XTB shares hit all-time high as 75% of 2022 profit set for Dividend, Buyback

Poland based Retail FX and CFDs broker XTB.com saw shares of its parent company XTB SA (WSE:XTB) hit an all time-high of PLN 36.90, after XTB announced that 75% of its 2022 profits would be returned to shareholders in the form of a Dividend and Share Buyback.

We reported at the beginning of February that XTB had its best-ever year in 2022 with Revenues of PLN 1,444 million ($328 million) and Net Profit of PLN 765 million ($174 million), although the fourth quarter of the year saw a significant slowdown.

Today, XTB announced that it made a decision regarding the intention to buy back its own shares, and the intention to recommend to the Supervisory Board and the General Meeting of the Company the distribution of the Company’s net profit for the year 2022, as follows:

a) payment to shareholders of 50% of the profit generated in 2022 in the form of a dividend, i.e. the amount estimated at PLN 381,496,813.75 which corresponds to PLN 3.25 in dividend per share;

b) 25% of the generated profit, i.e. the amount estimated at PLN 188,700,000.00 will be allocated to the purchase of own shares from shareholders and their redemption; and

c) keep the remaining amount, estimated at PLN 191,367,526.88 at the Company’s disposal and allocate it to reserve capital.

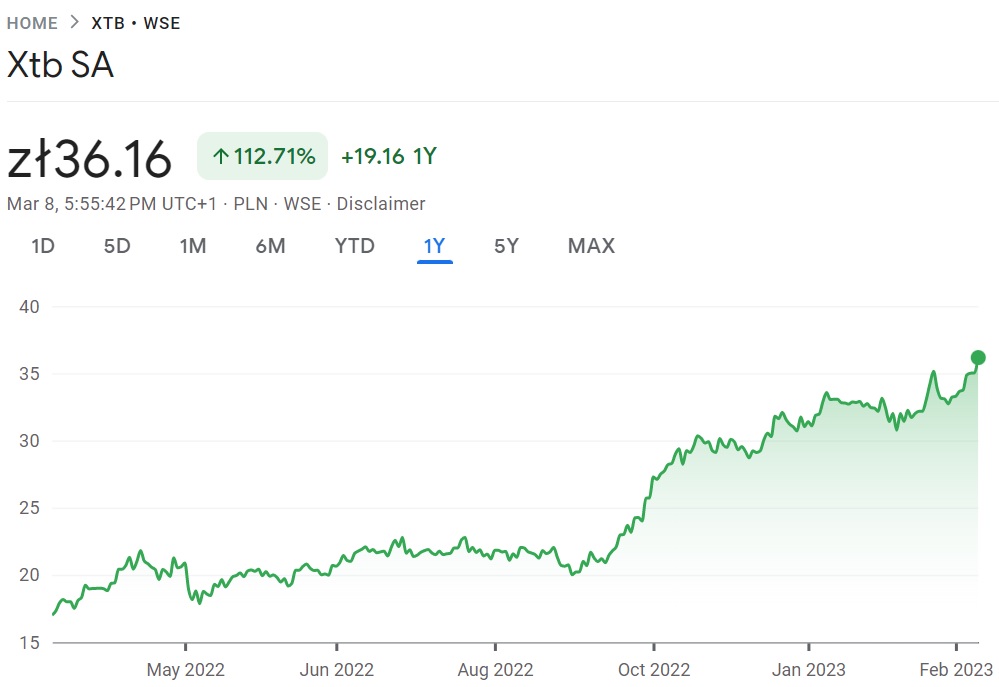

Following the announcement XTB shares climbed to an all-time high of PLN 36.90, before settling back to close Wednesday at PLN 36.16. XTB now has a market capitalization of PLN 4.246 billion, or USD $956 million.

XTB share price one-year graph. Source: Google Finance.

The above recommendation and the buy back of own shares is subject to the Company obtaining permission from the Polish Financial Supervision Authority to buy back up to 5,683,635 own shares, which represents 4.84% of the total number of shares/votes in the Company, by 31 December 2023, for their redemption.

In the event of a possible lack of consent on the part of the Commission for the above-mentioned own share buy back or the extension of the period for obtaining such consent, the intention of the Management Board of the Company will be to recommend to the Supervisory Board and the General Meeting the following alternative method of dividing the profit earned in 2022:

a) payment to shareholders of 75% of the Company profit generated in 2022 in the form of dividends, i.e. PLN 570,484,466.10, which corresponds to PLN 4.86 of dividend per share; and

b) keep the remaining amount, i.e. PLN 191,079,874.53, at the Company’s disposal and allocate it to reserve capital.

Considering the above, the Company will immediately apply to the Polish Financial Supervision Authority for permission to buy back its own shares and reduce instruments in the Company’s Common Equity Tier 1 capital. The above recommendation of the Company’s Management Board is consistent with XTB’s dividend policy, which assumes recommending to the General Meeting a dividend payment at the level of 50-100% of the Company’s standalone net profit for a given financial year, taking into account factors such as the need to ensure an appropriate level of the Company’s capital adequacy ratios and the capital necessary for Group development, as well as taking into account the guidelines of the Polish Financial Supervision Authority.

The decision of the Commission regarding the application submitted by the Company for a permit to buy back its own shares and the final recommendation of the Management Board regarding the distribution of net profit for 2022 will be announced by the Company in subsequent reports.