TradingView enhances futures data sourced from Bursa Malaysia

TradingView is bringing some enhancements to the futures data sourced from Bursa Malaysia, one of the largest stock exchanges in ASEAN.

Bursa Malaysia is also the world’s leading hub for palm oil futures trading, with its contracts recognized and referenced as the global price benchmark for the palm oil industry. Now, these and other futures will be displayed with additional features, making the data more visible and accurate.

- Last or settlement prices on the chart

This update lets you choose between the settlement or last price as the closing value for the contracts shown on the chart. The settlement price is set by the exchange at the end of a trading day, calculated from the averages of the final asks and bids. Traders often use it to get a clearer view of the gains and losses associated with their positions.

To switch between these values, click the SET button at the bottom of the chart, or select the Use settlement as close on daily interval option in the chart settings.

- Back-adjustment for continuous futures contracts

TradingView has added the option of back-adjusting previous contracts in the continuous view, eliminating the roll gap caused by price differences between different contracts.

When the continuous view switches to the next new contract, all previous contracts are adjusted based on a coefficient. This coefficient is calculated as the difference between the closing prices of the new and old contracts for the nearest daily bar to the switching point in the continuous view. Typically, these are the daily bars preceding the day the contract switches.

By default, back-adjustment is disabled. To enable this feature, just click the B-ADJ button at the bottom of the chart or select the Adjust for contracts changes option in the settings.

The back-adjustment feature comes with labels displaying roll dates and helping you navigate contract switching on the chart.

- Open interest

Finally, TradingView has implemented the display of the open interest value for Bursa Malaysia futures.

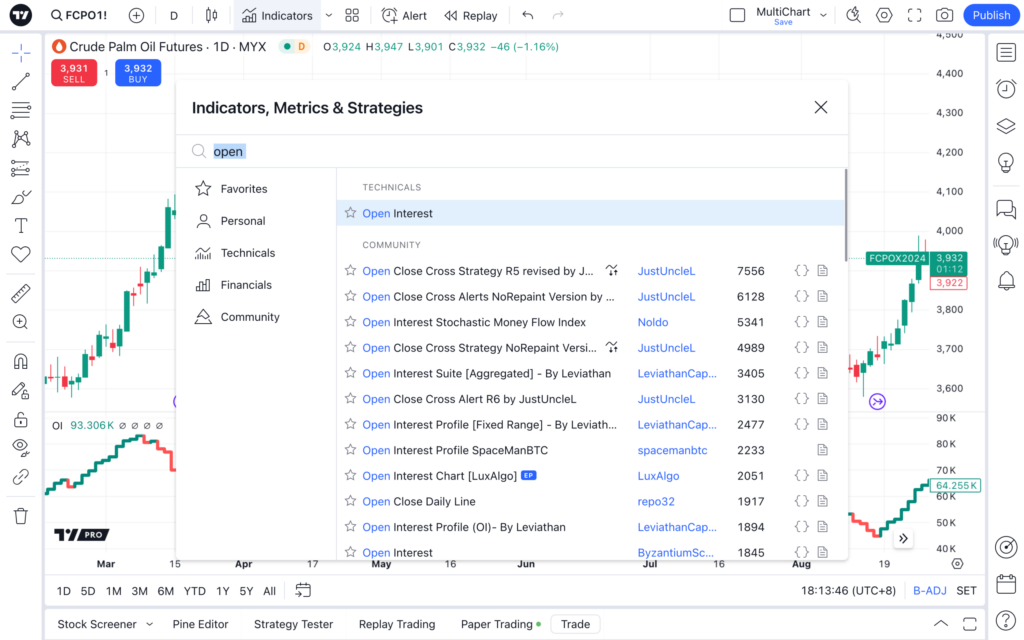

Open Interest represents the total number of outstanding derivative contracts that have not been settled. It’s important to understand that the number of open positions can fluctuate throughout the day. To view this data, go to the Indicators, Metrics & Strategies menu, and search for the Open Interest indicator.

The TradingView platform reliably connects to hundreds of data feeds, providing direct access to 1,357,880 instruments from around the world.