XTB sees record Revenues of $155M but flat Profit in Q1 2025

Following a somewhat subdued Q4 2024, Poland based Retail FX and CFDs broker XTB (WSE:XTB) has reported its preliminary results for Q1 2025, indicating record Revenues and new client acquisitions, although higher costs kept Net Profit at roughly the same level as Q4.

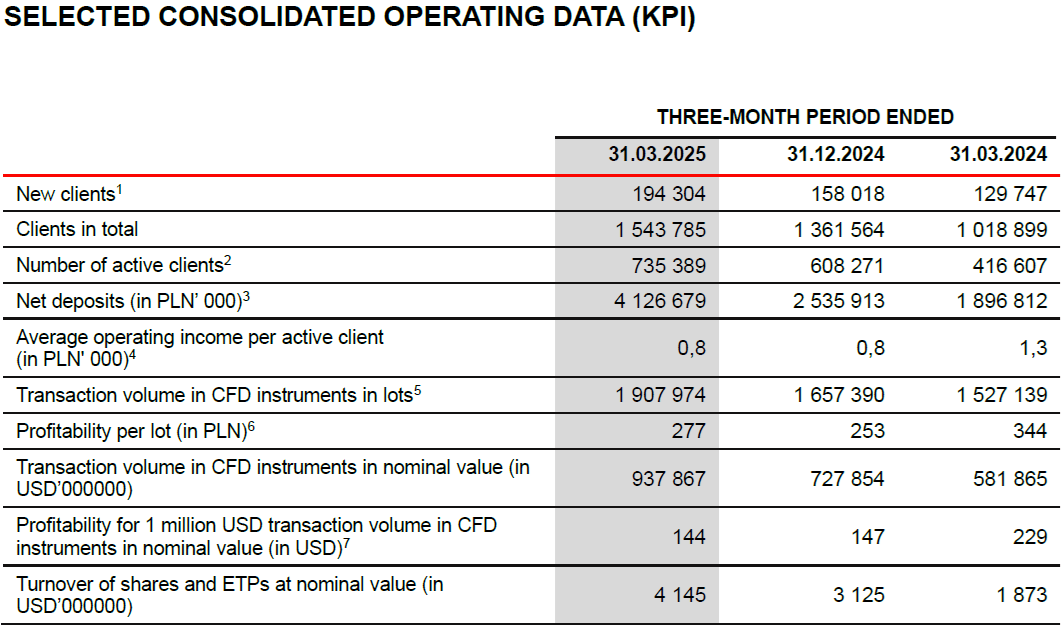

XTB Revenues and Profits Q1 2025

Revenues at XTB for the first quarter of 2025 came in at PLN 580 million (USD $155 million) – a new all-time best for XTB – up by 25% from Q4’s $124 million. Net Profit however was up by less than 1% QoQ, to PLN 194 million ($52 million) versus $51 million in Q3, well off XTB’s most profitable quarter in Q1-2024, at $81 million.

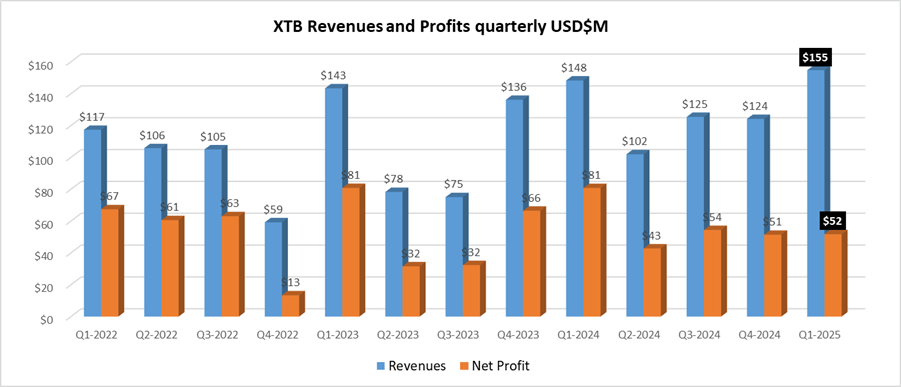

XTB Trading Volumes Q1 2025

Trading volumes at XTB averaged a record $313 billion monthly in Q1-2025, up 29% from $242 million per month in Q4-2024. The company’s profitability per 1 million USD transaction volume in Q1 however fell to 144, from 147 in Q4-2024.

XTB Client Acquisition Q1 2025

XTB said that it has a solid foundation in the form of a constantly growing base and number of active clients. In Q1 2025, the Group recorded another record in this area, acquiring 194,304 new clients compared to 129,747 a year earlier, an increase of 49.8%. Similar to the number of new clients, the number of active clients was also record-breaking, increasing from 416,607 to 735,389, i.e. by 76.5% y/y.

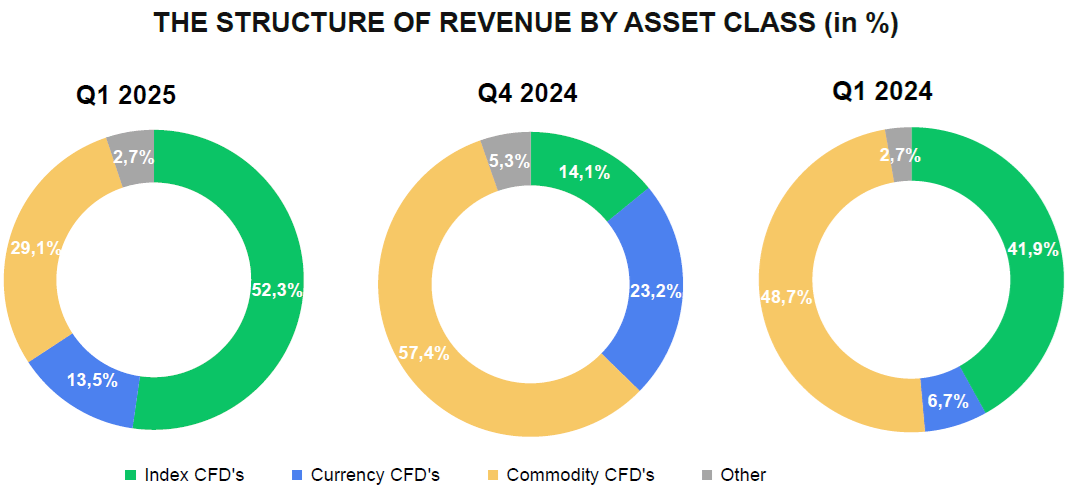

XTB Asset Classes Traded Q1 2025

Considering the structure of the achieved revenues in terms of instrument classes, it can be observed that in the first quarter of 2025, CFDs (Contracts for Difference) based on indices were the leading contributor. Their share in total revenues during the analyzed period reached 52.3% (Q1 2024: 41.9%). This is a result of, among other factors, the high profitability of CFDs based on the German stock index DAX (DE40), the US index US 100, and the US index US 500.

The second most profitable asset class was commodity-based CFDs. Their share in revenue structure reached 29.1%, compared to 48.7% the previous year. This was linked to the high profitability of trading CFDs based on the prices of natural gas, gold, and coffee. Revenues from currency-based CFDs accounted for 13.5% of total revenues, compared to 23.2% a year earlier. The most profitable financial instruments in this class were CFDs based on cryptocurrencies such as Ripple, Bitcoin, and the EURUSD currency pair.

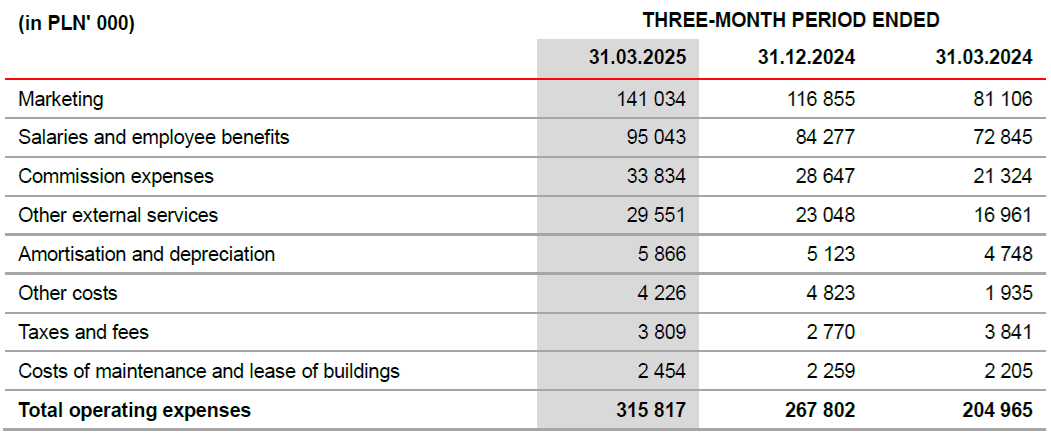

XTB Expenses Q1 2025

Operating expenses at XTB in Q1 2025 amounted to PLN 315.8 million and were PLN 110.9 million higher than in the previous year (Q1 of 2024: PLN 205.0 million). The most significant changes were in:

- marketing costs, increase by PLN 59.9 million resulting mainly from higher expenses for online and offline marketing campaigns;

- salaries and employee benefits, a increase by PLN 22.2 million, mainly due to a increase in the number of employees;

- commission costs, a increase of PLN 12.5 million resulting from higher amounts paid to payment service providers through which customers deposit their funds in transaction accounts;

- other external services, a increase by PLN 12.6 million mainly due to higher expenses for (i) IT systems and licenses (increase by PLN 8.3 million y/y) and (ii) IT support services (increase by PLN 1.9 million y/y).

On a q/q basis, operating costs were higher by PLN 48.0 million, mainly driven by an increase of PLN 24.2 million in online and offline marketing expenses, followed by an increase of PLN 10.8 million PLN in salaries and employee benefits, resulting mainly from a increase in employment, and an increase by PLN 6.5 million in other external services. Additionally, there was a PLN 5.2 million increase in commission costs resulting from higher amounts paid to payment service providers through which clients deposit their funds into transactional accounts. These expenditures are gradually increasing, and the activities to which the Company allocates them are closely related to the achievement of strategic goals.

Due to the dynamic development of XTB, the Management Board estimates that in 2025 total operating costs may be higher by up to approximately 40% than what was observed in 2024. The Management Board’s priority is to further increase the customer base and build a global brand. As a result of the implemented activities, marketing expenditures may increase by approximately 80% compared to the previous year, while assuming that the average customer acquisition cost should be comparable to what we observed in 2023-2024.

More highlights from XTB’s Q1 2025 results follow below.