFD instruments based on gold, natural gas, silver, and cocoa prices.

The second most profitable asset class comprised CFD instruments based on stock indices, whose share in the revenue structure reached 32.4%, compared to 44.9% a year earlier. This was due, among other factors, to the strong profitability of CFD instruments linked to the US 100 index, the Volatility Index (VIX), and the US 500 index. Revenues from CFD instruments based on currencies accounted for 10.8% of total revenues, compared to 14.6% a year earlier. Within this class, the most profitable financial instruments were CFDs based on cryptocurrencies — Ethereum, Bitcoin, and Ripple.

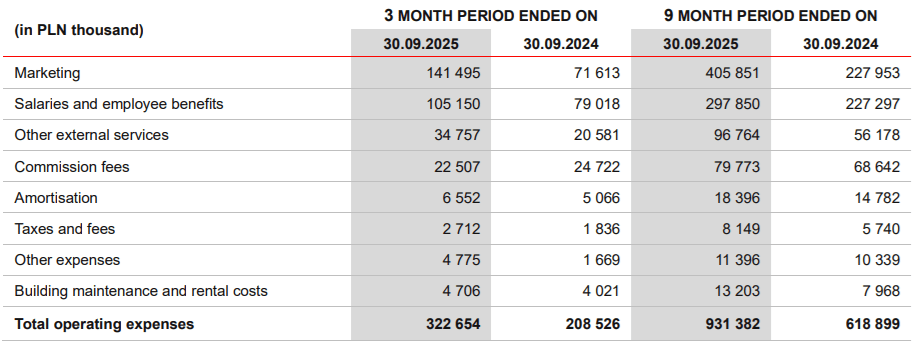

XTB Expenses Q3 2025

Operating expenses in the third quarter of 2025 amounted to PLN 322.7 million, representing an increase of PLN 114.1 million compared to the corresponding period of the previous year (Q3 2024: PLN 208.5 million). The most significant changes occurred in:

- marketing costs, an increase of PLN 69.9 million resulting mainly from higher expenditure on online and offline marketing campaigns;

- salaries and employee benefits costs, an increase of PLN 26.1 million, mainly due to an increase in employment;

- other external services increased by PLN 14.2 million, mainly due to: (i) higher expenses for IT systems and licenses (an increase of PLN 9.5 million year-on-year); (ii) market data provision services (an increase of PLN 1.6 million year-on-year); and (iii) legal and consulting services (an increase of PLN 1.5 million year-on-year)

Quarter-on-quarter (q/q), operating expenses increased by PLN 29.7 million and was mainly influenced by the increase by PLN 18.2 million in marketing expenditures, both offline and online. Subsequently, there was an increase of PLN 7.5 million in employee compensation and benefits costs, primarily resulting from higher employment levels, as well as an increase of PLN 2.3 million in other external services, mainly due to higher expenditures on IT systems and licenses. These expenditures are being increased gradually, and the activities for which the Company allocates them are closely linked to the achievement of strategic objectives.

As a result of XTB’s rapid growth, the Board estimates that in 2025 total operating expenses could be as much as approximately 40% higher than in 2024. The Board’s priority is to continue to grow its client base and build its global brand. As a consequence of the measures implemented, marketing expenditures could increase by approximately 80% compared to 2024, while assuming that the average cost of client acquisition should be comparable to what we observed in 2023-2024.

More highlights from XTB’s Q3 2025 results follow below.