ThinkMarkets IPO prospectus: tens of millions in losses, 99% in Australia

FNG Exclusive… Following our report yesterday that Australia/London based Retail FX and CFDs broker ThinkMarkets is planning to go public via the “SPAC route”, combining with Toronto Stock Exchange listed FG Acquisition Corp (TSE:FGAA.U), FNG has had the opportunity to view the Preliminary Prospectus filed with Canadian securities authorities by FG. The prospectus provides much more detail into ThinkMarkets’ financial and operating figures and plans, and reveals much more that wasn’t disclosed by the parties in the press release which went out announcing the transaction.

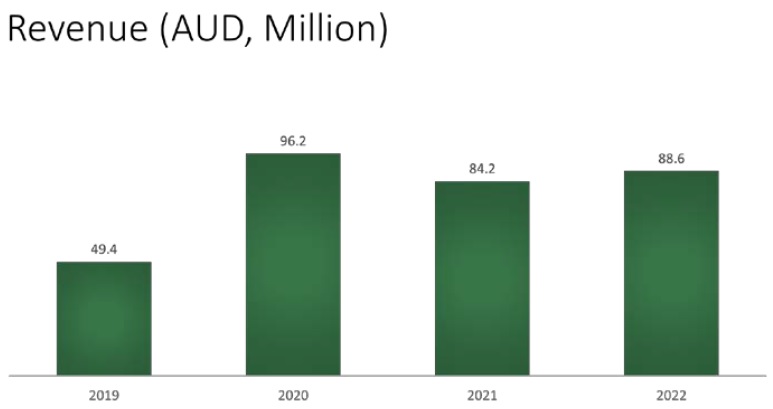

ThinkMarkets Revenues

The FG press release stated that ThinkMarkets had seen “significant revenue growth,” from USD $35 million in 2019 to over $62 million in 2022. While factually correct, it doesn’t tell the whole story – mainly that virtually all that growth occurred between 2019 and 2020, and that ThinkMarkets’ revenues have actually declined since 2020.

The above graph from the prospectus (in Australian dollars) provides a more complete picture, illustrating how ThinkMarkets has seen its Revenues decline by 8% from AUD 96.2 million in 2020 to AUD 88.6 million last year. The company did experience slight (5%) growth in Revenues between 2021 and 2022, but given that ThinkMarkets had significantly ramped up its advertising and partnerships spending in 2022 (more on that below), that really wasn’t very impressive.

In terms of client trading volumes, ThinkMarkets reported that in 2022, approximately 19.7 million trades were completed on its platform with a notional trading value of approximately Cdn $1 trillion – which works out to about USD $62 billion in monthly trading volume.

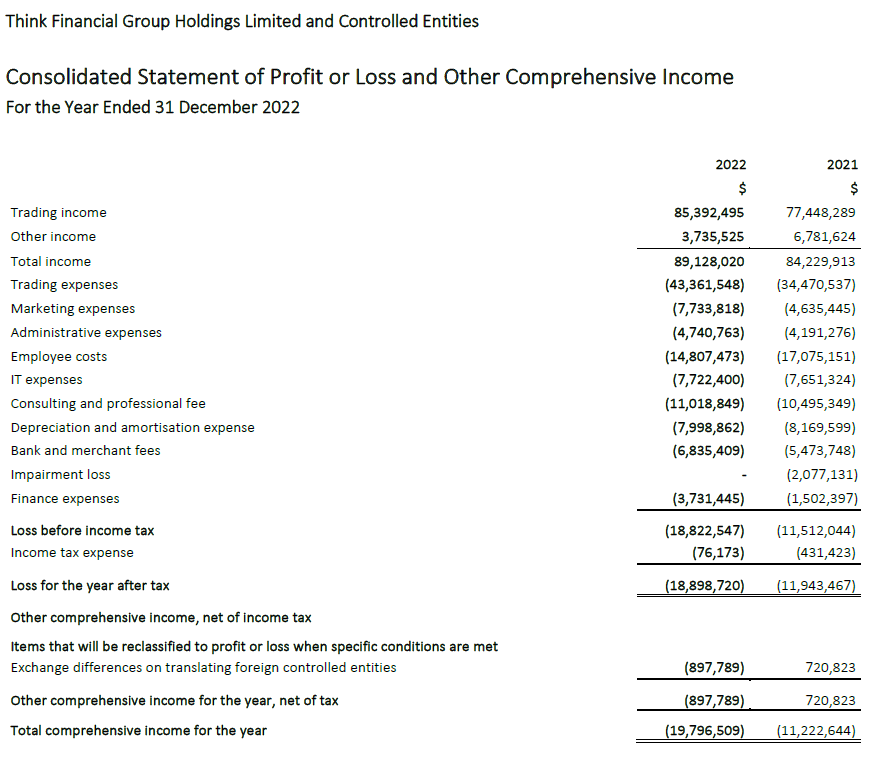

ThinkMarkets losses in 2021 and 2022 – tens of millions

One of the more troubling reveals of the prospectus was ThinkMarkets’ outsized losses over the past two years.

ThinkMarkets posted a net loss of AUD 11.2 million in 2021, with its loss growing to AUD 19.8 million in 2022 – in total AUD 31 million, or USD $20.7 million in net losses over the past two years.

On a cash flow basis, ThinkMarkets’ saw a net cash outflow from operating activities of AUD 9.0 million in 2021 and AUD 9.3 million last year. The company covered those cash outflows, plus an additional AUD 13 million in cash used for investing activities, by increased borrowing of AUD 12.4 million in 2021 and AUD 15.8 million in 2022. Most of that borrowing came via a USD $30 million credit facility set up in 2021 with Mars Growth Capital Fund, and Liquidity Capital II L.P.

There was more than AUD 20 million drawn under the Mars/Liquidity Capital facility at the end of 2022, out of total ThinkMarkets borrowings of AUD 32.0 million – almost double the company’s borrowings as at year-end 2021, of AUD 16.7 million.

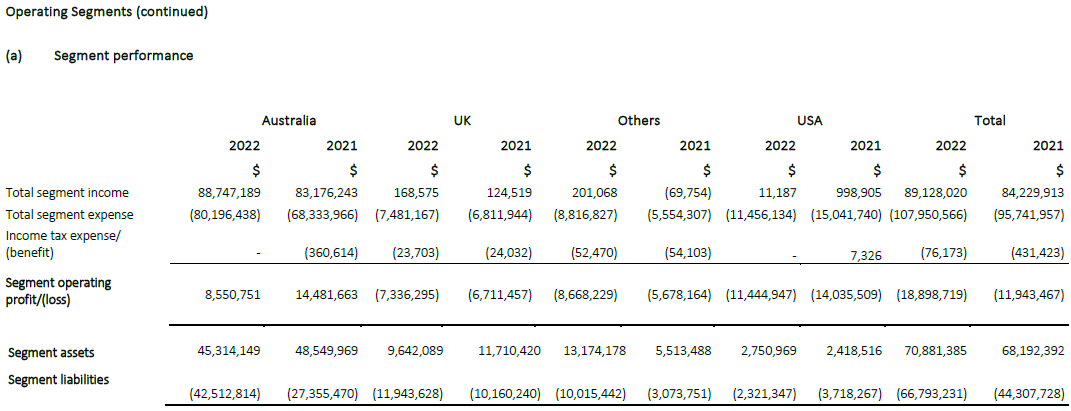

Geographical concentration

While operating a number of licensed subsidiaries in different jurisdictions around the world (including Japan, South Africa, Cyprus, UK, UAE), ThinkMarkets has remained a very Australia-centric company. The company’s press release touted ThinkMarkets as having “clients in over 165 countries.” However the prospectus reveals that more than 99% of the company’s revenues came from its Australia segment, as follows.

ThinkMarkets valuation

As per our previous report on the ThinkMarkets SPAC IPO, the company is being valued at USD $160 million pre-deal and $190 million pro-forma. The key question in all this – is that a reasonable valuation for ThinkMarkets with potential upside for shareholders? If not, the transaction will likely be turned down by the SPAC shareholders, who effectively have the ability to reject the proposed transaction and either get their money back, or demand that the SPAC sponsors find a different acquisition target.

The closest “comp”, or comparable publicly traded Retail FX/CFDs broker, is probably Hamburg based NAGA Group (ETR:N4G). NAGA did €11.6 million (USD $12.6 million) in Revenue in Q1-2023, or $50.4 million annualized – about 85% of ThinkMarkets’ USD $59.2 million in 2022 Revenues. NAGA has also had profitability issues, losing money in 2022 but now claiming to be EBITDA positive in 2023.

However NAGA is trading at a market cap of €75 million (USD $82 million), only about half of what ThinkMarkets is seeking.

The companies have many similarities but also several differences (especially in their geographical focus, with NAGA being very EU-centric), but a valuation twice NAGA’s might be a stretch at this point, especially given ThinkMarkets’ large losses over the past two years.

There are a number of other publicly traded “comps” – all listed in the UK and Europe – including Plus500, IG Group, CMC Markets, Swissquote, and XTB. But all those companies are a lot bigger (i.e. annual Revenues exceed $300 million) and are fairly profitable. So, we don’t believe that too much can be drawn from the valuation of those companies. (In any event, those companies’ valuations top out at about 3x Revenues).

Another important metric that the FX brokerage community looks at is Client Money held. ThinkMarkets reported having AUD 18.5 million (USD $12.3 million) in client money as at the end of 2022, up slightly (by 8%) from AUD 17.1 million in 2021. It is somewhat hard to imagine a USD $160 million valuation for a company based on just $12.3 million of client deposits.

ThinkMarkets IPO prospectus

The FG Acquisition Corp / ThinkMarkets preliminary prospectus can be downloaded at the Canadian Securities Administrators’ SEDAR website at https://www.sedar.com/search/search_form_pc_en.htm. ThinkMarkets’ 2022 income statement (in Australian Dollars) follows:

May 16, 2023 @ 4:58 pm

Looks like the Mars funding facility basically used up.

At this rate if the SPAC fails they are broke.

Wouldn’t touch this with a ten foot pole.

May 17, 2023 @ 10:21 am

So they’re hoping that Canadian investors are dumb enough to throw $ 100 mln of good money at an Australian company bleeding cash,wracking up debt and teetering on bankruptcy, that operates in a hypercompetitive business against well funded competitors.

If this gets public stock will go to zero faster than you can say Wayne Gretzky.

May 18, 2023 @ 3:41 am

Their Auditors have given a qualified opinion.

Extract from the Auditors Report:

Material uncertainty relating to going concern

We draw your attention to Note 3(D) in the financial report which indicates that Group incurred a loss after tax in the year from continuing operations of $18,898,720 (2021: $11,943,467 loss) and has cash outflow from operating activities of $9,269,974 (2021: $8,971,812) for the financial year ended 31 December 2022. The Group has net assets of $4,088,155

(2021: $23,884,664).

These conditions, along with other matters set out in Note 3(D), indicate that a material uncertainty exists that may cast significant doubt on the Group’s ability to continue as a going concern. Our opinion is not modified in respect of this matter.

No adjustments have been made to the financial report relating to the recoverability or classification of the recorded asset amounts and classification of liabilities that may be necessary should the Group not continue as a going concern.

May 18, 2023 @ 3:48 am

To start with: How can a firm make near 5 times of their average clients equity? Their churning rate is better then the likes of USGFX and FXCT, both the firm’s license cancelled after ASIC investigation.

These guys are paying 14.8m to staffs and another 11m to consultants to run a company with 18m in clients money? looks like a ploy to spend investors money. I have never come across a firm with nearly $270m revenue in the last 3 years and still making a loss of $30m.

With such financials, if Nauman and his brother still runs the company after SPAC listing…I will surely go short on their shares.

May 18, 2023 @ 3:51 am

extract from Auditors report:

Material uncertainty relating to going concern

We draw your attention to Note 3(D) in the financial report which indicates that Group incurred a loss after tax in the year from continuing operations of $18,898,720 (2021: $11,943,467 loss) and has cash outflow from operating activities of $9,269,974 (2021: $8,971,812) for the financial year ended 31 December 2022. The Group has net assets of $4,088,155

(2021: $23,884,664).

These conditions, along with other matters set out in Note 3(D), indicate that a material uncertainty exists that may cast significant doubt on the Group’s ability to continue as a going concern. Our opinion is not modified in respect of this matter.

No adjustments have been made to the financial report relating to the recoverability or classification of the recorded asset amounts and classification of liabilities that may be necessary should the Group not continue as a going concern.

May 18, 2023 @ 12:48 pm

do they even let money-losing companies with ‘going-concern’ warnings from the auditors onto the stock exchange in Canada?

They must scrutinize this like a ‘regular’ IPO.

June 19, 2023 @ 10:07 am

We know Canadian regulators are ‘nice’ but are they so asleep at the wheel that they will allow this?!

Whatever happened to full and fair disclosure? Nowhere in the prospectus descrip of TM do they mention the auditors ‘going concern’ warning aganist Think. isn’t that material?! Thinkmarkets is bleeding cash, building up debt it cant repay, revenues are falling. They operate in a hypercompetitive market against big boys who actually make money.

If investors really decide to put their money into this turd then fine, but they should have all the facts up front. isnt that what regulators are for?!

July 15, 2023 @ 1:55 am

The company is currently experiencing financial losses and facing challenges with unpaid invoices. In an attempt to attract clients, they ran a competitive campaign during the first quarter, but unfortunately, it did not yield the desired results. To reduce operating costs, they had to implement significant layoffs. Dealing with this particular provider has been difficult and challenging.