Will Cryptocurrencies Thrive During a Recession?

The following is a guest editorial courtesy of Andrew Lane, CEO of sentiment-based technology company Acuity Trading.

Bitcoin, the first decentralised cryptocurrency, was forged in the embers of the most severe recession in modern times. The Great Financial Crisis (GFC) of 2008 had wiped off $2 trillion in global growth within a year and, in its wake, left not only the world’s largest economy in ruins, but also in a miasma of distrust. Living through it created a cynicism of financial institutions, regulators, and government bodies. Bitcoin offered a promising alternative.

An experiment of trust, not in one centralised body or even a group of experts, but in the network. With peer-to-peer transactions and public ledgers, Bitcoin could exist without third-party intervention or corruption. When the next recession hit, it was forged to provide a haven for investors outside the purview of government policy and financial institutions.

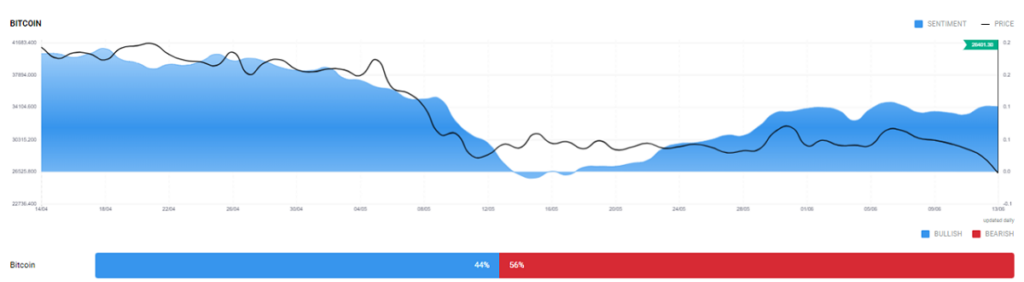

Bitcoin (BTC), and the legion of cryptocurrencies it inspired, took on the first economic recession they faced with distinction. Cryptocurrencies enjoyed significant growth through the pandemic crisis. In 2020, the year pandemic restrictions put speed bumps on economic activity, BTC grew nearly 400%, only to rise another 171% in 2021. Even after this phenomenal performance, the sentiment for the crypto king remains balanced, as can be seen on Acuity’s Sentiment Widget.

At its peak in November 2021, the entire crypto universe was valued at $3 trillion. Since then, however, the crypto market has had a few strained months. As of June 2022, the market capitalisation of cryptos has fallen to $1.3 trillion. Yet many investors, from Reddit forums to trading desks on Wall Street, continue to believe. Can cryptos once again thrive during a recession?

The Next Recession

Advanced economies, like Europe and the US, are experiencing supply shortages that have pushed inflation to the highest levels since the Great Inflation of the 1970s and 80s. Inflation increases prices and makes customers less likely to shell out for high-margin discretionary items. Since April, the US consumer confidence index has been steadily declining, signifying the reluctance to purchase non-essentials.

Central banks globally are raising rates to stave off inflation, but the resultant decline in demand is a bearish indicator for the world economy.

Bear signals also emanate from the Russian invasion of Ukraine and China’s zero covid-19 policy, which may have global ramifications that have not yet fully materialised. Goldman Sachs gives a 35% probability of a US recession over the next 24 months. Deutsche Bank analysts are even more bearish and predict a US recession in 2023.

Why Cryptos May Thrive Even If the Global Economy Stutters

Source of Value of Assets

In assessing the importance of cryptos as a portfolio asset during a recession, it is essential to see their sources of value. With economic signs turning bearish and central banks hiking rates, many speculators lowered their risk tolerance and cashed out their crypto bets. The treatment of Bitcoin as a risk vehicle, rather than a safe-haven option, is exhibited by its high positive correlation with major equity indices. However, cryptocurrencies have utility outside of being a speculative vehicle.

The most common utility is to facilitate transactions. With commercial activity being severely inhibited by a recession, their utility in this area is reduced On the flip side, cryptos that are supply capped can perform well as inflation-proof assets, if the current high supply-side inflation persists during a recession.

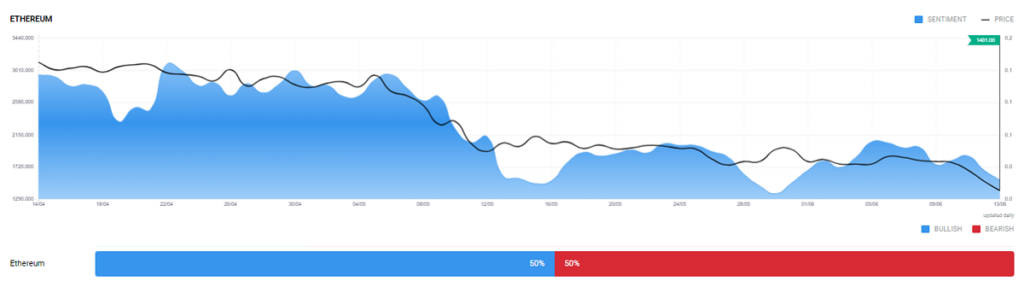

While the Bitcoin network is limited to acting as an exchange for bitcoin, other networks have found functionalities that would be useful during a recession. There are cryptos that facilitate financial activity through transparent algorithms called smart contracts, thereby eliminating the need for intermediaries and high transaction fees. During a recession, less disposable cash is available to pay for the myriad of intermediaries that investors and borrowers have to deal with in traditional markets, increasing the utility of these coins. Ethereum (ETH) is possibly the most popular altcoin because it supports smart contracts.

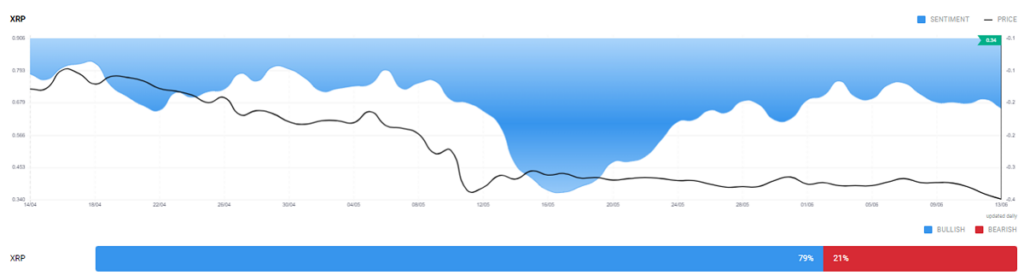

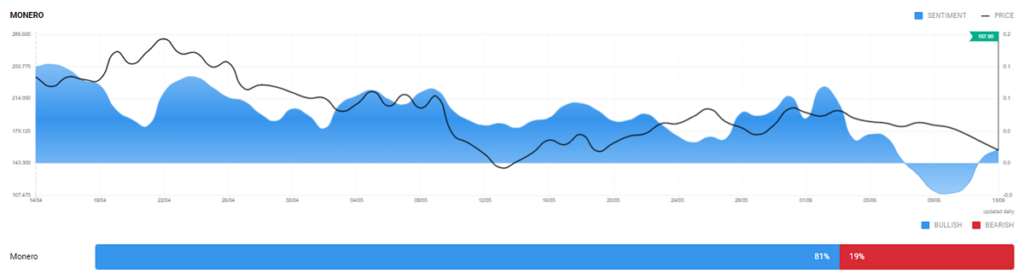

Cryptos have use besides facilitating financial transactions. Crucial to functions in a blockchain-enabled world of virtual commerce, companies may use digital currencies to drive online sales. Ripple (XRP) is known to facilitate cheaper and faster cross-border transactions than Bitcoin, while offering a robust open-source foundation for developers to build powerful applications. Although Monero’s popularity stemmed from its role in facilitating anonymous routing of funds, the platform has found utility in maintaining privacy to prevent corporate espionage.

Relative Performance

Traditionally, when the winds of recession blow, people flock to safe-haven assets such as the US dollar or gold. Gold rallied after the DotCom crash, the GFC, and the covid-19 downturn. However, more recently, gold has remained subdued, even amid economic and geopolitical uncertainties. While the US dollar continues to be popular, its value has already risen significantly. On the other hand, cryptocurrencies have underperformed and may be perceived as being undervalued.

Increase in Market Participants

The US government responded to the pandemic by record money injections into the economy. Money supply in the country has expanded more than 40% from the beginning of 2020. This increase in money supply impacted bond yields and encouraged risk-on yield-seeking behaviour, triggering broad-spectrum rallies in equities and cryptocurrencies.

The markets were also driven by something more. More retail traders entered the market for an alternate income stream and a source of entertainment. It means the market not only comprised of people who believed in the investment thesis of the assets they held, but also of speculators looking to earn from short-term market movements. With derivatives like options and CFDs, retail traders are identifying opportunities in both rising and falling markets. So, even when prices decline, trading volumes remain elevated.

With cryptos experiencing a tumultuous 2022, their value has been eroded and we may see investors looking to buy undervalued assets during an economic slowdown. The prospects for cryptos are also supported by the value advantage they offer over traditional commercial activity. Moreover, while inflation eats into fiat currencies, investors may shift to cryptocurrencies as a hedging tool.