Broadridge registers 13% Y/Y increase in revenues in Q2 FY25

Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the second quarter of its fiscal year 2025, that is, for the three months ended December 31, 2024.

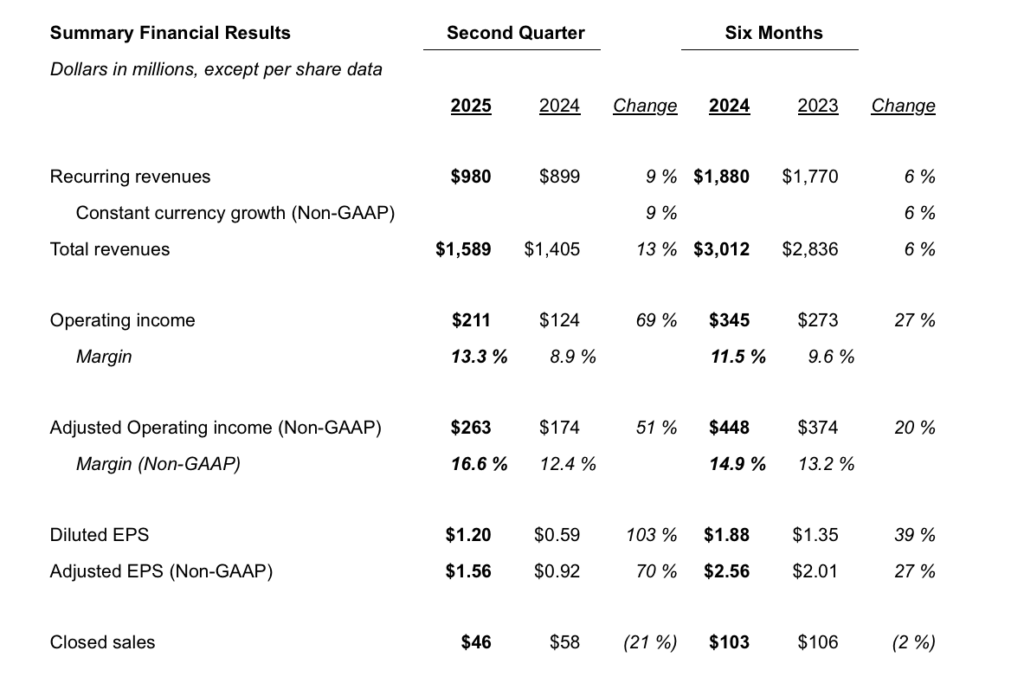

Total revenues in the three months to end-December 2024 increased 13% to $1,589 million from $1,405 million in the year-ago period.

Recurring revenues increased $81 million, or 9%, to $980 million. Recurring revenue growth constant currency (Non-GAAP) was 9%, driven by Net New Business in ICS and Internal Growth and Acquisitions in GTO.

Event-driven revenues increased $69 million, or 126%, to $125 million, driven by a higher volume of mutual fund communications.

Distribution revenues increased $34 million, or 7%, to $484 million, thanks to the postage rate increase of approximately $30 million.

Operating income was $211 million, an increase of $86 million, or 69%. Operating income margin increased to 13.3%, compared to 8.9% for the prior year period, primarily due to higher Recurring and event-driven revenues.

Adjusted Operating income was $263 million, an increase of $89 million, or 51%. Adjusted Operating income margin was 16.6% compared to 12.4% for the prior year period. The combination of higher distribution revenue and higher float income had an immaterial impact on the change in margin.

Interest expense, net was $33 million, a decrease of $4 million, primarily due to a decrease in interest expense from lower average borrowing rates.

Net earnings increased 103% to $142 million and Adjusted Net earnings increased 68% to $184 million.

Diluted earnings per share increased 103% to $1.20, compared to $0.59 in the prior year period, and

Adjusted earnings per share increased 70% to $1.56, compared to $0.92 in the prior year period.

Loss before income taxes was relatively flat at $48 million compared to $47 million in the prior year period.

On November 1, 2024, Broadridge completed the acquisition of Kyndryl’s Securities Industry Services (“SIS”) business to provide wealth management, capital markets, and information technology solutions in Canada, expanding the Company’s product offerings in the GTO reportable segment. The total purchase price, translated to U.S. dollars, was approximately $185 million.