CMC Markets posts FY23 net income of £288.4M, in line with guidance

CMC Markets Plc (LON:CMCX), a leading global provider of online retail and institutional (B2B) platform technology, today announced its final results for the year ended 31 March 2023.

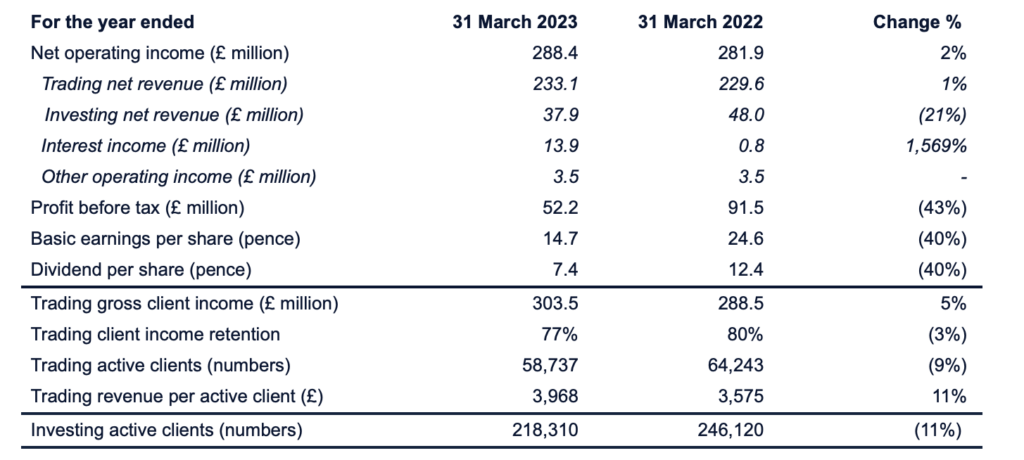

Net operating income of £288.4 million increased by £6.5 million compared to 2022, driven by increased client income, particularly in the institutional B2B channel, and a significant increase in interest income as a result of global interest rate rises. The result was in line with the guidance issued in March 2023.

Trading net revenue increased by £3.5 million (1%) driven by increases in gross client income being largely offset by client income retention decreasing to 77%. The increase in gross client income was a result of market volatility broadly remaining at levels seen in H2 2022, resulting in higher levels of client trading, despite an overall decrease in active clients.

Client income retention was lower during the period at 77% (2022: 80%) as a result of a change in the mix of asset classes traded by clients. This resulted in revenue per active client (“RPC”) increasing by £393 (11%) to £3,968.

Trading active client numbers decreased by 9% in comparison to 2022; however, monthly average active clients remain 25% above pre-COVID-19 levels, demonstrating the structural shift in the Group’s client base.

Investing net revenue was 21% lower at £37.9 million (2022: £48.0 million), with an unfavourable market environment resulting from uncertainty around the global economic outlook, inflationary pressures and the resultant impact on interest rates dampening client activity.

The decrease in profit after tax for the year of £30.1 million (42%) was due to higher net operating income being offset by increases in expenses incurred as part of the investment roadmap and the impacts of the global inflationary environment.

Dividends of £35.0 million were paid during the year (2022: £72.6 million), with £25.3 million relating to a final dividend for the prior year paid in August 2022, and a £9.8 million interim dividend paid in January 2023 relating to current year performance. The Group has proposed a final ordinary dividend of 3.90 pence per share (2022: 8.88 pence per share).

The Group also exited the year with significant prospects for future client growth, with the development of the CMC Invest platforms in the UK and Singapore along with a significant expansion in the institutional product offering giving multiple channels for both client acquisition and revenue per client expansion.

CMC Markets’ ambitious digital transformation and technology investment plan has made significant progress throughout 2023 with more frequent product enhancements along with the retail launch of the CMC Invest platform in the UK and the rollout of the platform in Singapore on track for release imminently.

In addition to the successful release of CMC Invest UK platform, the CMC Invest brand has been rolled out to the existing Australian stockbroking business and CMC will be imminently launching its CMC Invest Singapore offering as well. In Singapore, CMC Invest will initially offer equities, exchange-traded funds, options, and futures building on the offering in Australia. The UK D2C market represents a significant opportunity, with aggregate assets under administration (“AuA”) standing at c.£290 billion even after weaker capital markets seen over 2022.

In CMC Markets’ institutional trading business, it continues to grow volumes as a non-bank liquidity provider and is successfully forging new trading relationships across the globe.

Through the CMC Connect brand, the Group offers larger institutions the ability to develop a white-label trading proposition for their client base. This can be custom-built in a bespoke fashion to best suit the needs of its partners. By combining both natural client order flow and a range of external pricing sources CMC can offer consistent liquidity, market depth and best execution.

Lord Cruddas, Chief Executive Officer commented:

“Since pioneering online trading over 30 years ago, CMC continues to innovate and respond to market changes and challenges. Today the Group boasts a broad financial services offering spanning the globe. Through our new API ecosystem we can add new products and markets quickly, for both our B2B and B2C clients. We believe this breadth and level of flexibility, through one industry standard connection protocol, will be the best-in-class B2B and B2C financial services platform on the market.

During the past year, we have made progress to refine and deliver our diversification strategy. We have improved our product range across our core trading CFD and spread bet businesses, offering our clients access to a wider range of financial instruments through our award-winning platforms. We have leveraged our existing technology to launch a new investment platform in the UK, with a Singapore platform launching imminently, as well as opening a new office in Dubai to support the rapid growth we are seeing in our institutional business.

Through our new API ecosystem we are leveraging our technology to facilitate growth through B2B expansion. By partnering with our clients directly we are able to offer access to our deep liquidity, products, and technology stacks. Fostering additional B2B partnerships is front and centre in our strategy to achieve sustainable long-term growth.

CMC is changing quickly. Investment in our trading platforms continues and over the coming six months we’re positioned to launch cash equities, options and listed futures across our various platforms to allow our clients better opportunities to trade or hedge existing portfolio positions. Invest UK will be launching SIPPs and mutual funds, whilst Invest Singapore will initially offer equities, ETFs, options and futures. Additionally, over the course of the next 12 months, we plan to introduce a new multi-asset platform capable of trading a much wider range of instruments. I look forward to updating you later this year on further progress.”