Beeks Financial Cloud registers 35% Y/Y increase in revenues in H1 FY23

Beeks Financial Cloud Group Plc (LON:BKS), a cloud computing and connectivity provider for financial markets, today announced its unaudited results for the six months ended 31 December 2022.

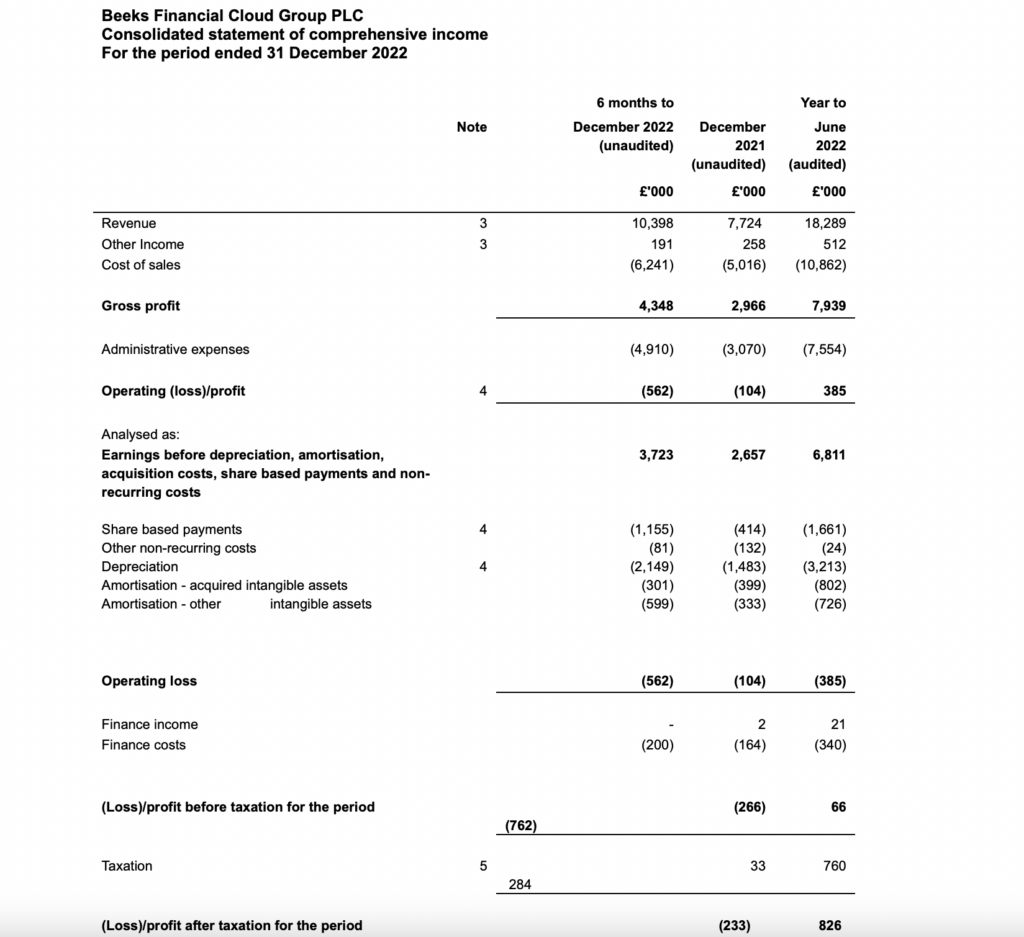

Group revenues grew by 35% to £10.40 million (H1 2022: £7.72m) primarily driven by the expansion of the Tier 1 customer base as the company executes on its land and expand strategy. During the period Beeks has grown our existing Tier 1 contract values and signed additional Tier 1 customers which now represent 50% (H1 2022: 30%) of Group total revenue.

Beeks’ core Private Cloud offering has continued to grow and has largely driven the sales increase, whilst the sales pipeline for Proximity and Exchange remains strong.

Gross profit in the period increased by 47% to £4.35 million (H1 2022: £2.97m) with gross margin up at 41% (H1 2022: 37%). Gross margins in the period have been helped by the recurring element of Proximity Cloud sales during the second half of the previous year as Beeks starts to see a return on its investment made.

Underlying EBITDA increased by 48% to £3.59 million (H1 2022: £2.43m) with underlying EBITDA margins at 35% (H1 2022: 31%). Underlying operating profit increased by 39% to £0.85m (H1 2022: £0.61m). Underlying operating profit is defined as operating profit excluding grant income, amortisation on acquired intangibles, share based payments and exceptional non-recurring costs.

Underlying EBITDA, underlying operating profit, underlying profit before tax and underlying earnings per share are alternative performance measures, considered by the Board to be a better reflection of true business performance than statutory measures only.

Beeks reported a loss before tax of £0.76 million (H1 2022: loss of £0.27m) with underlying profit before tax increasing to £0.65m (H1 2022: £0.45m).

There has been an increase in administrative expenses when compared to the prior year (excluding share based payments and non-recurring costs) of 35% to £3.67m (H1 2022: £2.52m) largely driven by an increase in staff costs of 53% (excluding share based payments and net of capitalisation) to £2.17m in the period (H1 2022: £1.42m). During the period Beeks has grown its headcount to 106, up from 89 as at 30 June 2022 and from 87 as at 31 December 2021, primarily in the software development area as it continues to evolve and exploit the Proximity and Exchange Cloud opportunity.

Beeks has continued to invest in product, most significantly in product enhancements to Exchange Cloud. As such, capitalised development costs in the period were £1.43m (H1 2022: £1.28m).

The Group generated an increase of cash from operations (before movement in working capital) in the period of 46%, up to £3.68m (H1 2022: £2.52m). Expenditure on investing activities was again significant as Beeks invested £4.17m (H1 2022: £6.28m) in property, plant and equipment (including stock capacity) across its infrastructure estate.

During the period Beeks took an asset finance facility of £1.36m as well as re-financing its loan facilities with Barclays to better preserve cash. Period end debt has been reduced to £3.34m (H1 2022: £4.83m). Cash and cash equivalents totalled £6.70m at 31 December 2022 (H1 2022: £1.10m) with trade and other receivables of £5.60m (H1 2022: £2.80m) as well as inventories of £2.35m (H1 2022: £nil).

Gross debt remains at a comfortable level of 0.5x underlying annualised EBITDA (H1 2022: 1.0x). Gross debt is defined as borrowings excluding IFRS16 lease liabilities divided by the annualised underlying EBITDA.

At the end of the period, the Group had net cash of £3.35m (H1 2022 net debt: £3.73m).

At 31 December 2022 net assets were £31.54m compared to net assets of £14.00m at 31 December 2021 and net assets of £30.76m at 30 June 2022.