Exclusive: ThinkMarkets UK sees 20% Revenue jump in 2019

FNG Exclusive… FNG has learned via regulatory filings that TF Global Markets (UK) Limited, the FCA-regulated arm of Australia-UK Retail FX broker ThinkMarkets saw a 20% rise in Revenues as well as a nice leap in profitability in 2019 – a year in which many other Retail FX brokers saw a dip in activity, after the FCA and ESMA cut allowed leverage for retail traders in the UK and EU to a maximum of 30x in mid-2018.

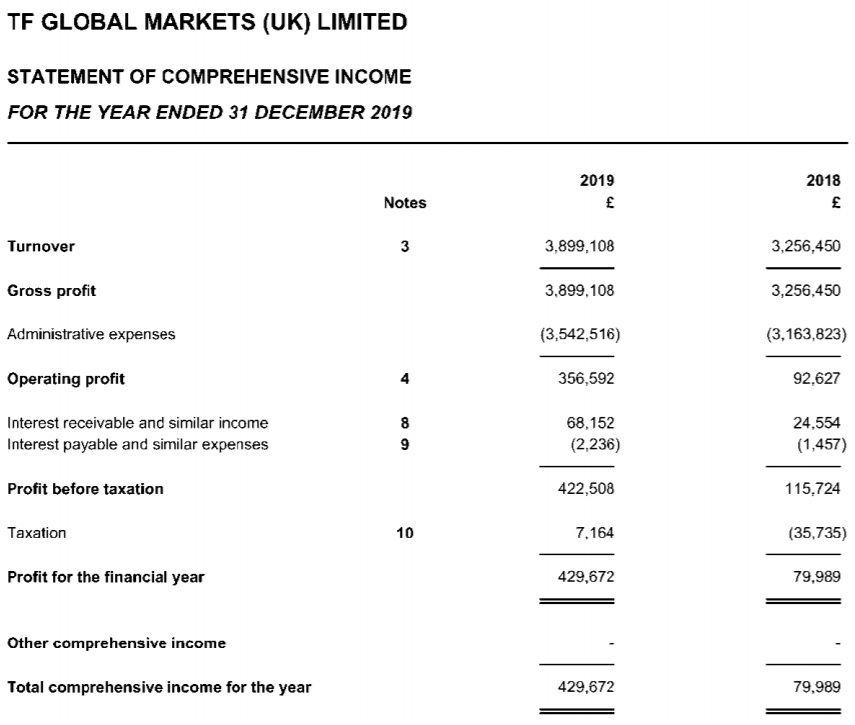

ThinkMarkets UK brought in Revenue of £3.90 million in 2019, up from £3.26 million the previous year. Net profit for 2019 was £430,000, versus just £80,000 in 2018.

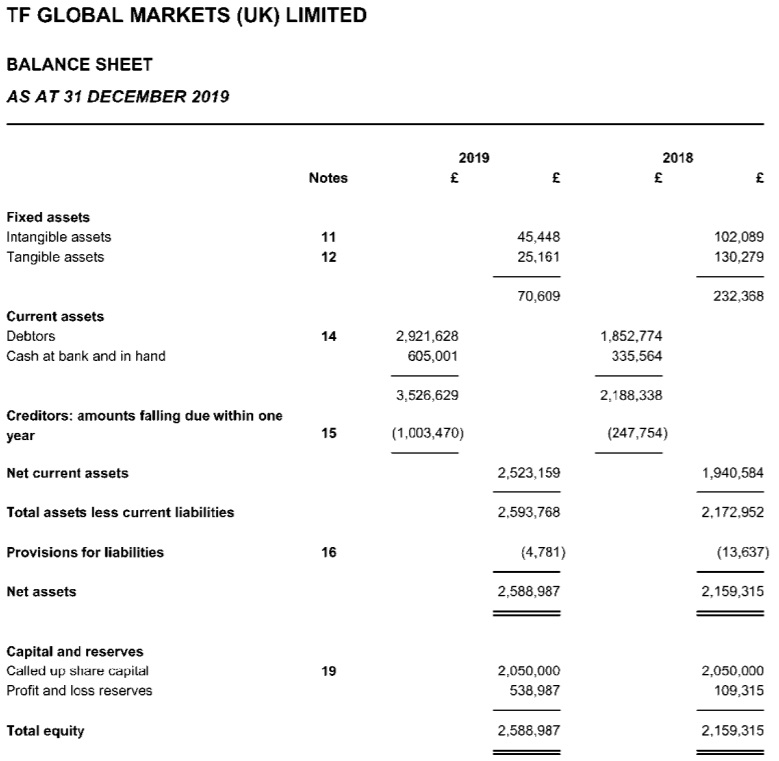

Client money held by ThinkMarkets UK rose to £5.35 million as at year-end 2019, up from £3.36 million in 2018.

We understand that Revenues at the overall ThinkMarkets group is at around $75 million annualized, with that figure up substantially from last year. The company was reported to be pursuing a public offering over the summer, but since there has been no word about a potential ThinkMarkets IPO. The IPO market globally is quite hot right now, we reported earlier today that US online trading upstart Robinhood has initiated a $20 billion valuation IPO, to be led by Goldman Sachs.

ThinkForex was established in 2010 by brothers Nauman and Faizan Anees in New Zealand, and relocated its headquarters to Australia upon obtaining ASIC regulation in 2012. ThinkForex rebranded as ThinkMarkets in 2016. The company has dual headquarters in Melbourne and London, where ThinkMarkets set up its FCA-licensed subsidiary TF Global Markets (UK) Limited in 2015. The firm also has a licensed subsidiary in South Africa, established in 2019. ThinkMarkets offers trading on its proprietary ThinkTrader platform, as well as MT4 and MT5.

ThinkMarkets UK’s income statement and balance sheet for 2019 follow.