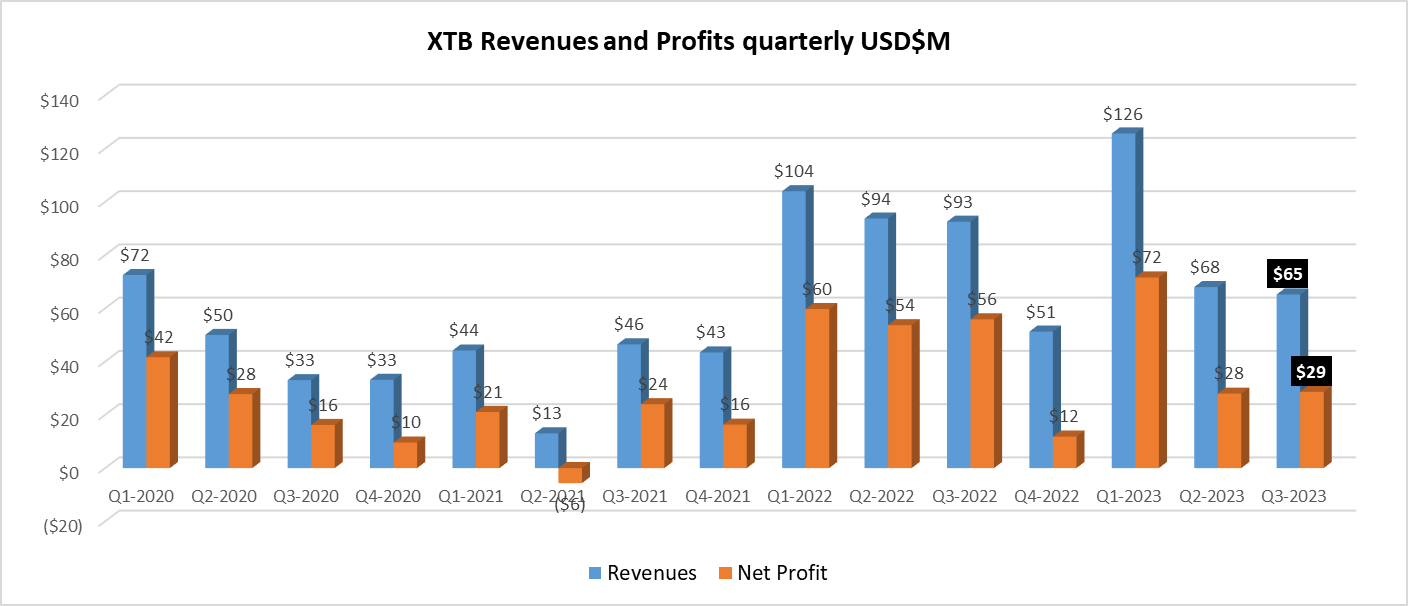

XTB sees Revenues ($65M) and Profits ($29M) stable in Q3 2023

Poland based Retail FX and CFDs broker XTB SA (WSE:XTB) has reported its financial results for Q3 2023, indicating a fairly stable quarter as compared to Q2 at XTB – Revenues were down slightly by 4% QoQ, but Net Profit was up slightly by 2%. But in the big picture of an industry famous for large ups-and-downs in quarterly results, again a fairly stable quarter for XTB.

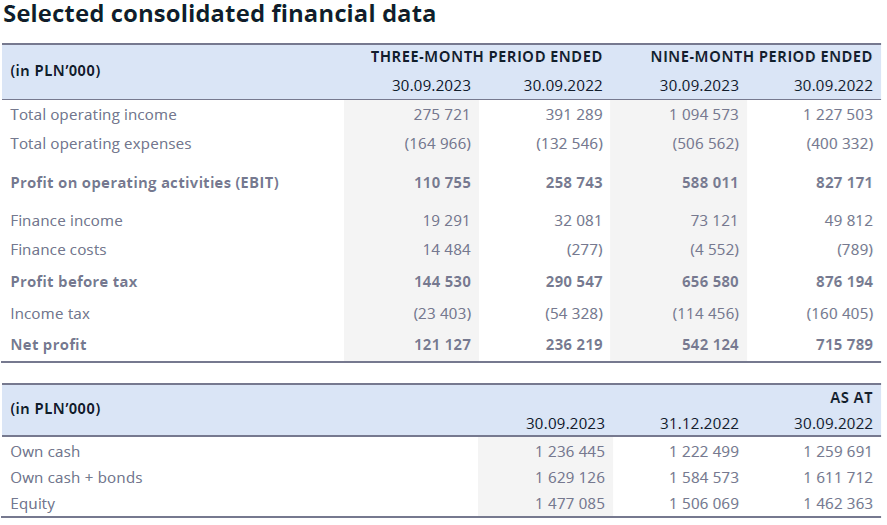

Q3 Revenues at XTB came in at PLN 275.7 million (USD $65 million), versus $68 million in Q2. Net Profit totaled PLN 121.1 million (USD $29 million) in Q3, versus $28 million in Q2.

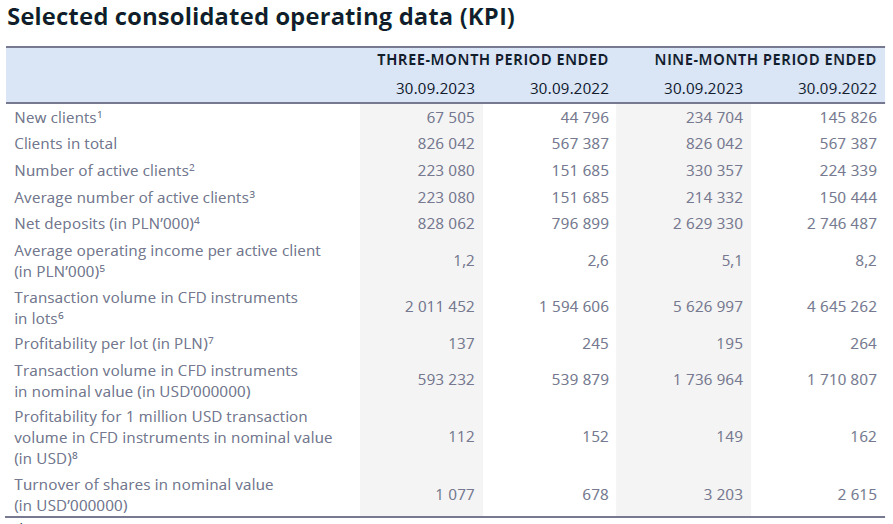

Monthly trading volumes averaged $198 billion at XTB during Q3 2023, up from $182 billion monthly in Q2 and closer to the $199 billion/month that XTB averaged in Q1.

New client acquisition

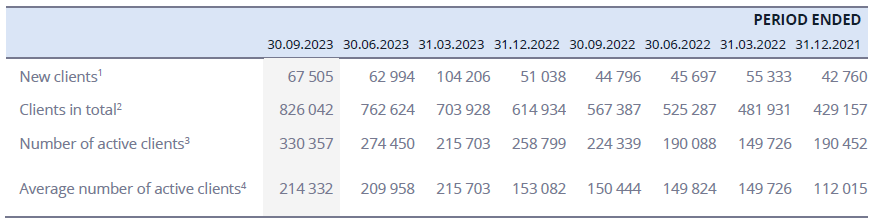

XTB stated that the priority of its Management Board is to further increase the client base leading to the strengthening of XTB’s global position by reaching the mass client with its product offerings. The ambition of the Management Board in 2023 is to acquire, on average, at least 40-60 thousand new clients per quarter.

These activities are supported by a number of initiatives, including the first passive investment product introduced in September 2023, which allows clients to build up to 10 strategies based on ETFs. Each strategy can consist of up to 9 ETFs. Investors have a choice of over 350 exchange traded funds currently available on the xStation 5 platform. The client determines the percentage of each ETF included in the plan. The product is currently launched in 6 markets: Czech Republic, Slovakia, Germany, Portugal, Romania and Italy. It will also be launched in Spain and Poland in the fourth quarter of this year. According to the company, the product is attracting considerable interest despite the lack of significant marketing activity around it.

Following the realized activities, the Group acquired a total of 104,2 thousand new clients in the first quarter of 2023, in the second quarter of this year 63,0 thousand new clients, and more than 67,5 thousand new clients in the third quarter of this year. On the other hand, in the first 25 days of October 2023, 21,4 thousand new clients were acquired.

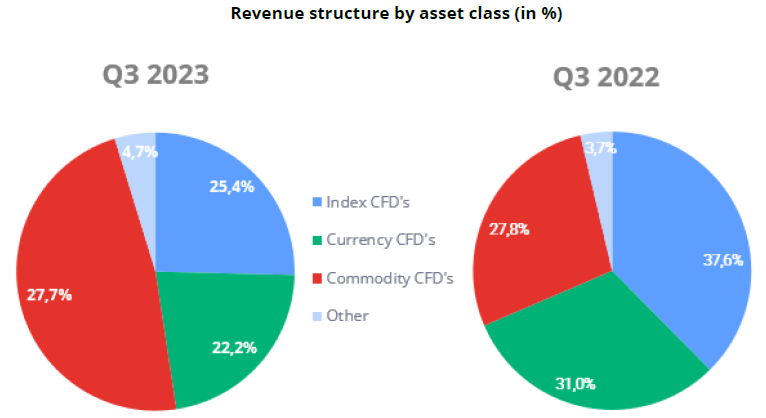

Revenue by Product

Looking at XTB’s revenues in terms of the classes of instruments responsible for their creation, it can be seen that commodity-based CFDs led the way in the third quarter of 2023. Their share in the structure of revenues on financial instruments reached 47,7%. This is a consequence of high profitability on CFD instruments based on oil, gold and wheat quotes. The second most profitable asset class was CFD instruments based on indices. Their share in the revenue structure in the third quarter of 2023 was 25,4%. The most profitable instruments in this class were CFDs based on the US 100 and the US 500 index. Revenue on CFD instruments based on currencies accounted for 22,2% of total revenue, where the most profitable instruments in this class were CFDs based on the EURUSD, USDJPY and GBPUSD currency pairs.

XTB business model

The business model used by XTB combines features of the agency model and the market maker model, in which the Company is a party to transactions concluded and initiated by clients. XTB does not engage, in proprietary trading for its own account in anticipation of changes in the price or value of the underlying instruments (so-called proprietary trading).

The hybrid business model used by XTB also uses an agency model. For example, on the majority of trading in CFD instruments based on cryptocurrencies, XTB hedges these transactions with third-party partners, virtually ceasing to be the other party to the transaction (legally, of course, it is still XTB). The Company’s fully automated risk management process limits exposure to market changes and forces it to hedge positions in order to maintain appropriate levels of capital requirements. In addition, XTB executes directly on regulated markets or alternative trading venues all transactions in shares and ETFs and CFDs instruments based on these assets. XTB is not a market maker for this class of instruments.

XTB expenses in Q3

In the third quarter of 2023 operating expenses amounted to PLN 165,0 million and were higher PLN 32,4 million to the same period a year earlier (Q3 2022 r.: PLN 132,5 million). The most significant changes occurred in:

- costs of salaries and employee benefits, an increase of PLN 14,7 million mainly due to the increase in employment;

- marketing costs, an increase of PLN 10,0 million mainly due to higher expenditures on marketing online and offline campaigns;

- other external services, an increase by PLN 2,8 million as a result of mainly higher expenditure on: (i) legal and advisory services (increase by PLN 1,6 million y/y); (ii) IT systems and licenses (increase by PLN 1,0 million y/y).

In q/q terms, operating costs increased by PLN 7,6 million mainly due to PLN 3,8 million higher offline marketing expenses and PLN 2,3 million higher salary and employee benefits expenses, mainly resulting from an increase in employment, as well as 0,7 million higher commission expenses resulting from higher amounts paid to payment service providers through which clients deposit their funds on transaction accounts.

As a result of XTB’s rapid growth, the Board estimates that total operating expenses in 2023 could be as much as a quarter higher than what we saw in 2022. The Management Board’s priority is to further increase the client base and build a global brand. As a consequence of the ongoing activities, marketing expenditure may increase by less than a fifth compared to last year.

Foreign expansion

XTB, with its strong market position and dynamically growing client base, is increasingly boldly building its presence in non-European markets, consistently pursuing the strategy of creating a global brand. The Management Board of XTB puts the main emphasis on organic growth, on the one hand increasing the penetration of European markets, and on the other successively building its presence in Latin America, Asia and Africa. Following these actions, the composition of the capital group may expand with new subsidiaries. It is worth mentioning that geographical expansion is a process carried out by XTB on a continuous basis, the effects of which are spread over time. Therefore, one should rather not expect sudden, abrupt changes in the Group’s results on this account.

XTB’s development is also possible through mergers and acquisitions, especially with entities that would allow the Group to achieve geographical synergies (complementary markets). The Management Board intends to carry out transactions of this type only if they are associated with tangible benefits for the Company and its shareholders.

Currently, the Management Board’s efforts are focused on reaching the mass client with its offer. This is crucial for XTB’s further dynamic development and building a global brand. This goal is also served by the addition of new products to the offer in 2023 and subsequent years. The Management Board estimates that the results of this works will give a much higher yield than if the available resources were invested in launching operations in South Africa. For this reason, the start of operations of XTB Africa (PTY) Ltd. has been postponed until at least 2024.

Selected financial and operating data for Q3 and the first nine months of the year at XTB follows.