Exclusive: Trading 212 shareholders pump in another £13.75 million of capital

FNG Exclusive… It looks like big things are planned at Trading 212.

FNG has learned via regulatory filings that FCA regulated online brokerage firm Trading 212 UK Limited has raised an additional £13.75 million (USD $19 million) of capital from its controlling shareholders Borislav Nedialkov and Ivan Ashminov. The latest capital raise, made at the end of July, comes after Mr. Nedialkov and Mr. Ashminov put £6.0 million of additional money into Trading 212 at the end of May – as was also reported exclusively at FNG – bringing the total amount raised this year by Trading 212 to £19.75 million (USD $27.5 million).

FNG confirmed with Trading 212 management that the latest capital injection – like the last one – was done to help support the growth in the business, both current and expected in the future.

Like a number of its online brokerage counterparts, Trading 212 has seen a sharp uptick in all metrics over the past year covering everything from number of clients to client assets held to trading volumes. While that growth has (likely) come with an increase in profitability at Trading 212, it also requires more capital.

The company’s shareholders have also overseen an overhaul of company management to reflect the company’s increased prospects, including bringing on board former Tickmill executive Mukid Chowdhury as CEO, as was exclusively reported at FNG in early May.

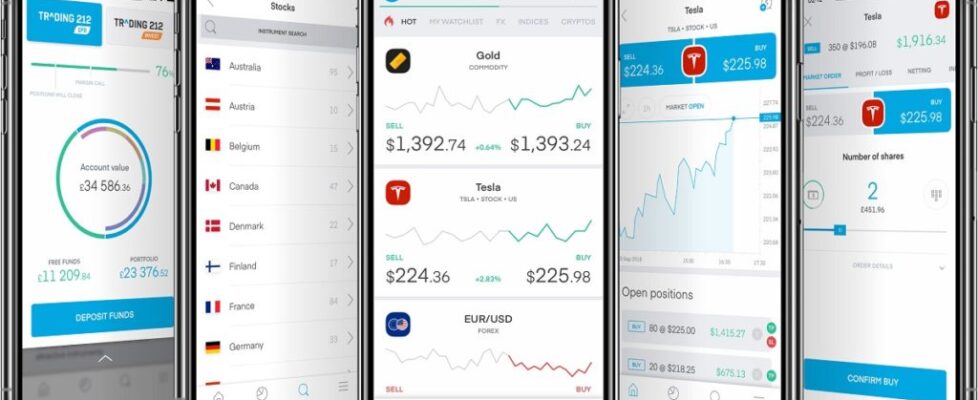

Trading 212 group revenue came in at £29.7 million (USD $41 million) in 2019, but we understand that the figure was considerably higher in 2020. The company, which now divides its branding between Trading 212 CFDs and a commission-free stocks and ETF offering Trading 212 Invest, tweeted out in August 2020 that it had reached $1 billion in client assets after posting in July that more than 500,000 people have opened and funded Invest and ISA accounts.