eToro considers relaunching its IPO this week

Business news source Bloomberg is reporting that Israel based online trading outfit eToro might be looking to relaunch its initial public offering (IPO) in the US this week, as equity markets have somewhat stabilized, citing “people familiar with the matter.”

Bloomberg did say that according to its sources no final decision has been made on the matter, and that the eToro IPO might be further delayed.

eToro IPO postponement

eToro filed its “F-1” registration statement with the US Securities and Exchange Commission (SEC) on March 24, publicly stating its intention to pursue an IPO on NASDAQ and list its shares under the ticker symbol ETOR. However its planned IPO roadshow – in which a going-public company typically travels and meets with a variety of large institutional investors prior to pricing “the deal” – was interrupted by Donald Trump’s April 2 Liberation Day tariffs bombshell.

The April 2 tariffs announcement was followed by a rapid 10%+ drop in global equity markets. The markets’ volatility led a number of companies including eToro, event ticket sale site StubHub, and Sweden fintech company Klarna Bank AB, to postpone their IPO roadshow plans.

However equity markets have mostly recovered those losses. The broad S&P500 index, at 5,686.67, is actually slightly higher than its pre-tariffs April 2 value (5,670.97). Same for the NASDAQ Composite index, now at 17,977.73 versus 17,601.05 on April 2.

Webull issue

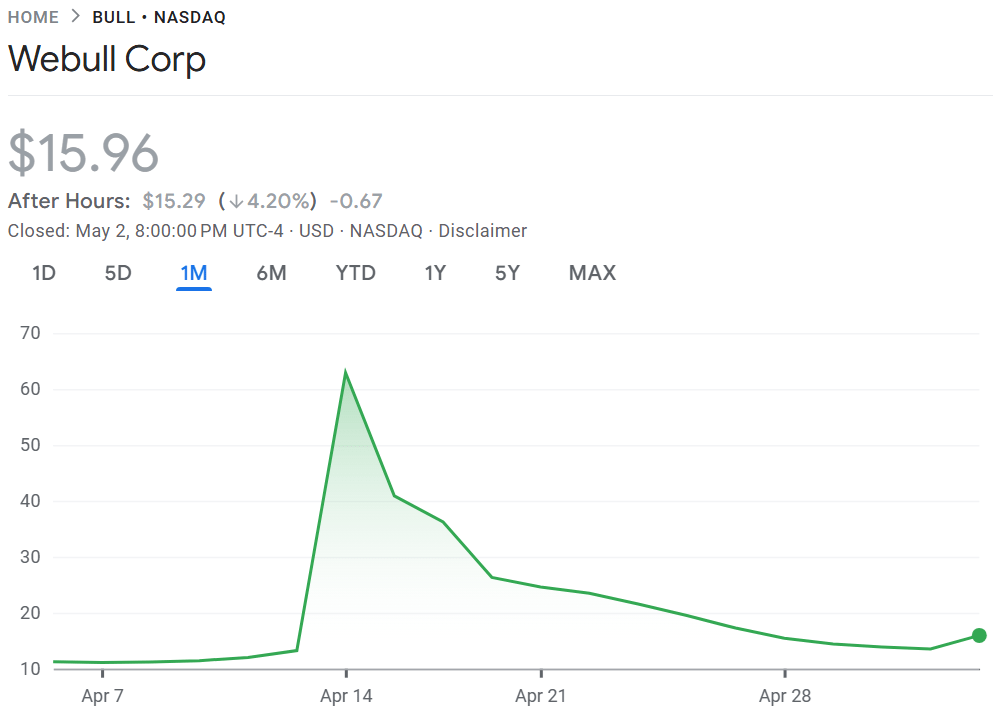

Another headwind facing the eToro IPO is what has happened to rival neobroker Webull. Webull went public on NASDAQ on April 11 via a SPAC merger (whose closing wasn’t affected by the post-tariff market mayhem), and on its second day of trading saw its shares soar to as high as $79.56. Since then, Webull shares have traded down, down, down, by 80% (!!), sitting now at just $15.96.

That has left a bad taste in the mouths (and pocketbooks) of many of the investors in newly-public online brokers, and could leave some natural eToro investors on the sidelines, or at least looking for a much lower IPO valuation before deciding to jump on board.

Webull share price from SPAC-IPO to present. Source: Google Finance.

eToro valuation revisited

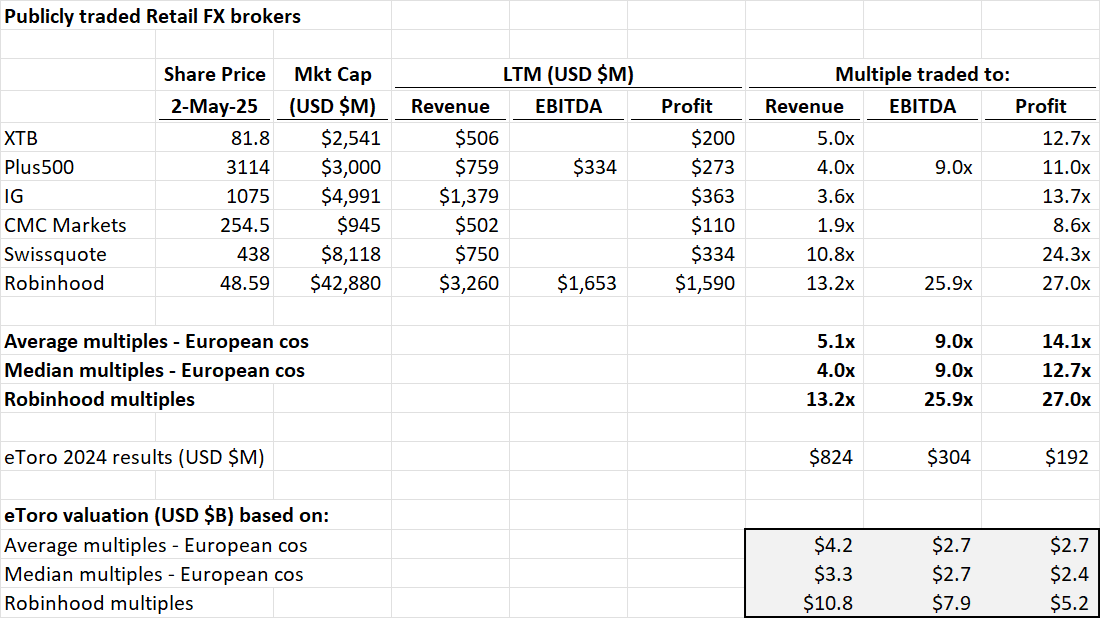

While eToro’s public filings and statements have yet to disclose a planned IPO offering transaction size, or valuation for the company, speculation in the Israeli business media (such as Globes and Calcalist) has been that eToro plans to raise somewhere in the neighborhood of $300-400 million, based on a company valuation of about $5 billion. (The Renaissance Capital IPO Center, a popular IPO tracking site in the US, has a deal size of $750 million listed for eToro).

Following up on our earlier report covering eToro’s IPO valuation, and why the company is looking to go public in the US and not in the UK or Europe, the good news is that several of the “comps” have traded up since eToro first publicly filed its IPO prospectus in late March, with several in the group posting very healthy financial results for Q1-2025 (which eToro itself has yet to disclose), such as Robinhood, Plus500, and XTB.

If eToro indeed wants to achieve a $5 billion-ish valuation in its IPO, it will need to convince investors that it should be valued more like Robinhood, and less like its UK and Europe listed comps like XTB, and Plus500. A UK/Europe comps valuation leads to a roughly $2.5-3.5 billion valuation for eToro, versus a $5 billion-plus valuation off of Robinhood’s lofty multiples.

We will continue to follow this story as it develops.