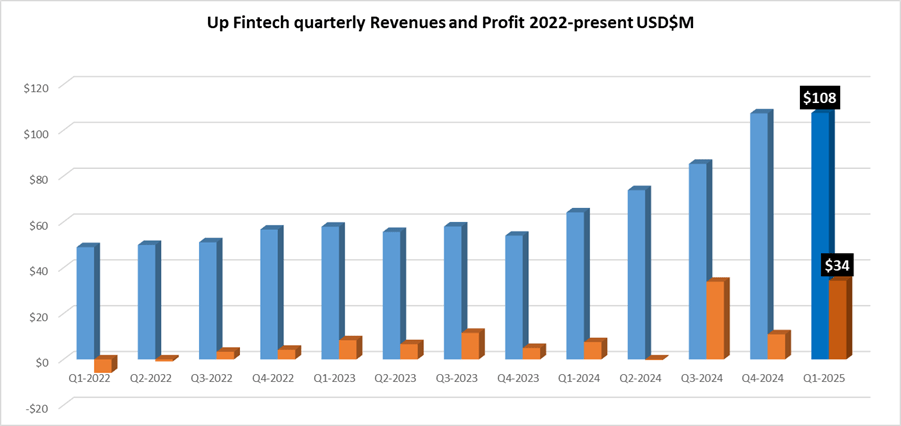

Tiger Brokers sees Revenues flat but soaring Profit in Q1 2025

UP Fintech Holding Limited (NASDAQ:TIGR), which operates the online brokerage brand Tiger Brokers, has announced its financial results for the first quarter of 2025 showing flat Revenues after a record Q4, but a sharp increase in Net Profit for the company.

Net Revenue came in at $107.6 million in Q1-2025, basically the same as $107.4 million in Q4 2024, which was the first time that Revenues topped $100 million in a quarter at UP Fintech. However due to a much more favorable foreign currency translation in Q1, Net Profit totaled a record $34.3 million in Q1, versus $10.9 million in Q4.

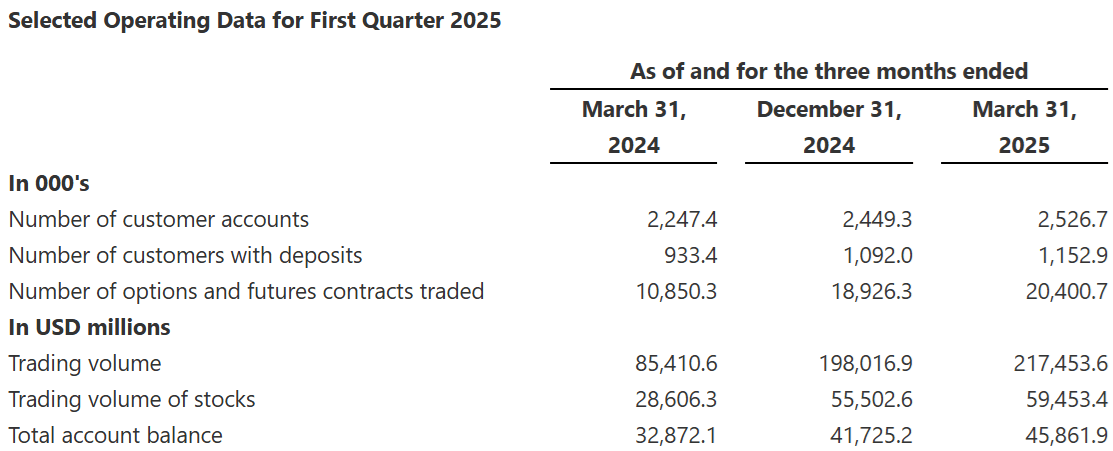

Trading volumes at Tiger Brokers came in at a record $217.5 billion in Q1 2025, or $72 billion monthly.

UP Fintech owns the Tiger Brokers online brokerage brand, which operates licensed subsidiaries in the US, Australia, New Zealand, Hong Kong and Singapore. Tiger Brokers targets mainly Chinese traders, and other selected markets in the Far East. The company is controlled by Beijing based founder and majority shareholder Wu Tianhua.

Wu Tianhua, Chairman and CEO of UP Fintech stated,

Wu Tianhua, Chairman and CEO of UP Fintech stated,

“The macro environment remained dynamic in the first quarter, our total revenues reached US$122.6 million, representing an increase of 55.3% year-over-year. Benefiting from our brand strength and continued investment in R&D, both our GAAP and non-GAAP net income saw impressive growth. Net income attributable to ordinary shareholders of UP Fintech was US$30.4 million, up 8.4% quarter over quarter and 146.7% year over year. Non-GAAP net income attributable to ordinary shareholders of UP Fintech reached US$36.0 million, an increase of 18.3% sequentially and 145.0% from the same period last year.

“In the first quarter, we added 60,900 new customers with deposits, already achieving 40% of our yearly guidance of 150,000 new customers with deposits for 2025, and bringing our total number of customers with deposits at the end of the first quarter to 1,152,900, a 23.5% increase compared to the same quarter last year. Asset inflow remained strong, we saw net asset inflow of US$3.4 billion in the first quarter, of which the majority comes from retail users, combining with a US$776 million mark to market gain, led total account balance rose by 9.9% quarter over quarter and 39.5% year over year to US$45.9 billion, setting another historic high. We also achieved notable growth in Hong Kong, the average net asset inflows of new funded clients in Hong Kong during the first quarter were above US$30,000.

“In the first quarter, we continued to roll out new features aimed at enhancing the user experience across our platform. In Hong Kong, we introduced additional functionality on top of its existing virtual asset trading service. Retail investors can now deposit and withdraw cryptocurrency, such as Bitcoin and Ethereum, while professional investors are also able to deposit and withdraw USDT. Additionally, Tiger Brokers Hong Kong recently launched Delivery Versus Payment (DVP) functionality, which strengthens our ability to serve institutional and high-net-worth clients. We also introduced equity repo services to further enhance our securities lending and treasury management capabilities. In addition, we remain committed to improving our Tiger AI offering based on user feedback. It now supports portfolio and watchlist analysis, allowing users to more effectively identify investment opportunities, receive risk alerts on their holdings, and access actionable strategy suggestions.

“In our Corporate business, we underwrote 4 Hong Kong IPOs in the first quarter, including “Chifeng Gold” and “Nanshan Aluminum”, and acted as distributor for “Mixue Group”, the largest Hong Kong IPO in the first quarter. In our ESOP business, we added 20 new clients in the first quarter, bringing the total number of ESOP clients served to 633 as of March 31, 2025.”

The full UP Fintech / Tiger Brokers press release detailing its Q1 2025 results can be seen here.