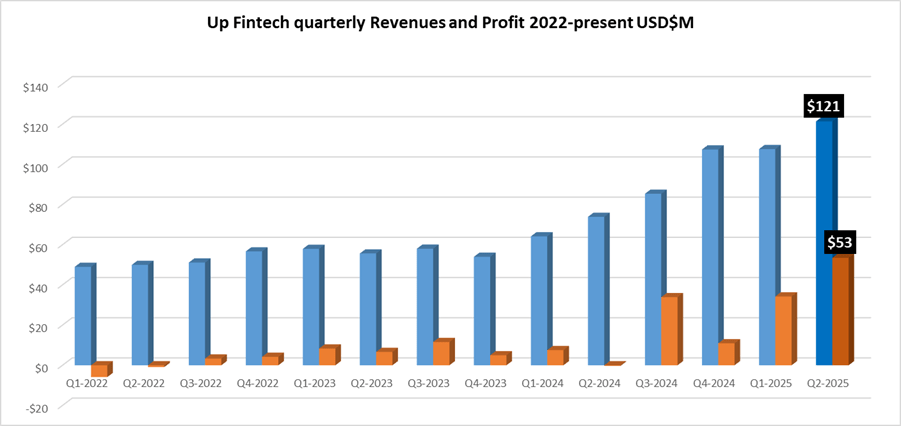

Tiger Brokers sees Revenues ($121M) and Profits ($53M) soar in record Q2 2025

What a quarter for Tiger Brokers.

UP Fintech Holding Limited (NASDAQ:TIGR), which operates the online brokerage brand Tiger Brokers, has announced its financial results for the second quarter of 2025, which include best-ever results for the company on both the top and bottom line.

Revenue at Tiger Brokers came in at $121.4 million in Q2 2025, up by 13% over Q1’s then-record $107.6 million, just the third time that the company has topped $100 million in quarterly revenue. Net profit totaled a record $53.5 million in Q2, helped out by a $12 million foreign currency translation adjustment.

Wu Tianhua, Chairman and CEO of UP Fintech, explained what was behind the company’s stellar Q2 performance,

Wu Tianhua, Chairman and CEO of UP Fintech, explained what was behind the company’s stellar Q2 performance,

“We saw increased user engagement in the second quarter with more diversified products offering and supportive market backdrop, which helped fuel our total revenue to a record high. Our bottom-line items for first half of the year, including operating profit, net income, and non-GAAP net income, all have already surpassed the totals for the entire previous year.

“In the second quarter, we added 39,800 new customers with deposits. Year-to-date, we have onboarded over 100,000 new customers with deposits, reinforcing our confidence in achieving our annual target of 150,000 new customers with deposits for 2025. By the end of the second quarter, our total number of customers with deposits reached 1,192,700, representing a 21.4% increase compared to the same quarter last year. Asset inflow remained robust, with net asset inflows of US$3 billion in the second quarter, primarily driven by retail investors.

“In the second quarter, we refined our customer acquisition approach by closing channels that did not meet our ROI and payback period standards, ensuring the long-term quality of our user base. As a result, we are pleased to see the average net asset inflow of newly acquired funded clients reached a record high of over US$20,000 this quarter. In particular, average net asset inflow of new clients in Hong Kong and Singapore markets is around US$30,000, contributing to approximately 50% and 20% quarter-over-quarter growth in client assets in these two regions, while other markets also experienced healthy double-digit sequential increases in client assets.”

Trading volumes at Tiger Brokers came in at a record $284 billion in Q2 2025, or $95 billion monthly, easily topping Q1’s $72 billion monthly.

The full UP Fintech / Tiger Brokers press release detailing its Q2 2025 results can be seen here.

UP Fintech owns the Tiger Brokers online brokerage brand, which operates licensed subsidiaries in the US, Australia, New Zealand, Hong Kong and Singapore. (The company recently sold its FCA licensed UK operation to Ultima Markets). Tiger Brokers targets mainly Chinese traders, and other selected markets in the Far East. The company is controlled by Beijing based founder and majority shareholder Wu Tianhua.