Exclusive: Valutrades revenues recover 27% in 2024 but losses persist

Following a fairly disastrous 2023 which included a 77% decline in Revenues, FCA regulated FX and CFDs broker Valutrades posted a somewhat better 2024, but still far off from its better years earlier this decade, based on regulatory filings seen by FNG.

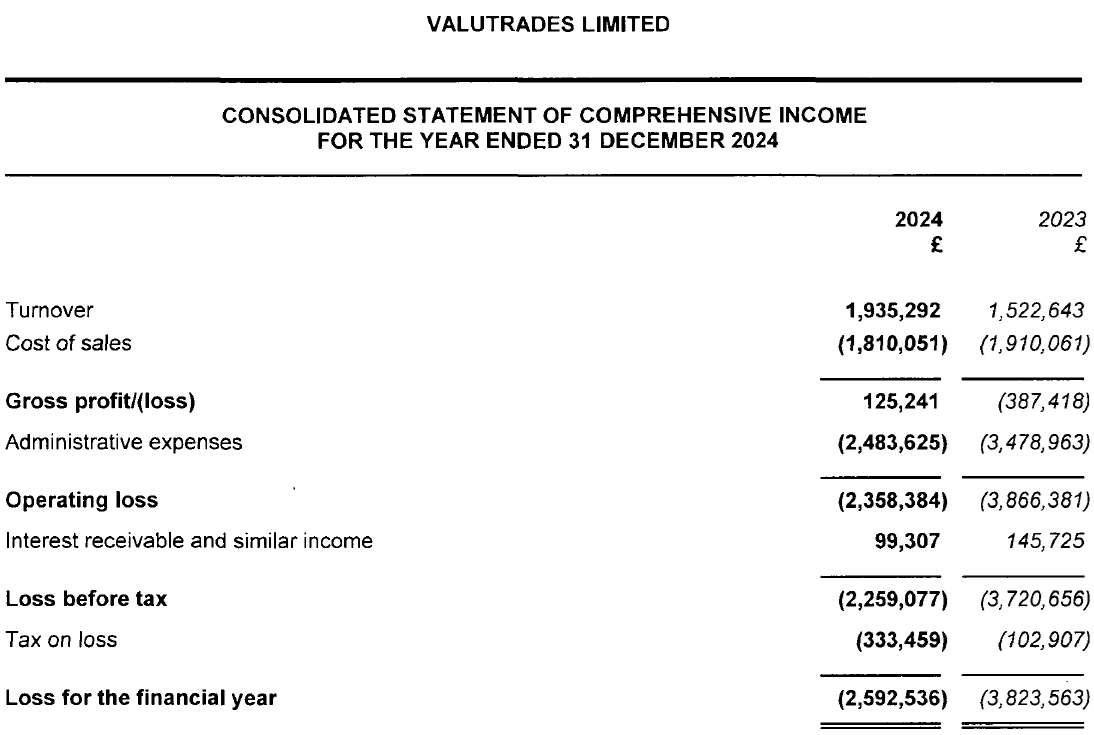

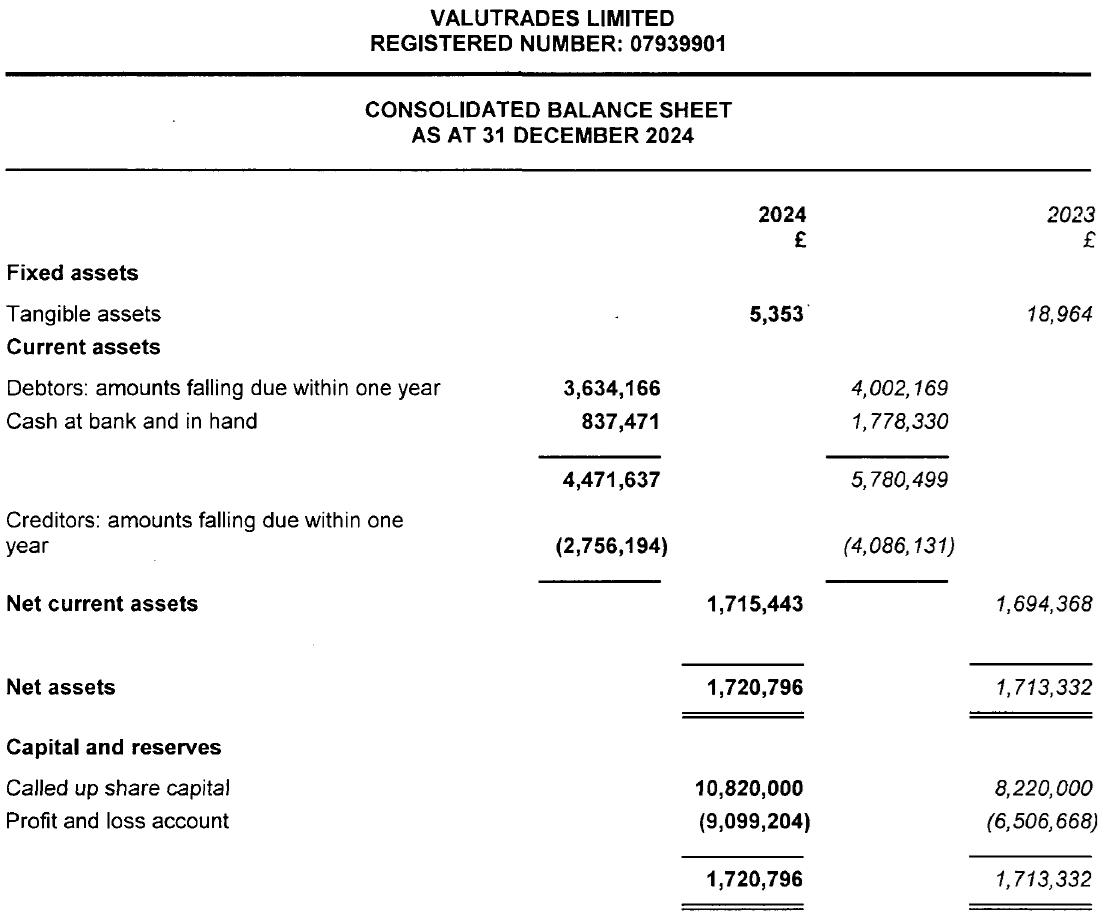

Valutrades 2024 results

Revenues at Valutrades came in at £1.94 million (USD $2.6 million) in 2024, up by 27% from £1.52 million in 2023, but still well below the £6.5 million Valutrades brought in during 2022.

Valutrades posted a Net Loss of £2.59 million ($3.5 million) in 2024, better than its 2023 loss of £3.82 million but still well below breakeven. Between 2023 and 2024 Valutrades has lost £6.41 million, eating away a good chunk of its capital base and requiring the company’s shareholders to put more money in (more on that below).

Client funds

Retail client funds held at Valutrades continued to fall, from £3.4 million in 2022 to £2.0 million in 2023 and then £1.78 million as at the end of 2024.

Management review

In explaining the company’s results, Valutrades called 2024 a “challenging year”, which saw a reduction in overall client numbers and activity. This was however balanced by some significant milestones including launching its first proprietary mobile app, launching a new website and client area, completing a rebrand and significantly reducing operating costs.

Valutrades said it understands the cyclical nature of markets it operates in and expects tough years to be balanced with easier years over the long term while the short to medium term focus remains on growth above profitability.

Management noted that the current business strategy has been in place since 2016. The firm will continue this strategy, with further investments in technology, staff and business relationships which will enhance Valutrades expected profitability.

Capital injection

To help offset its losses, Valutrades shareholders injected £2.6M in new capital into the company during 2024. The shareholders stated that they fully support the firm’s plans for 2025 and are excited for the future.

CEO comment

FNG spoke with Valutrades CEO Graeme Watkins, who commented,

“2024 marked a year of transition as we solidified the brand refresh we executed in November 2023, invested heavily and launched a new mobile app and recapitalized the business to ensure we could drive forward our future growth plans. Now the groundwork has been laid we have a solid platform to expand on our areas of focus including seamless client experience, educational tools and ECN spreads that have always been at the core of our offering.”

About Valutrades

Valutrades Limited is an online financial services business that offers clients trading of forex, CFDs and commodities via the Metatrader4 and Metatrader5 platforms and FIX API connectivity. The company is run from London led by Graeme Watkins, who has been CEO since 2015. Valutrades is controlled by Indonesian investors Aman Lakhiani and Anil Bahirwani.

Valutrades’ 2024 income statement and balance sheet follow below.