TP ICAP posts 15% Y/Y rise in revenues for H1 2022

TP ICAP Group plc (LON:TCAP) today posted its financial and interim management report for the six months ended 30 June 2022.

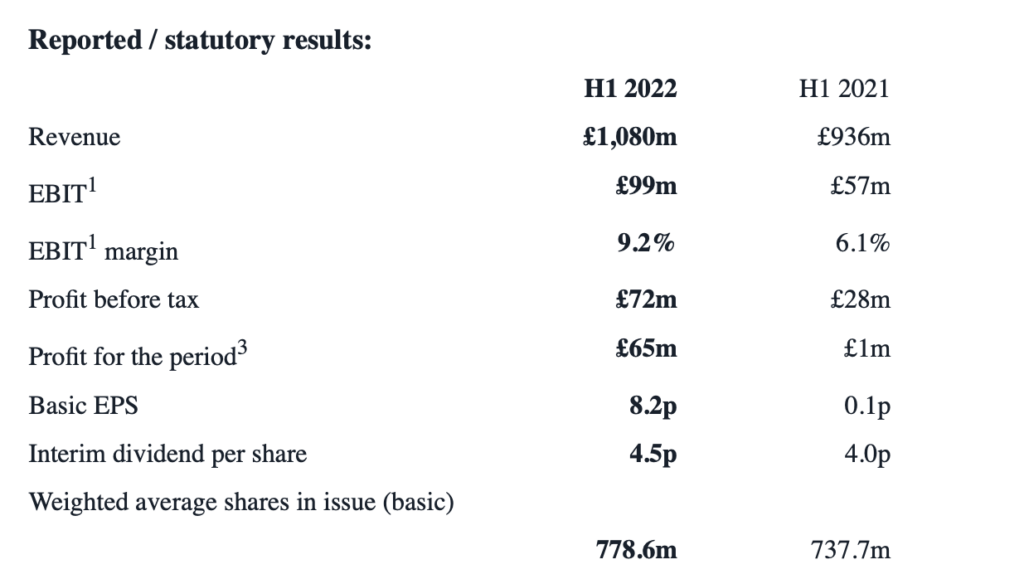

Group revenue in H1 2022 amounted to £1,080 million, marking a 15% rise when compared to the prior year in reported currency (12% ahead in constant currency). Excluding Liquidnet, revenue was 10% higher in reported currency (7% higher in constant currency).

Global Broking revenue for the period was £636 million (which represents 59% of total Group revenue), 8% higher than the prior period (11% higher in reported currency). Market volatility during the first half drove strong secondary market volumes. This was driven by geopolitical events, inflationary pressures and monetary policy tightening by Central Banks across main markets. As a result, revenue grew across all asset classes.

Revenue in FX & Money Markets was up by 10%, marginally underperforming the year-on-year increase of c.14% in CME FX Futures volumes. Credit revenue increased by 11%, outperforming the wider market, with total US corporate bond trading volumes decreasing by c.3% in H1 2022.

Energy & Commodities (E&C) amounted to £197 million in H1 2022 and was 2% higher than H1 2021 (5% higher in reported currency), with growth in environmental markets, oil and bulk commodities being offset by lower revenues in gas. By comparison the number of oil, gas and other energy products traded on the Intercontinental Exchange (ICE) increased by c.5% in H1 2022.

Agency Execution revenue increased 58% from £106 million in H1 2021 to £168 million in H1 2022, driven by the inclusion of Liquidnet revenue from 23 March 2021 onwards (the date of the acquisition).

The Group’s revenue and EBIT margin benefited from an FX tailwind in the first half, with GBP weakening by 6%, on average, against the USD.

The Group incurred significant items of £36 million (post-tax) in reported earnings (H1 2021: £74m), including £21 million of non-cash amortisation of intangible assets that arose on the acquisition of ICAP and Liquidnet. Reported EBIT increased from £57 million in H1 2021 (reported EBIT margin of 6.1%) to £99 million in H1 2022 (reported EBIT margin of 9.2%).

TP ICAP is reducing its guidance for significant items for FY 2022 from c.£125m (pre-tax) to c.£110m. All other FY 2022 guidance remains unchanged.

Nicolas Breteau, CEO of the Group, said:

“We have delivered high single digit revenue growth. We have also grown revenue across all our asset classes and increased our market share. A strong performance from Rates, helped deliver an uplift in profitability.

Our transformation continues at pace, including the rollout of Fusion, our award-winning electronic platform. Our focus on diversification is reaping benefits, too. Parameta Solutions is announcing today an enhanced consensus pricing solution in partnership with PeerNova and involving many of the world’s largest investment banks. Meanwhile, at Liquidnet, our Dealer-to-Client credit proposition went live, as planned, in June, initially with a small number of clients ahead of a wider campaign. Trades have already been completed and key dealers are connected electronically via API.

We are committed to delivering capital efficiencies for the Group as a strategic priority. In the first phase of a review we are conducting following our Jersey redomicile, we have identified around £100 million of cash that will be generated or freed up by the end of 2023 and used to repay debt. Following that, and as part of the ongoing assessment of the Group’s balance sheet and investment requirements, the Board is committed to identifying and returning any resultant surplus capital to shareholders.

Volatility has continued across many markets. Our core franchise, the depth of our liquidity pools, and our ongoing focus on our transformation mean we are well positioned in these market conditions.”