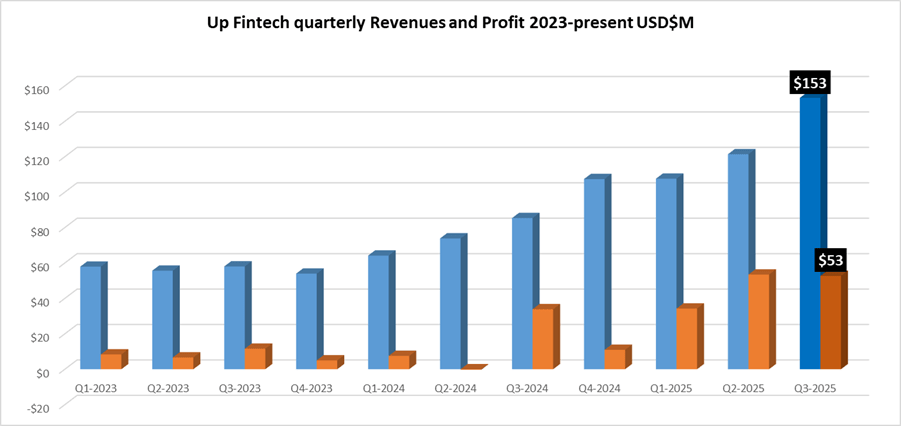

Tiger Brokers hits record Revenues in Q3 2025 topping $150M

UP Fintech Holding Limited (NASDAQ:TIGR), which operates the Tiger Brokers online trading brand, had another blowout quarter in Q3 2025, with Revenues topping $150 million for the first time while the company operated near record profitability.

Revenues and profits

Revenues at Tiger Brokers came in at $153.2 million in Q3, up by a whopping 26% from what was a record $121.4 million in Q2. We’d note that Q4-2024 (i.e. less than a year ago) was the first time that Tiger Brokers topped $100 million in quarterly Revenue, which are basically triple now what they were as recently as 2022, in the low $50-millions.

Tiger Brokers turned a Net Profit of $52.7 million in Q3 2025, just below the record $53.5 million the company earned last quarter.

Q3 results explanation

Wu Tianhua, Chairman and CEO of UP Fintech explained,

Wu Tianhua, Chairman and CEO of UP Fintech explained,

“The market environment remained supportive in the third quarter. Commission income, interest income and other revenue all saw impressive growth both sequentially and year over year, each setting new record highs. By prioritizing user quality and product diversification, we have sustained a high ARPU that underpins our profitability and a healthy business model.

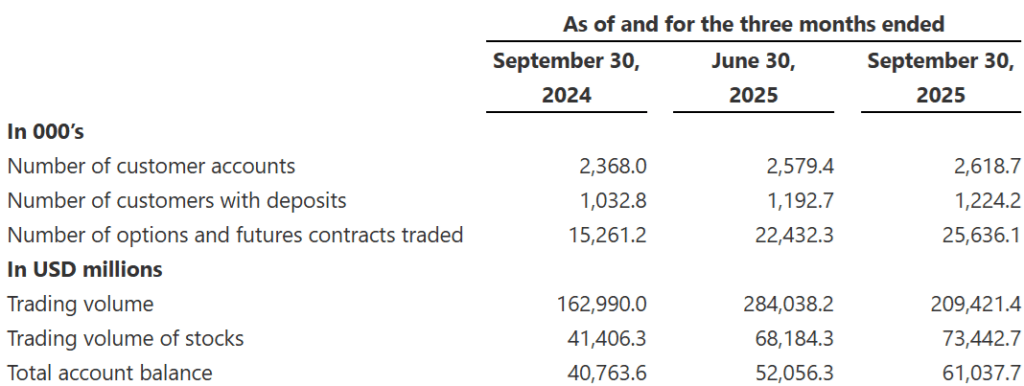

“In the third quarter, we added 31,500 new customers with deposits, with Singapore and Hong Kong being the primary contributors, each accounting for roughly 40% of new funded clients. In the first three quarters of 2025, we onboarded over 132,200 new customers with deposits, and as of today, have effectively achieved our annual target of 150,000 new customers with deposits for 2025.

“By the end of the third quarter, our total number of customers with deposits reached 1,224,200, representing an 18.5% increase compared to the same quarter last year. Asset inflow remained robust, driven primarily by retail investors. Combined with mark-to-market gains, total account balance rose 17.3% quarter over quarter and 49.7% year over year to a record US$61.0 billion.”

New Initiatives

In the third quarter, Tiger Brokers said it enhanced product breadth and user experience across digital assets and wealth management. In digital assets, the company launched digital asset trading in New Zealand, enabling local users to trade spot cryptocurrency on our platform and rolled out macro market insights for digital assets and introduced featured market data, such as coin issuers and on-chain metrics, to help users make better-informed decisions and capture investment opportunities.

In wealth management, the company significantly expanded Tiger AI’s capabilities. It launched the innovative TradingFront AI function to give advisers a real-time analytical edge. TradingFront AI delivers instant insights on portfolio performance, risk exposure, and asset allocation for each client’s unique portfolio. The tool automatically surfaces market-sensitive updates, macroeconomic outlooks, and actionable recommendations, enabling advisers to respond faster to changing conditions and conduct more informed, personalized client conversations.

Trading volumes

Trading volumes at Tiger Brokers actually declined in Q3 2025 from the previous quarter, with total volumes of $209.4 billion (or $70 billion monthly), versus $95 billion monthly in Q2.

The full UP Fintech / Tiger Brokers press release detailing its Q3 2025 results can be seen here.

About Tiger Brokers

UP Fintech owns the Tiger Brokers online brokerage brand, which operates licensed subsidiaries in the US, Australia, New Zealand, Hong Kong and Singapore. (The company recently sold its FCA licensed UK operation to Ultima Markets). Tiger Brokers targets mainly Chinese traders, and other selected markets in the Far East. The company is controlled by Beijing based founder and majority shareholder Wu Tianhua.