Exclusive: ATFX UK grows Revenues 4x to £2.2 million in 2019

FNG Exclusive… FNG has learned that the FCA-licensed, London based UK arm of global Retail FX broker ATFX has increased its presence during its first full year operation.

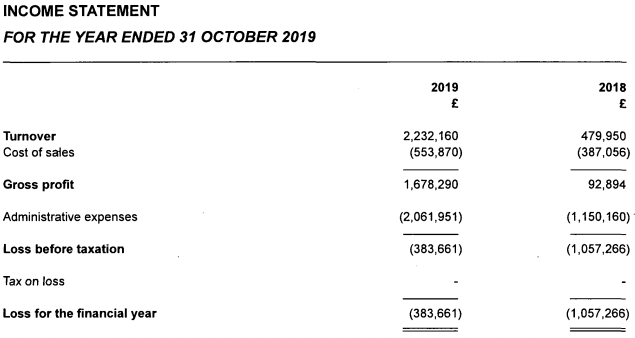

AT Global Markets (UK) Limited, or ATFX UK, posted Revenues of £2.23 million (USD $2.9 million) in the year ended October 31, 2019, versus just £480,000 in 2018. The company’s net loss shrunk from £1.06 million in 2018 to £384,000 last year.

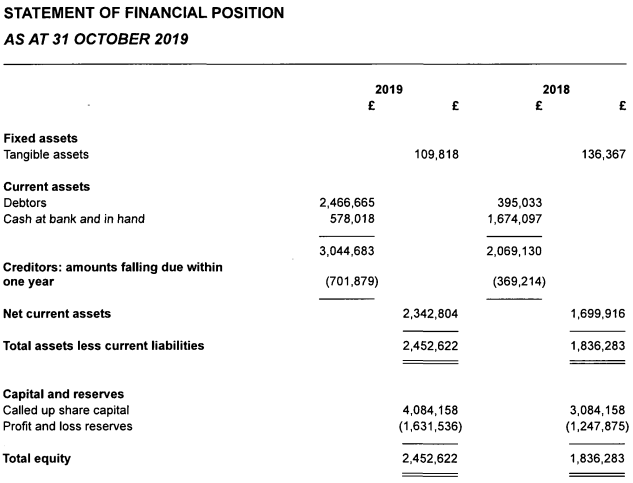

Client assets held at ATFX UK grew to £1.67 million as at year-end 2019, from £307,000 in 2018.

During the year the company’s Cayman Islands parent company AT Global Group Limited kicked in an additional £1 million of capital into ATFX UK. With the additional capital, ATFX UK exited 2019 with a strong balance sheet and £2.45 million of Equity. The company added an additional £1.5 million of capital in April and £3.1 million in July 2020.

ATFX continued to grow its employee base, growing to 22 London based employees in 2019 from eight in 2018. (We understand that they are now up to about 40). The company also opened a Krakow office earlier this year, outsourcing some IT and marketing functions to its new Polish operation.

ATFX UK received its authorization from the FCA in July 2017, and spent the rest of 2017 and most of 2018 preparing for launch with UK and EU retail investors. The company undertook a large and very visible branding campaign in the UK, splashing its logo across London Taxis (see photo above). The company has also been active in online marketing.

ATFX is controlled by Chinese entrepreneur Hiu Keung (Joe) Li. The group has licensed subsidiaries in the UK (FCA), Cyprus (CySEC), and Mauritius.

FNG spoke with Wei Qiang Zhang, ATFX (UK) Managing Director, who had the following to say about 2019 and beyond at ATFX:

2019 is the second full year we’ve been operating after acquiring a license in 2017. We’re now regulated in the UK (FCA), Cyprus (CySEC) and Mauritius (FSA). Lots of hard work and investment has gone into creating a solid European infrastructure from which we can grow. We’re proud of what the team has delivered up to now, which has led to impressive revenue increases.

A big push in 2019 was the launch of our institutional arm, ATFX Connect. It offers clients a bespoke liquidity solution, risk management, back-office reporting tools and powerful trading technology. Given the challenges in the retail arena at the time of launch, it made sense to expand our offering to institutional clients.

2020 has been a great year for ATFX (UK). We’ve shown ourselves to be very capable of managing the challenges presented by Covid-19. This is evident in our higher revenue earnings and trade volumes, which increased by 61.29% and 46.52% for Q1 and Q2 respectively when compared to 2019. What’s more, the number of total active traders rose by an astonishing 54.64% and 66.4%.

After increasing share capital in April by £1.5 million and again in July by £3.15 million, it’s clear we’re committed to our expansion and investment plans.

We’ve invested heavily in recruitment, both in our UK office where we’ve nearly doubled our team to 40 and in our new operational office in Kraków, Poland, where we have seven new recruits. We’ve enhanced our product offering substantially and added additional tools like our new social trading application. We’re in the process of launching our new web technology infrastructure, which will provide a better automated solution for the entire business as well as continuing to establish a leading position in all our target markets.

Lead by Joe Li, a Hong Kong Chinese entrepreneur, the emphasis has been on growing and sustaining a financially strong company over the long-term and continuing to make a positive impact not just on our clients, but to the economy and society.

ATFX UK’s 2019 income statement and balance sheet follow: