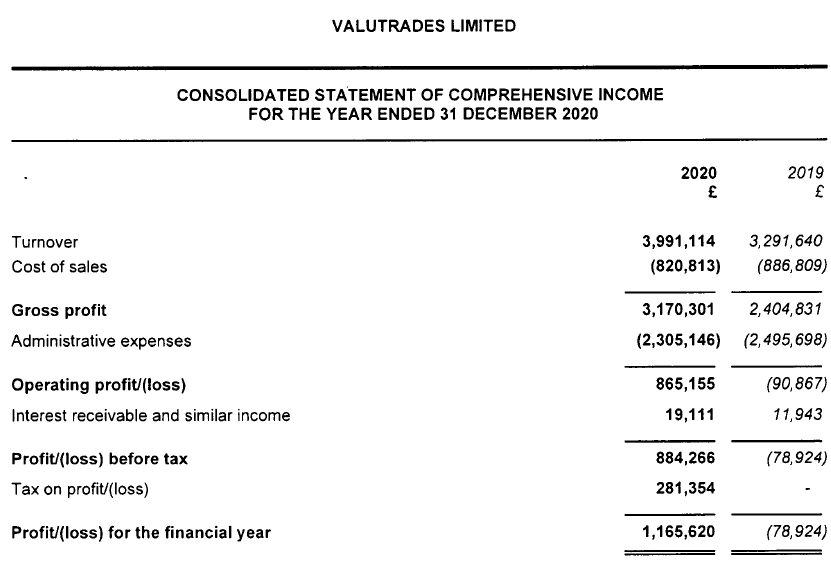

Exclusive: Valutrades 2020 Revenues up 21% to £4.0 million

FNG Exclusive… FNG has learned that FCA regulated FX and CFDs broker Valutrades saw an uptick in activity in 2020, with Revenues coming in at £4.0 million, up 24% from £3.3 million in 2019. The company turned a £1.2 million profit versus a small loss of £79,000 the previous year.

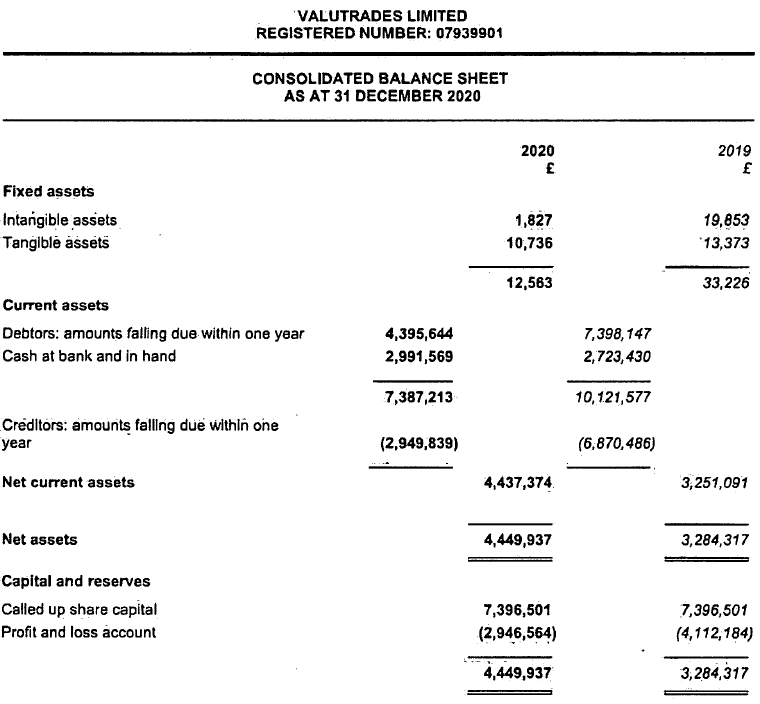

Retail client funds held at Valutrades increased by 45% in 2020, coming in at £2.6 million at year end (2019: £1.8 million).

Valutrades is an online financial services business that offers clients trading of forex, CFDs and commodities via the Metatrader4 (MT4) platform and FIX API connectivity. The firm has a full scope FCA IFPRU €730K regulatory license.

Management indicated that 2021 looks set to be another good year for Valutrades with the same market trends – Covid-19, US political leadership change and Brexit reaction, causing increased volatility in financial markets. This has a net positive effect on client volumes and commission incomes. Valutrades said it continues to be positioned to benefit from uncertain times and is proud to be able to support all staff, and has continued to hire additional staff throughout 2020 and the beginning of 2021.

Valutrades was able to generate its first substantial profits in 2020 and is seeing a continued positive start to 2021. It noted that its existing shareholders continue to support the business with profits intended to be reinvested in further growth. Since the initial decline as a result of the drastic ESMA regulation changes in 2018, the firm was able to grow revenues from 2019 onwards and is still seeing an increase of revenues at the start of 2021.

The current business strategy has been in place since 2016 with results consistent with expectations. The firm said it will continue this strategy, with further investments in technology, staff and business relationships expected in 2021 which will enhance Valutrades’ expected profitability. Investments in the Client Area and Quarch systems are of particular importance allowing Valutrades to scale efficiently with automation and reduced costs. A low level of staff turnover is helping to build an additional knowledge base that will help continue to scale the business.

Valutrades is run from London led by Graeme Watkins, who has been CEO since 2015. The company is controlled by Indonesian investors Aman Lakhiani and Anil Bahirwani.

Valutrades’ 2020 income statement and balance sheet follow: