Compagnie Financière Tradition reports 12.3% Y/Y increase in revenues for H1 2025

Compagnie Financière Tradition today reported a set of solid financial metrics for the first six months of 2025.

This performance was supported by elevated market volatility driven by ongoing uncertainty surrounding monetary policy, new trade barriers and heightened geopolitical tensions.

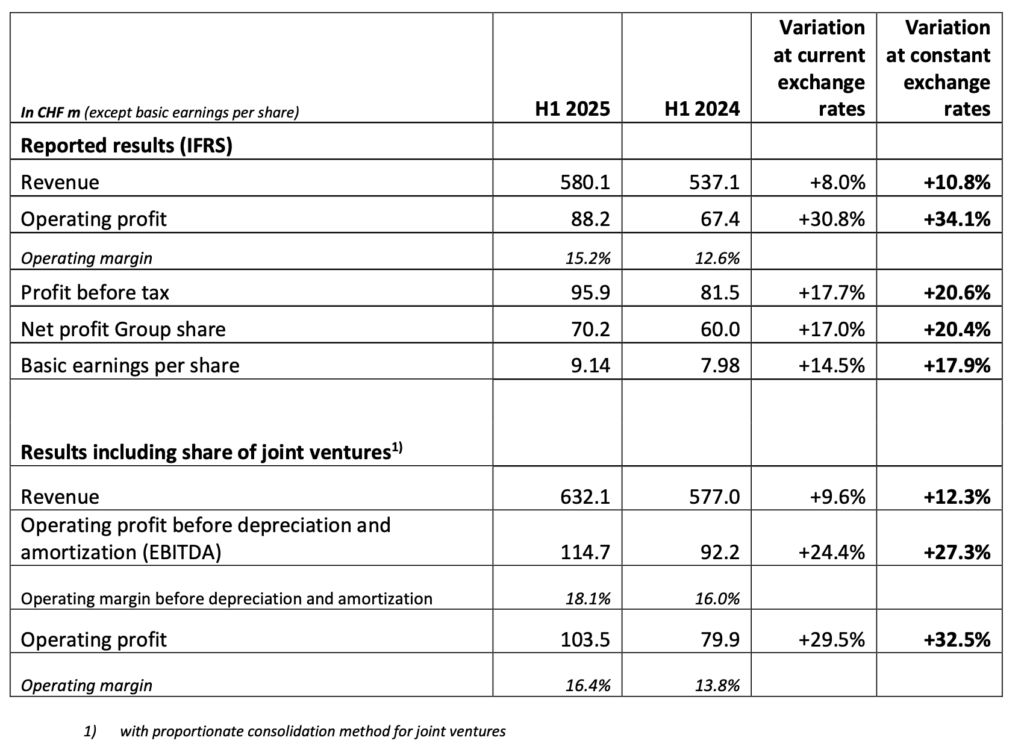

The Group’s consolidated revenue, including the share of joint ventures, was up 12.3% at constant exchange rates to CHF 632.1m, compared with CHF 577.0m in the first six months of last year.

Revenue from interdealer broking (IDB) business was up 11.2% at constant exchange rates to

CHF 607.6m, while revenue from the online forex trading business for retail investors in Japan (Non- IDB), grew 47.6% to CHF 24.5m.

Operating profit before depreciation and amortization (EBITDA), including the share of joint ventures, was CHF 114.7m against CHF 92.2m in H1 2024, up 27.3% at constant exchange rates, with an operating margin of 18.1% and 16.0% respectively.

The Group recognised a net financial expense of CHF 4.4m in H1 2025, against income of CHF 1.7m in 2024. Net exchange differences due to foreign currency fluctuations had a negative impact of CHF 4.9m for the period, compared with a nil impact in 2024. Interest income from cash investments was down CHF 1.3m, generating income, net of interest expense on bank borrowings and bonds, of CHF 1.3m against CHF 2.6m in the previous period. This change is mainly due to an increase in interest expense related to the refinancing, in October 2024, of a bond maturing in July 2025 and now fully repaid.

The share in the results of associates and joint ventures was CHF 12.1m against CHF 12.4m in H1 2024, down 0.4% at constant exchange rates.

Consolidated net profit was CHF 74.0 m compared with CHF 63.9m in H1 2024 with a Group share of CHF 70.2m against CHF 60.0m in 2024, an increase of 20.4% at constant exchange rates.

At the end of July, the joint venture Gaitame.com, consolidated using the equity method, sold its stake in one of its subsidiaries to a third party for an estimated amount of CHF 29.9 million, generating an estimated gain of CHF 15.7 million, of which CHF 7.9 million for the Group’s share.