Broadridge registers drop in net earnings in Q1 FY25

Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the first quarter of its fiscal year 2025.

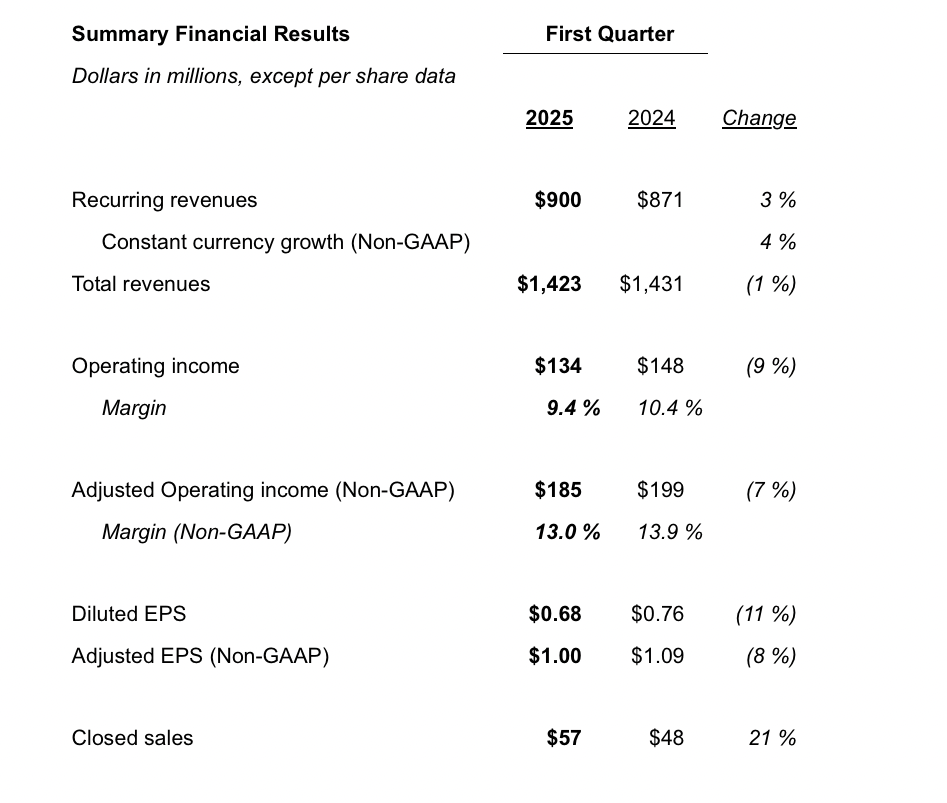

Total revenues for the three months to end-September 2024 decreased 1% from the year-ago period to $1,423 million.

Recurring revenues increased $29 million, or 3%, to $900 million. Recurring revenue growth constant currency (Non-GAAP) was 4%, driven by Net New Business in ICS and Internal Growth in GTO.

Event-driven revenues decreased $24 million, or 28%, to $63 million, driven by lower corporate action activity and lower volume of mutual fund proxy communications.

Distribution revenues decreased $13 million, or 3%, to $460 million, driven by lower volume of event-driven mailings partially offset by the postage rate increase of approximately $23 million.

Operating income was $134 million, a decrease of $14 million, or 9%. Operating income margin decreased to 9.4%, compared to 10.4% for the prior year period, primarily due to lower event-driven revenues partially offset by higher Recurring revenues.

Adjusted Operating income was $185 million, a decrease of $14 million, or 7%. Adjusted Operating income margin was 13.0% compared to 13.9% for the prior year period. The combination of lower distribution revenue and modestly higher float income negatively impacted margins by 30 basis points.

Interest expense, net was $32 million, a decrease of $1 million, primarily due to a decrease in average borrowings.

Net earnings decreased 12% to $80 million and Adjusted Net earnings decreased 9% to $118 million.

Diluted earnings per share decreased 11% to $0.68, compared to $0.76 in the prior year period, and

Adjusted earnings per share decreased 8% to $1.00, compared to $1.09 in the prior year period.

Tim Gokey, Broadridge CEO, commented:

“Broadridge’s first quarter results keep us on track to deliver a strong fiscal year 2025. In a seasonally small quarter, Recurring revenue constant currency grew 4% and Adjusted EPS was $1.00. Closed sales rose 21%, highlighting continued strong demand for our solutions.

We continue to execute on our strategy to democratize and digitize investing, simplify and innovate trading, and modernize wealth management. That execution is driving our results in the form of strong sales, a growing sales pipeline, and continued product innovation.

We are raising our Fiscal Year 2025 outlook for Recurring revenue growth to 6-8%, reflecting strong organic growth and our recently closed acquisition of SIS. We are also reaffirming our guidance of 8-12% Adjusted EPS growth and strong Closed sales of $290-330 million.”